If you’re running a small business, the right SaaS tools for small businesses can compress admin, sharpen visibility, and accelerate cash flow without adding headcount. In plain terms: pick a solid CRM for revenue, accounting for truth, invoicing for faster payments, support for happier customers, and a handful of well-chosen apps around them—then connect everything so data moves without you. Quick answer: choose one tool per job, prefer platforms that integrate natively or via automation, and set simple rules for data hygiene, permissions, and backups. Within minutes, you can assemble a stack that’s easy to run and cheaper than the cost of rework.

Fast path to your stack: (1) List your top three bottlenecks; (2) Map one tool to each; (3) Trial two contenders per category; (4) Validate integrations and migration steps; (5) Lock processes with short SOPs; (6) Review costs vs. time saved after one billing cycle. The payoff: less swivel-chair work, faster handoffs, fewer mistakes.

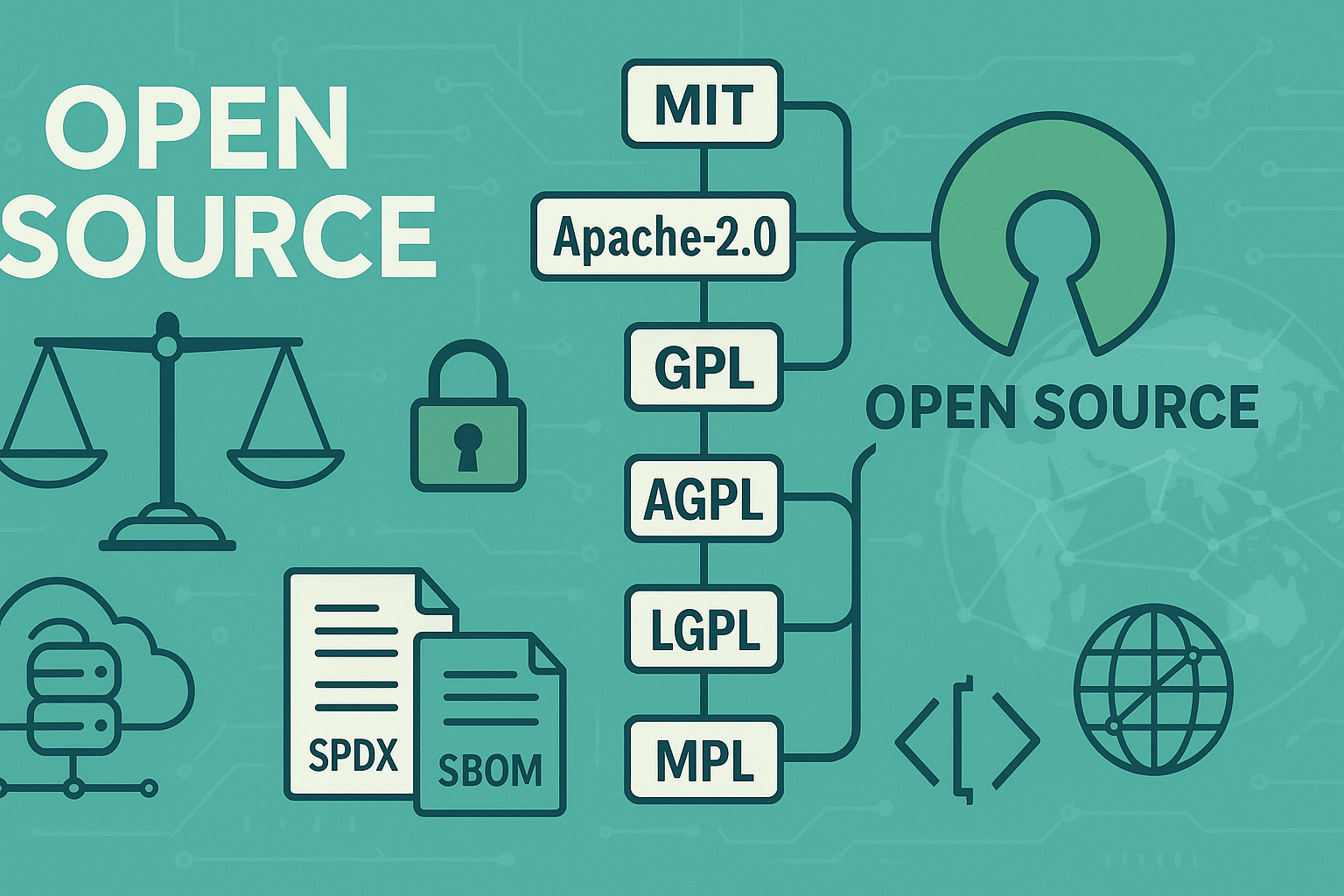

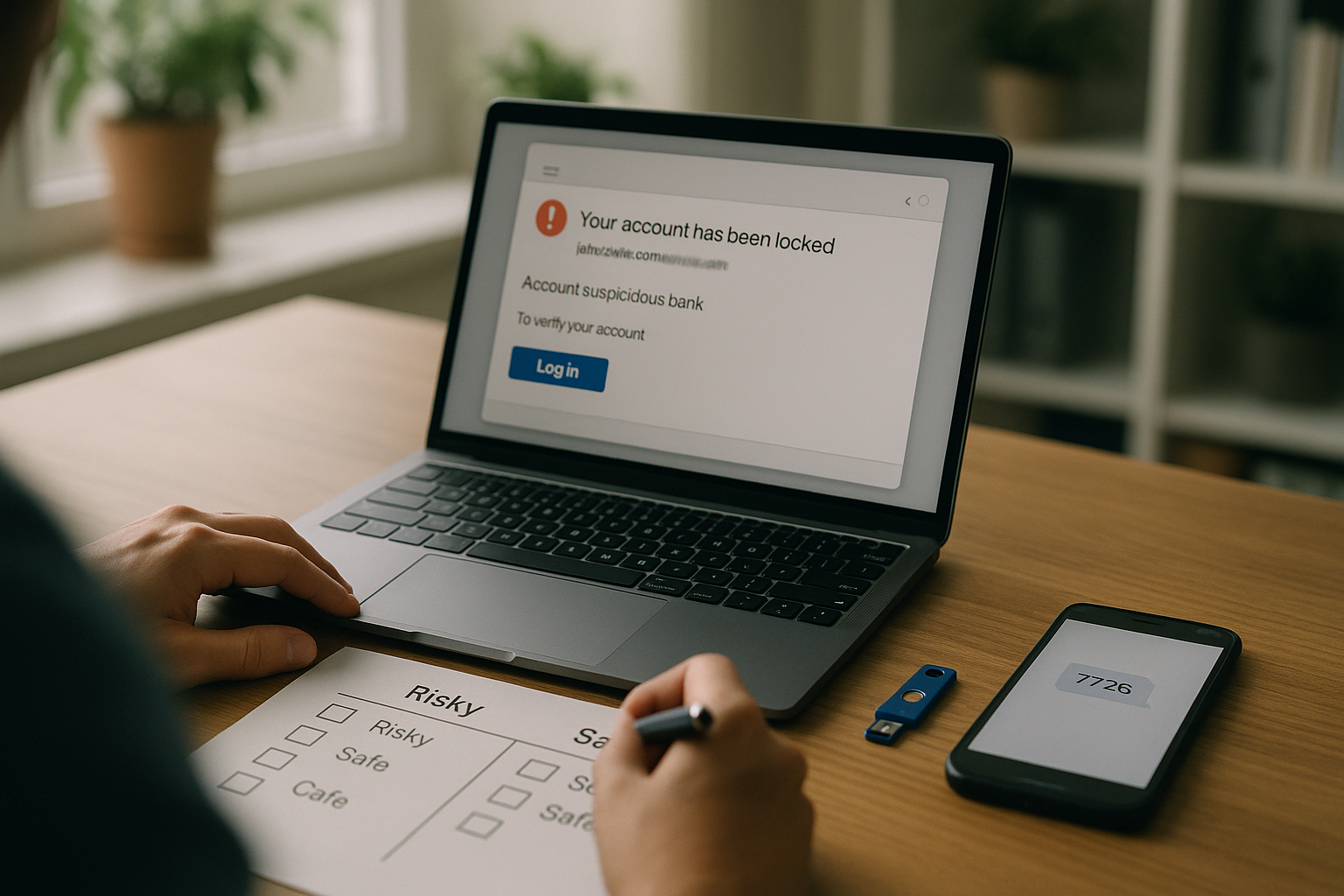

One guardrail up front: treat customer and payment data with care—prefer vendors with recognized security posture (e.g., SOC 2), robust information-security management (e.g., ISO/IEC 27001), and card-payment compliance (PCI DSS) if you accept cards. These are industry standards that help you gauge a provider’s controls and alignment to best practices.

Quick-fit matrix (keep it simple):

| Need | Must-have features | Good examples |

|---|---|---|

| Close more deals | Pipelines, email sync, reporting | HubSpot CRM, Zoho CRM, Pipedrive |

| Keep books clean | Bank feeds, reconciliation, multi-user | QuickBooks Online, Xero, Zoho Books |

| Get paid faster | Recurring invoices, reminders, card/bank | Stripe Invoicing, Square, PayPal |

| Nurture leads | Automations, segmentation, analytics | Mailchimp, HubSpot Marketing Mailchimp |

| Support customers | Ticketing, knowledge base, omnichannel | Zendesk, Freshdesk |

Light business note: none of this is legal, tax, or compliance advice. For regulated workflows (finance, health, personal data), consult a qualified professional.

1. Centralize Sales with a CRM Platform

A customer relationship management (CRM) tool is the heartbeat of your revenue engine because it unifies contacts, emails, pipelines, deals, and tasks in one place. The direct answer: pick a CRM that your team will actually use daily; that means intuitive UI, fast search, and tight email/calendar integration so data updates itself. Start with a shared pipeline that mirrors how you sell, keep fields lean, and automate follow-ups so you never lose a lead to silence. A CRM also surfaces performance—conversion by stage, velocity, win reasons—so you can coach effectively and forecast with more confidence. Finally, ensure the CRM integrates with your marketing, support, and invoicing tools to reduce manual entry and keep every team on the same page. HubSpot’s small-business CRM is a popular baseline because it’s easy, has a free tier, and provides sales, marketing, and service add-ons as you grow.

How to do it

- Define 5–7 core fields you’ll enforce on every deal (source, industry, amount, close date, stage, owner, next step).

- Mirror reality: name deal stages after actual milestones (e.g., Qualified → Demo → Proposal → Commit).

- Enable email logging and calendar sync; use templates and snippets for repeatable replies.

- Automate nudges: if no activity for 3 days on an open deal, assign a task and send a reminder.

- Review a single dashboard weekly: pipeline coverage, stuck deals, and top loss reasons.

Numbers & guardrails (mini case)

If three reps handle 20 new leads weekly and your baseline close rate is 10%, you’ll land ~2 deals. Cleaning data and adding a “next step” rule can lift conversion to a modest 15%, which yields ~3 deals—50% more wins from the same lead flow. Even at an average deal size of $1,200, that’s +$1,200 per week—material for a small team. Make the rule visible: every open deal must show a next action and date. Close with clarity: lost reason must be chosen to inform campaigns and training.

Tools/Examples

HubSpot CRM (sales + marketing add-ons) and similar tools like Zoho CRM and Pipedrive deliver contact management, pipelines, and email tracking that fit small teams.

Tie-back: A simple, enforced CRM rhythm—clean fields, consistent stages, next-step rules—translates directly into better forecasts and fewer dropped leads.

2. Keep the Books True with Online Accounting

Accounting software records every transaction correctly, reconciles bank feeds, tracks invoices and bills, and produces the financial statements you’ll rely on for decisions and taxes. The direct answer: choose software with reliable bank connections, clean reconciliation flows, and role-based access so your bookkeeper, accountant, and owner can collaborate without stepping on each other. Look for built-in invoicing, expense capture, inventory (if needed), and integrations to your payment and payroll tools. QuickBooks Online and Xero are the most common small-business choices; both offer bank feeds, invoicing, reporting, and app marketplaces that expand capabilities as you grow. The U.S. Small Business Administration stresses using tools that match your processes and help you weigh costs against benefits—still great advice when selecting accounting software.

How to do it

- Build a simple chart of accounts that mirrors how you talk about money; avoid overly granular categories.

- Turn on bank feeds and reconcile weekly; zero out unreconciled items at month-end.

- Use itemized products/services so reports show revenue mix by line.

- Capture receipts via mobile; attach source docs to transactions for clean audits.

- Invite your accountant with appropriate permissions and schedule a monthly close.

Numbers & guardrails (mini case)

If you spend ~3 hours weekly on manual entry and your hourly value is $60, a tool that auto-categorizes 70% of transactions can return ~2 hours/week—about 8 hours/month. At a modest $30–$70 monthly subscription, that’s a strong ROI without counting error reduction or faster invoicing. Guardrails: require two-person review for bank reconciliations, lock closed periods, and separate “create” vs. “approve” permissions.

Tools/Examples

QuickBooks Online and Xero both cover the essentials (bank feeds, reconciliation, invoicing) and integrate widely with payroll, payments, and reporting.

Tie-back: Clean books mean confident pricing, healthy cash flow, and simpler tax season—no more late-night spreadsheet archaeology.

3. Accelerate Cash with Invoicing & Payments

You get paid faster when invoicing is simple for you and frictionless for customers. The direct answer: adopt an invoicing tool that sends professional invoices in minutes, offers multiple ways to pay, and automates reminders. Stripe Invoicing, Square Invoices, and PayPal Invoicing are reliable, widely recognized options that support recurring billing, saved payment methods, and links to a secure hosted checkout. If you accept cards, ensure your provider operates under PCI DSS to reduce risk and streamline your compliance burden.

How to do it

- Standardize terms (e.g., Net 7/10/15) by product line; shorter terms tighten cash.

- Enable auto-reminders: one before due, one on due, one 3–5 days after.

- Offer multiple payment methods (card, bank, wallets) and a hosted invoice page.

- For subscriptions, enable automatic charging on saved methods with clear consent.

- Reconcile payouts automatically into accounting to avoid duplicate work.

Numbers & guardrails (mini case)

Assume monthly revenue of $30,000 and average daily sales of ~$1,000. Cutting days-sales-outstanding by 10 days frees roughly $10,000 in working capital. That alone can fund inventory or ads. Guardrails: use branded invoice templates with line-item clarity, collect tax IDs when required, and log all changes with an audit trail to resolve disputes quickly. Stripe, Square, and PayPal each provide documented invoicing and hosted payment flows designed to reduce friction. Stripe Docs

Tools/Examples

Stripe Invoicing (plus Billing for subscriptions), Square Invoices, and PayPal Invoicing each cover the core flows and integrate with popular accounting tools.

Tie-back: Faster, clearer invoicing improves cash flow without squeezing customers—win-win when you’re growing.

4. Scale Outreach with Marketing Automation & Email

Marketing automation sends the right message to the right person at the right time based on behavior, not guesswork. The direct answer: start with a welcome series for new subscribers, cart abandonment for e-commerce, and re-engagement flows for inactive contacts. Use segmentation (interests, lifecycle stage, last purchase) to avoid blasting everyone with everything. Track open, click, and conversion metrics in one dashboard so you see which journeys drive revenue. Mailchimp provides approachable automation flows and integrations; HubSpot’s marketing toolkit adds deeper CRM alignment if you need it later.

How to do it

- Build three “always-on” flows: Welcome (value + next step), Abandoned Cart/Browse (nudge + social proof), and Win-back (offer + feedback).

- Segment by lifecycle stage and last engagement date; sunset cold contacts to protect deliverability.

- Use UTM parameters consistently so revenue attribution is trusted.

- Test one variable at a time (subject, CTA, send time) and document learnings.

- Sync audiences with your CRM and ads platforms to close the loop.

Mini checklist & tips

- Consent: collect clear permission; link to your policy.

- Frequency: start light (1–2 emails/week) and let behavior drive more.

- Content: lead with value—education or offer—before asking for a sale.

- Handoff: push “hot” replies straight into sales via CRM tasks.

Tie-back: Automation keeps you present without being pushy, turning one-time clicks into repeat customers.

5. Delight Customers with a Help Desk

A help desk consolidates email, chat, social, and phone into one queue so nothing slips. The direct answer: adopt a system with ticketing, a searchable knowledge base, and multichannel support. Set basic SLAs (e.g., first reply within a few business hours), measure CSAT, and review the top drivers weekly to fix root causes. Zendesk and Freshdesk both offer small-business suites that include ticketing, messaging, and self-service knowledge bases—plus reporting to spot patterns quickly.

How to do it

- Create 6–10 macros for common issues (shipping, returns, password reset, billing).

- Build a lightweight knowledge base with 15–25 high-impact articles; link them in replies.

- Set SLAs (first response and resolution) and show them to customers.

- Tag tickets by issue type; review weekly to highlight fix-once opportunities.

- Connect support to CRM so product feedback informs sales and marketing.

Numbers & guardrails (mini case)

If your average first-response time is 24 hours, adding live chat during business hours and macros for FAQs can cut it to 6 hours or less, often lifting CSAT and reducing repeat contacts. Guardrails: consistent identity verification on account-sensitive requests, granular agent permissions, and audit trails for changes. Zendesk and Freshdesk outline these capabilities clearly on their product pages.

Tie-back: A small team looks big when responses are fast, consistent, and searchable.

6. Deliver Work with Project & Task Management

Projects slip when plans live in heads and inboxes. The direct answer: adopt a task manager that makes priorities and owners visible, supports due dates and dependencies, and offers multiple views (list, board, timeline) so each role sees their preferred lens. Asana and Trello are approachable for small teams; both allow you to map processes with templates and automate routine steps. The goal is simple: make work status obvious, reduce meetings, and capture learnings so every new project starts stronger than the last. Asana

How to do it

- Give every task a verb, a single owner, and a due date; avoid multi-owner ambiguity.

- Use sections: Backlog → Ready → In Progress → Review → Done; keep WIP limits sane.

- Create templates for repeat projects (launch, hiring, onboarding) to save setup time.

- Automate: when a task moves to “Review,” auto-assign a QA step and notify stakeholders.

- Run a 15-minute weekly review to kill stale tasks and unblock critical ones.

Numbers & guardrails (mini case)

On a five-person team, saving just 15 minutes/day of status-hunting and context-switching adds up to ~25 hours/month reclaimed (5 people × 0.25 hr × ~20 workdays). That’s time you can redeploy to revenue or customer experience. Guardrails: define who can archive projects, track change logs on critical tasks, and tie project roles to your HR tool for easy onboarding/offboarding.

Tie-back: Visible work is faster work; a shared board beats status meetings every time.

7. Communicate & Create with Collaboration Suites

Collaboration suites bundle chat, meetings, email, cloud storage, docs, and shared calendars—your digital office. The direct answer: pick one suite and go all-in so your files, chats, and meetings live together with unified search and permissions. Google Workspace pairs business email with Docs/Sheets/Slides/Drive and built-in video meetings; Slack focuses on channel-based messaging, work automation, and app integrations that pull your other tools into one canvas. Together or separately, they reduce “where is that file?” and keep teams moving.

How to do it

- Standardize channels (e.g., #sales, #support, #ops, #announcements) and name conventions.

- Store files in shared drives/workspaces; restrict “My Drive” for personal drafts.

- Replace recurring status calls with async updates in channels using a simple template.

- Turn on data retention and set sensible defaults; apply two-factor authentication tenant-wide.

- Use meeting agendas in a shared doc; share notes and action items back to the channel.

Practical notes

Google Workspace documents collaboration, storage, and admin controls at a business-ready level, while Slack lays out plan features around message history, external partners, automation, and compliance options. Choose based on your center of gravity: docs/email vs. chat/automation. Google Workspace

Tie-back: When your conversations, files, and calendars live together, the “work about work” shrinks—leaving more time for customers.

8. Pay People Right with HR, Payroll & Time

Even very small teams benefit from a modern payroll and HR system that handles wages, filings, onboarding, time off, and basic recordkeeping. The direct answer: adopt software that automates payroll taxes and filings, provides employee self-service, and syncs hours from a time tracker to reduce errors. Gusto is a small-business favorite for payroll and filings with time tracking; BambooHR adds people ops (performance, time-off, reporting) if you want a fuller HR suite. Both integrate with accounting tools. Gusto

How to do it

- Centralize employee records; require e-signed offer letters and policy acknowledgments.

- Standardize pay schedules, approval cutoffs, and overtime rules.

- Connect time tracking to payroll; block submissions with missing approvals.

- Use org-wide holidays and time-off policies; auto-accrual to avoid manual math.

- Lock down permissions; HR sees compensation, managers see only their team.

Numbers & guardrails (mini case)

If five employees each average 3 hours/week of avoidable overtime at $20/hour, tightening approvals and schedules can save $1,200/month (3 × 20 × 5 × ~4 weeks). Guardrails: double-check tax jurisdictions, use built-in compliance checklists, and restrict who can edit pay rates. Gusto documents automated filings and unlimited payroll runs; BambooHR highlights reporting and people-ops features. Gusto

Tie-back: Accurate, timely payroll builds trust; fewer errors mean fewer late-night fixes.

9. Move Agreements Faster with E-Signature & Document Workflow

E-signature tools speed up contracts, proposals, and HR paperwork by removing printers from the process. The direct answer: pick a tool that supports templating, automatic reminders, field validation, and a tamper-evident audit trail. DocuSign, Adobe Acrobat Sign, and Dropbox Sign are widely recognized, integrate with CRMs and storage, and support mobile signing. For most small businesses, that means fewer delays, clearer status tracking, and a smoother experience for customers and new hires. DocuSignAdobe

How to do it

- Turn your common docs (proposal, SOW, NDA, offer letter) into reusable templates with required fields.

- Set signing order and auto-reminders; choose authentication level appropriate to risk.

- Store executed agreements in a shared drive with consistent naming and retention rules.

- Connect to your CRM to trigger agreements from quotes and update status automatically.

- Use checkboxes and required initial fields to reduce errors and renegotiation loops.

Numbers & guardrails (mini case)

If a typical contract cycle is 7 days with back-and-forth edits and reminders, templates and automated reminders can often bring that down to 1–2 days. Over a month with 20 agreements, that’s dozens of days of lead time returned to the business. Guardrails: restrict who can modify templates, use audit trails, and align your identity and retention policies with your legal counsel’s guidance. Vendors document features such as templates, bulk sending, mobile signing, and audit trails. DocuSign

Tie-back: Fewer clicks to “signed” means faster revenue and smoother onboarding.

10. See the Whole Picture with Business Intelligence & Reporting

A BI tool consolidates data from your apps and turns it into dashboards you trust. The direct answer: start with a single KPI dashboard for leadership (revenue, pipeline, gross margin, support volume, cash), then expand. Looker Studio (free and flexible), Microsoft Power BI, and Tableau Cloud are excellent entry points; they connect to many sources and support interactive, shareable reports. Spend time defining your “source of truth,” then keep calculations centralized so everyone speaks the same numbers.

How to do it

- Inventory your apps (CRM, accounting, support) and list the one metric each must contribute.

- Use connectors to pull data automatically; schedule refreshes instead of manual exports.

- Define metrics and dimensions in a shared doc (e.g., “MRR,” “churn”) so there’s no debate.

- Build one clean “Exec” dashboard, then role-specific views (sales, ops, support) later.

- Add annotations on charts to capture context behind spikes or dips.

Numbers & guardrails (mini case)

If weekly reporting takes 4 hours of manual exports and slide-making, a shared dashboard can cut that to 30 minutes for review and commentary—saving ~14 hours/month. Guardrails: restrict edit access, version your data sources, and log refresh failures. Looker Studio, Power BI, and Tableau Cloud each outline connectors and publishing workflows for reliable, shareable analytics. lookerstudio.google.comPower BI

Tie-back: When everyone sees the same live numbers, you trade debates for decisions.

Conclusion

You don’t need a giant stack to get enterprise-grade leverage. The durable approach is to cover the essentials—CRM, accounting, invoicing/payments, marketing automation, help desk, project management, collaboration, HR/payroll, e-signature, and BI—then connect them so data flows and your team doesn’t. Favor tools with clean interfaces, clear permissions, app marketplaces, and strong security posture (SOC 2, ISO 27001) and, if you handle cards, PCI DSS alignment for payments. Layer light processes on top: consistent naming, required fields, simple SLAs, and short SOPs that survive turnover. Most of all, evaluate with a “one billing cycle” mindset—trial, instrument, measure time saved and cash accelerated, and keep only what pulls its weight. When your stack is lean, integrated, and documented, your business feels bigger than your headcount and your customers feel the difference.

Copy-ready CTA: Pick the first category you need most, trial two tools this week, and turn your best one on for a full billing cycle.

FAQs

1) What’s the minimum viable SaaS stack for a very small team?

Aim for five: a CRM, accounting, invoicing/payments, a help desk or shared inbox, and a collaboration suite. This covers revenue, truth of numbers, cash collection, customer happiness, and daily work. Add project management when you juggle cross-functional work, and marketing automation once your list grows beyond manual sends.

2) How do I choose between QuickBooks Online and Xero?

Both handle bank feeds, invoicing, reconciliation, and reports. Choose based on your accountant’s preference, your integrations (e.g., POS or inventory), and how comfortable you feel in the interface. Try both with a sample month of transactions and see which produces faster, cleaner closes with fewer clicks.

3) Is a free CRM enough?

Often, yes—especially if you’re formalizing process for the first time. The key is adoption: email sync, basic automation, pipeline views, and a dashboard that drives your weekly review. As you scale, you may add paid features like advanced automation, more reporting, and custom permissions. HubSpot

4) Do I need a separate invoicing app if my accounting tool can send invoices?

Not always. If your accounting product’s invoicing covers your needs and offers the payment methods your customers prefer, keep it simple. Consider a dedicated invoicing tool when you need advanced features like automatic card updates, hosted payment pages, smart retries, or subscription logic tightly integrated with checkout.

5) What about data privacy and compliance (GDPR)?

If you serve or track EU residents, confirm your tools offer appropriate data processing terms and controls aligned with GDPR principles. Map your data flows, collect consent where needed, and honor requests like deletion and export. Favor vendors with clear documentation and admin controls. Council of the European Union

6) How do I connect tools without hiring a developer?

Use an automation platform. Zapier lets you link apps with triggers and actions (e.g., “new paid invoice” → “mark deal won” in your CRM), often in minutes and without code. Start with one high-friction handoff and expand once it proves its value.

7) When should I graduate from spreadsheets to accounting software?

As soon as bank reconciling takes more than an hour or you can’t tie out outstanding invoices at a glance. Software reduces data entry, supports multi-user collaboration, and locks closed periods. The payoff is cleaner books and fewer surprises. Small Business Administration

8) How do I keep licenses and costs under control?

Assign owners for each app, audit seats quarterly, and remove access during offboarding. Prefer annual billing only after a full cycle proves value. Track monthly active users and automate deprovisioning with your HR tool where possible. Suites can be more cost-effective than many single-purpose apps.

9) Are chat and docs in the same suite a must?

Not strictly—but using one suite tends to reduce duplication and confusion. If you keep chat separate, ensure search spans your files and conversations and set channel conventions so knowledge doesn’t vanish in DMs.

10) How do I measure if a tool is working?

Define a clear before/after metric: time saved per task, tickets resolved per agent per day, days-sales-outstanding, first response time, or on-time delivery rate. Review the metric after one billing cycle, then keep, tweak, or cancel. This keeps your stack honest and focused on outcomes.

References

- Checklist for Choosing Business Software, U.S. Small Business Administration — Small Business Administration

- SOC 2® — SOC for Service Organizations, AICPA — aicpa.org

- ISO/IEC 27001 — Information security management systems, International Organization for Standardization — ISO

- PCI Data Security Standard (PCI DSS), PCI Security Standards Council — PCI Security Standards Council

- CRM Software for Small Business, HubSpot — HubSpot

- Small Business Software Solutions, QuickBooks (Intuit) — QuickBooks

- Online Accounting Software, Xero — Xero

- Marketing Automation Flows, Mailchimp — Mailchimp

- Zendesk for Small Business, Zendesk — Zendesk

- Small Business Solutions, Google Workspace — Google Workspace

- Invoicing, Stripe — Stripe

- How Zapier Works, Zapier Docs — docs.zapier.com