If you’ve heard the term decentralized autonomous organization (DAO) and wondered what these groups actually ship in the real world, you’re in the right place. This guide breaks down 12 real-world DAOs in plain English—what they do, how their governance works, and why they matter—so you can quickly understand the outcomes they produce beyond hype. For transparency: this is educational, not financial advice; always do your own research and consult qualified professionals for investment or legal questions.

Quick definition: A DAO is a blockchain-native organization whose rules and treasury are controlled by token-holders or members through transparent, auditable smart contracts and public governance processes. The “autonomous” part means execution is encoded where possible; the “organization” part means people still do real work.

How to read this guide fast:

- Scan the table below to match each DAO to its domain.

- Skim the numbered sections for what they do, how decisions get made, and a practical example.

- Use “Numbers & guardrails” to see risks, thresholds, or typical decision levers.

- Follow the references to explore docs and forums.

| DAO | Domain | One-line “what they do” |

|---|---|---|

| MakerDAO | Stablecoin & collateralized credit | Governs the Maker Protocol and Dai stablecoin. |

| Uniswap DAO | Exchanges & liquidity | Stewards upgrades and parameters of the Uniswap DEX. |

| Aave DAO | Lending & borrowing | Manages the Aave money market protocol and risk parameters. |

| ENS DAO | Identity & naming | Governs the Ethereum Name Service protocol and treasury. |

| Arbitrum DAO | Layer-2 infrastructure | Sets policy for Arbitrum L2 chains via an on-chain constitution. |

| Optimism Collective | Layer-2 + public goods | Bicameral governance, funds public goods (“Retro Funding”). |

| Gitcoin DAO | Grants & public goods | Runs open grants and quadratic funding programs. |

| Nouns DAO | Cultural IP & grants | Uses daily NFT auctions to fund on-chain proposals. |

| Curve DAO | Liquidity & stable assets | Uses veCRV voting to direct emissions and parameters. |

| Mantle (BitDAO) | L2 + ecosystem treasury | DAO-initiated L2 with large, token-governed treasury. |

| CityDAO | Real-estate experiments | Experiments with tokenized land and civic governance. |

| PleasrDAO | Digital culture & collectibles | Acquires and stewards culturally significant digital assets. |

1. MakerDAO: A Stablecoin DAO That Runs a Collateralized Credit System

MakerDAO governs the Maker Protocol, the set of smart contracts that let anyone generate Dai, a crypto-collateralized stablecoin designed to track the value of a unit of account like the U.S. dollar. In practice, users lock approved collateral in “vaults,” mint Dai against it, and later repay Dai plus stability fees to unlock their assets. Governance by MKR token-holders decides which collateral types are allowed, how risk parameters are set, and how emergency tools like shutdowns work. The result is a decentralized credit facility and savings system that aims for resilience and transparency across market cycles. makerdao.comMakerDAO Docs

Why it matters

A credibly neutral stablecoin and credit primitive enables payments, remittances, trading, and hedging without relying on a single custodian. MakerDAO’s processes are extensively documented, and its governance has also pioneered approaches to real-world assets (RWAs)—onboarding off-chain credit structures through formal proposals and legal wrappers when the DAO approves them.

How it works

- Collateralized vaults: Deposit approved assets to mint Dai up to a risk-managed limit.

- Governance polling & executive votes: Community discussion → signal polls → on-chain executive actions.

- Risk modules: Smart contracts like Jug accrue fees; Oracles feed prices with safety delays; End coordinates emergency shutdown. MakerDAO Docs

Numbers & guardrails

- Collateral lists, debt ceilings, liquidation ratios, and stability fees are tuned by DAO votes; these change over time and should be reviewed before minting.

- RWA vaults are added by specific MIPs and executive votes; examples include bank and structured-credit integrations via dedicated vault types. vote.makerdao.com

Synthesis: If you need a decentralized dollar-like asset or want to analyze crypto-collateralized credit, MakerDAO is the canonical case of a DAO running a complex, risk-managed financial system.

2. Uniswap DAO: Community Governance for a Non-Custodial Exchange

The Uniswap DAO stewards the Uniswap Protocol, the most widely used automated market maker (AMM). UNI token-holders govern upgrades and parameters through a module and Timelock that enforce proposal lifecycles: discuss, propose, vote, and execute. In practical terms, the DAO may fund grants, adjust fee switches, or coordinate deployments across chains. For liquidity providers and traders, Uniswap remains permissionless: governance focuses on protocol evolution, ecosystem support, and safeguards to keep the core invariant—trustless swaps—reliable.

How it works

- Forum → Snapshot/On-chain: Proposals typically surface in the forum, progress to temperature checks, then on-chain votes.

- Governor contracts: The governance module specifies thresholds, voting periods, and execution through a Timelock.

- Ecosystem scope: The DAO coordinates grants and initiatives via community processes.

Numbers & guardrails (illustrative)

Imagine a proposal to allocate 2,000,000 units of a grant token over 12 weeks to bootstrap liquidity on a new chain. You’d check quorum/voting thresholds, the Timelock delay before execution, and measurable KPIs (e.g., target daily volume, unique LP addresses, and fee capture). The exact thresholds are codified in governance contracts and can evolve via proposals.

Synthesis: Uniswap’s DAO demonstrates how a protocol with massive day-to-day use can remain permissionless while evolving through open, modular governance.

3. Aave DAO: Risk-Managed Money Markets Run by Token-Holders

Aave is a decentralized, non-custodial lending protocol where suppliers earn yield and borrowers post collateral to draw liquidity. The Aave DAO—primarily AAVE token-holders—governs markets, onboarding of new assets, risk parameters (like loan-to-value ceilings), and upgrades. Aave’s docs emphasize a structured proposal lifecycle so changes to rates, oracles, and controllers are deliberate and auditable. For builders and treasuries, Aave offers a composable credit layer that’s widely integrated; for governance analysts, it’s a case study in continuous risk calibration by a DAO.

How it works

- Delegate & vote: Token-holders or their delegates introduce proposals with risk analyses.

- Parameter tuning: Markets have asset-specific configurations (LTVs, liquidation bonuses, reserve factors) set by governance.

- Upgrades: Executed via on-chain proposals after community review.

Numbers & guardrails (illustrative)

Consider adding a new collateral: if modeled stress tests show a 99% VaR drawdown requires a liquidation threshold above a chosen level, governance may insist on conservative LTV and caps until liquidity deepens. You’d also want circuit-breaker logic for oracle failure scenarios.

Synthesis: Aave shows how a DAO can run risk-sensitive markets at scale by encoding change control and parameter governance end-to-end.

4. ENS DAO: Human-Readable Names and the Governance That Keeps Them Reliable

ENS (Ethereum Name Service) maps human-readable names like yourname.eth to blockchain addresses and other records. The ENS DAO governs the protocol and treasury, coordinating improvements, working groups, and long-term funding so names remain dependable infrastructure. In practice, that means open discussions, off-chain temperature checks, and on-chain votes via established platforms, all documented in a public process. If you care about wallet UX, identity, and cross-app interoperability, ENS sits at the heart of the addressability layer that makes crypto feel usable.

How it works

- Working groups: Focus areas (e.g., Meta-governance) propose budgets and scopes.

- Voting stack: Forum for discussion; Snapshot and on-chain tools for proposals and execution.

- Scope: Protocol upgrades, grants, and ecosystem programs.

Numbers & guardrails

Executable proposals and working-group budgets are processed through defined templates and review windows; proposers should factor voter turnout patterns and delegation maps when timing initiatives. Recent governance pages list the venues and tooling used for each phase.

Synthesis: ENS DAO safeguards a critical piece of web3 identity, using clear process design to keep a shared namespace resilient over the long term.

5. Arbitrum DAO: A Constitution-Driven L2 with Community Control

Arbitrum is a high-throughput Layer-2 (L2) scaling network. The Arbitrum DAO governs key parameters and approvals across chains built with Arbitrum technology under an explicit DAO Constitution. This document lays out how proposals are categorized, how core contracts are controlled, and how additional L2 chains can be authorized, anchoring governance choices in a public, amendable framework. For users and builders, it means upgrades, treasury programs, and chain expansions are subject to token-holder consent with codified checks.

How it works

- Conceptual overview: Token-holders propose and vote on changes that affect Arbitrum One/Nova and associated technologies.

- Constitutional hierarchy: Certain proposals include longer delays and stricter requirements.

- Ecosystem scope: DAO may authorize new chains and allocate funding. Arbitrum DAO

Numbers & guardrails (illustrative)

Suppose a proposal seeks to authorize one new L2 chain. The Constitution states each AIP can authorize no more than one chain; proposers must supply security, upgrade, and resourcing plans plus community review time before execution.

Synthesis: Arbitrum shows how an L2 can embed a constitutional layer so token-holder decisions have predictable categories, timelines, and scope.

6. Optimism Collective: Bicameral Governance and Funding for Public Goods

The Optimism Collective uses a two-house model: a Token House of OP token-holders and a Citizens’ House tasked with allocating Retro Funding for public goods. This bicameral design seeks better decision quality and checks and balances than pure token voting, while preserving speed for technical changes. In practice, the Collective funds builders and infra that grow the ecosystem, evolves the L2, and iterates on governance mechanics in the open with docs and a community forum.

How it works

- Two houses, distinct roles: Token House handles protocol upgrades and missions; Citizens’ House allocates retroactive rewards.

- Deliberation venues: Public forum, published guidelines, and dedicated program documents.

- Iteration by design: The model is framed as an evolving experiment.

Numbers & guardrails (illustrative)

A Retro Funding round might specify scoring rubrics and budget caps; reviewers score impact ex-post rather than predicting it ex-ante. The bicameral structure means certain cross-house checks must pass before funds move.

Synthesis: Optimism’s governance is a living example of pluralistic design—using more than one voting body to reduce common token-voting failure modes.

7. Gitcoin DAO: Open Grants and Quadratic Funding at Scale

Gitcoin DAO is a community that funds builders and public goods, best known for its quadratic funding rounds and grants programs. Governance documents outline steward roles, working groups, processes, and evolving frameworks for progressive decentralization. For maintainers, Gitcoin is a route to fund open source; for communities, it’s a replicable blueprint for transparent grants pipelines with delegate oversight and public scorecards.

How it works

- Steward registry & scorecards: Delegated participants curate, review, and vote.

- Governance process: Proposal templates, review windows, and conflict-of-interest rules.

- Programs: The forum coordinates grants programs and changes to operations.

Numbers & guardrails (illustrative)

Imagine a round with a treasury cap of 1,000,000 units. Quadratic funding matches community contributions, so 1,000 small donors can outweigh a few whales. Proposals should set caps per project, matching formulas, and post-round audits to mitigate sybil risk—all common themes in Gitcoin’s governance threads. Gitcoin Governance

Synthesis: Gitcoin DAO operationalizes “fund what works” for the open internet, with processes others can fork and adapt.

8. Nouns DAO: Turning Daily NFT Auctions into a Community Treasury

Nouns DAO mints one generative NFT (“a Noun”) per day via a public auction. Each Noun equals one vote in governance that controls a substantial treasury used to fund creative, cultural, and public goods projects. The governance system is a fork of Compound’s model with on-chain proposals and the ability to delegate votes. In practice, you’ll see proposals to sponsor events, build software, or experiment with new media—each debated and executed transparently.

How it works

- Supply schedule: A regular auction cadence adds new members and funds.

- One Noun, one vote: Voting rights can be delegated.

- On-chain proposals: Accepted proposals execute via governance contracts.

Mini case (illustrative)

A team proposes a 50-ETH budget to produce educational content featuring Nouns. They outline milestones, escrow, and KPIs (views, remix licenses). Token-holders weigh brand impact, distribution, and cost per outcome before voting.

Synthesis: Nouns DAO showcases how a DAO can bootstrap a cultural commons by pairing predictable funding with on-chain decision rights.

9. Curve DAO: Vote-Escrowed Governance That Directs Liquidity Emissions

Curve DAO governs Curve Finance, a suite of AMMs focused on low-slippage swaps for similar-pegged assets. Governance uses vote-escrowed CRV (veCRV)—locking CRV for longer increases voting weight—which aligns participants toward multi-period decisions. A distinctive feature is gauge weight voting: veCRV holders direct where future CRV emissions go across liquidity pools, shaping incentives network-wide. Documentation outlines governance flows, fee splits, and risk controls across lending and stable assets, including crvUSD. resources.curve.firesources.curve.firesources.curve.fi

How it works

- veCRV model: Lock CRV to gain governance power and reward boosts.

- Gauge weights: Weekly votes adjust how emissions are distributed across pools.

- Risk levers: The DAO sets crucial parameters for lending and stablecoin products.

Numbers & guardrails

Gauge weights update on a fixed weekly cadence; misaligned votes can dilute rewards, so sophisticated participants simulate emission outcomes before casting ballots. Fee-split rules and allocation caps are DAO-set and can be revised through proposals. resources.curve.fi

Synthesis: Curve DAO is a masterclass in mechanism design, showing how token-locking and emission steering can coordinate deep liquidity.

10. Mantle (formerly BitDAO): A DAO-Initiated L2 and Ecosystem Treasury

Mantle is an Ethereum Layer-2 initiated by a DAO lineage (BitDAO → Mantle Governance). The network and its surrounding products are governed by token-holders, with a focus on ecosystem growth through grants, investments, and partnerships. Documentation and blog posts describe the migration from BIT to MNT and the consolidation of governance and treasury into a single Mantle umbrella. For founders, Mantle’s pitch is straightforward: a capitalized, DAO-owned L2 that can accelerate projects from early grant to exchange listings via its ecosystem ties. mantle.xyz

How it works

- Governance tokens: Mantle has operated with BIT and MNT during migration; the goal is unified governance under MNT.

- Treasury & programs: Proposals can fund strategic investments, token swaps, and ecosystem initiatives.

- Network scope: Governance steers L2 roadmap and integrations. mantle.xyz

Mini case (illustrative)

A partner DEX proposes a token swap of 2,000,000 units plus liquidity incentives for a Mantle deployment. The DAO evaluates strategic fit, lockups, and performance milestones (TVL growth, unique traders) before release. Mantle’s forum archives show similar token-swap patterns. mantle.xyz

Synthesis: Mantle demonstrates how a DAO can found and fund an L2 while coordinating treasury, growth, and governance under one roof.

11. CityDAO: Tokenized Land and Civic Experiments in the American West

CityDAO explores how on-chain governance could manage real-world land and civic processes. The community purchased a parcel of land (“Parcel 0”) in Wyoming under a compliant structure and continues to experiment with membership, proposals, and operational frameworks. Public testimony and repositories outline the mission: tokenizing rights and records, testing new forms of collective ownership and participation, and collaborating with local stakeholders as regulations and tooling mature.

How it works

- Membership via NFTs: “Citizens” hold NFTs that gate participation and voting.

- Governance proposals: Community introduces initiatives for land use, operations, and structure.

- Legal wrapper: Organized under a jurisdiction that recognizes DAO-style LLCs.

Numbers & guardrails (illustrative)

A proposal to improve Parcel 0 might request $75,000 equivalent for access roads and signage. The community would vet vendor quotes, insurance, and stewardship plans, requiring multi-sig milestones before funds flow.

Synthesis: CityDAO shows how DAOs can leave the screen and coordinate tangible projects, highlighting the interface between on-chain governance and off-chain compliance.

12. PleasrDAO: A Collector DAO for Culturally Important Digital Artifacts

PleasrDAO is a collective that acquires and stewards culturally significant digital works and artifacts, often with a charitable or community-ownership twist. It’s known for syndicating purchases and then experimenting with community participation—sometimes fractionalizing ownership or building new engagement layers around the assets. For creators and curators, it demonstrates how DAOs can organize capital and attention to preserve and extend cultural IP in ways that traditional institutions struggle to match.

How it works

- Sourcing & syndication: Members coordinate to pursue high-impact pieces.

- Stewardship: Assets can be exhibited, licensed, or reinterpreted with community input.

- Experimentation: Projects like community tokens around iconic works have invited broader participation. doge.pleasr.org

Mini case (illustrative)

Imagine the DAO acquiring a digital artifact for 1,000 units and allocating 10% to a public engagement fund. The group defines licensing rules, creator royalties, and governance over derivatives, then tracks outcomes like attendance, remix count, and educational partnerships.

Synthesis: PleasrDAO proves that DAOs can coordinate taste, curation, and public benefit—turning internet culture into a shared, governed collection.

Conclusion

DAOs aren’t just governance experiments; they are operating organizations that run stablecoins, exchanges, lending markets, naming systems, L2 networks, grant programs, cultural institutions, and even land projects. Across the 12 real-world DAOs covered here, you saw recurring patterns: open forums leading to on-chain actions, parameterized risk and treasury controls, explicit constitutions or process documents, and the use of token-locking or bicameral models to temper short-termism. The practical takeaway is simple: study the governance process as closely as the product, and insist on numbers, milestones, and clear execution paths before you support a proposal. Ready to go deeper? Pick one DAO above, open its docs and forum, and shadow a proposal from discussion to execution—then contribute to one small issue this week.

CTA: Share this guide with a teammate, pick one DAO from the list, and join a governance thread today.

FAQs

1) What is a DAO in one sentence?

A DAO is an internet-native organization whose rules and treasury are governed by its members through transparent smart contracts and public voting, aiming to minimize centralized control while coordinating real work.

2) How do DAOs make decisions?

Most DAOs use a pipeline: community discussion in a forum, off-chain signaling (e.g., Snapshot), and on-chain votes executed by governance contracts with delays and safety checks. The exact thresholds and timelines differ by protocol and are documented publicly.

3) Are DAOs legally recognized?

Legal recognition varies by jurisdiction. Some DAOs operate informally; others use wrappers like LLCs where available to sign contracts, hold assets, and comply with regulations. CityDAO’s public testimony shows one example of using a compliant wrapper while experimenting with on-chain governance.

4) What’s the practical benefit of token-locking models like veCRV?

Time-weighted voting aligns incentives toward longer-term thinking and reduces short-term governance attacks; it also lets communities steer emissions where liquidity is most useful. Curve’s docs explain how veCRV powers proposal voting and gauge weight allocations. resources.curve.fi

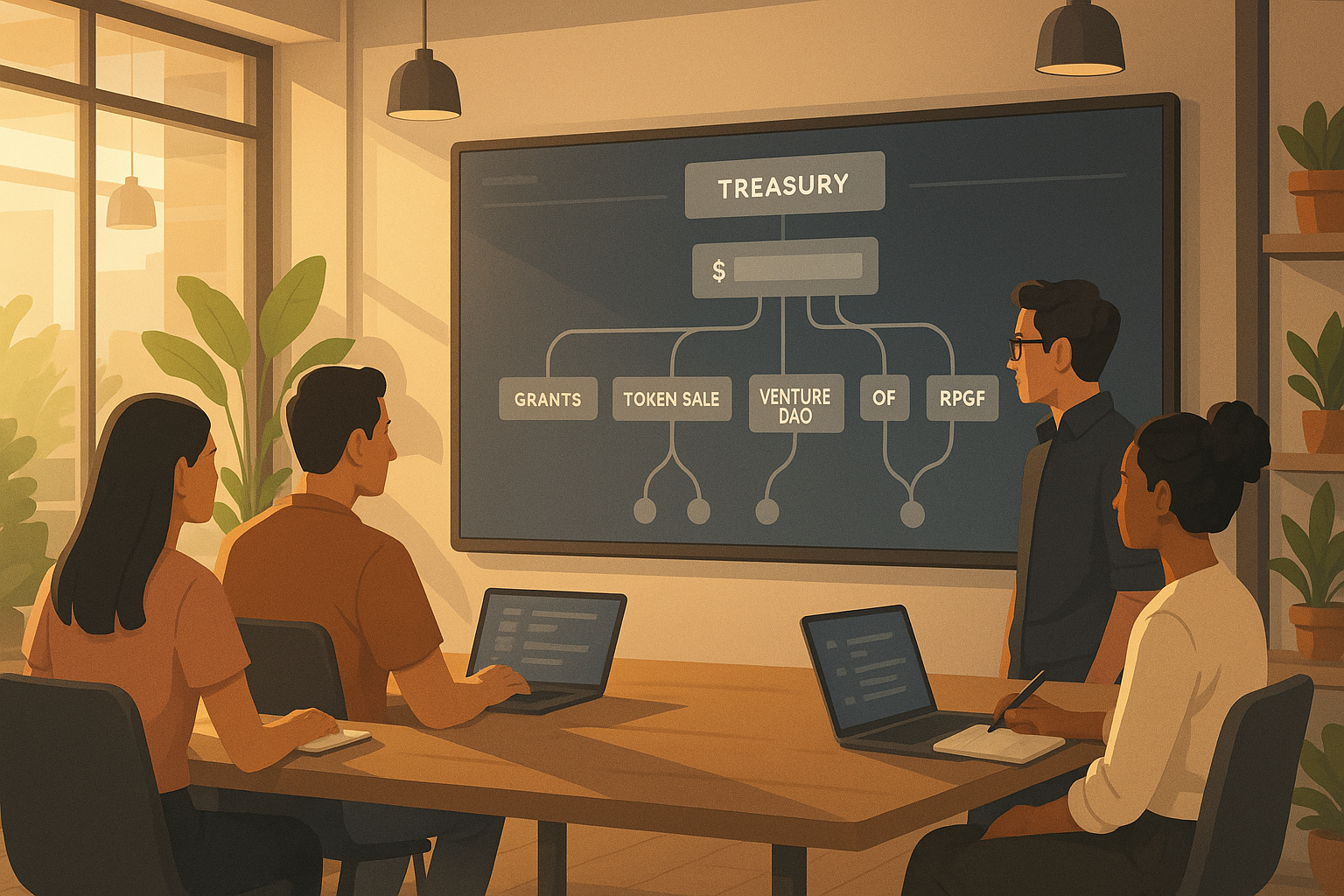

5) How do DAOs fund builders and public goods?

Grant DAOs like Gitcoin run transparent rounds using quadratic funding to amplify broad community support, while protocol DAOs (e.g., Uniswap, Optimism) budget for ecosystem grants through governance processes. Each publishes criteria, review steps, and post-funding accountability.

6) What risks should I check before interacting with a DAO?

Review smart-contract risk (audits, upgrade powers), governance risk (capture, low quorum), treasury management, and oracle dependencies. Protocol docs often include risk sections and disclaimers—Curve’s resources are a good example. resources.curve.fi

7) How do L2 DAOs (Arbitrum, Optimism) differ from app DAOs?

L2 DAOs govern base infrastructure—upgrades, security councils, and ecosystem programs—sometimes under constitutional rules or multi-house systems. App DAOs tune product parameters and fund integrations. Both publish process docs and forums to keep changes transparent.

8) What’s a realistic first contribution to a DAO?

Start small: comment on a forum thread with a concrete question, help draft a proposal template, test a governance dashboard, or contribute translation/docs. Many DAOs maintain newcomer guides and delegate registries to help you plug in. Uniswap Docs

9) Where do I find live proposals?

Each DAO links to a forum, Snapshot space, and on-chain voting portal. Uniswap, ENS, and others maintain clear “process” or “governance” pages with all the relevant links.

10) Do DAOs interact with off-chain assets?

Yes. Some DAOs integrate real-world assets via legal entities and specific governance proposals; MakerDAO’s MIPs document how off-chain credit or collateral can be onboarded when approved. Always read the legal structure and risk disclosures.

11) How can cultural DAOs avoid governance gridlock?

They define clear proposal sizes, milestone-based disbursements, and lightweight review committees, while preserving member voting for major decisions. Nouns’ one-Noun-one-vote model with on-chain execution is an example of keeping decision flow crisp.

12) What metrics help evaluate a DAO proposal?

Look for measurable outcomes: user growth, TVL/liquidity, throughput, grant milestone completion, and risk reduction. Proposals should include budgets, timelines, KPIs, and rollback plans; most governance frameworks encourage this structure. aave.com

References

- Maker Protocol Technical Docs, MakerDAO — documentation portal. https://docs.makerdao.com/

- The Maker Protocol White Paper, MakerDAO — formal overview of Dai, vaults, oracles, and voting. https://makerdao.com/whitepaper/

- MIP21: Real World Assets — Off-Chain Asset-Backed Lender, MakerDAO — governance proposal documenting RWA module. https://mips.makerdao.com/mips/details/MIP21

- Uniswap Governance Reference, Uniswap Docs — governance module, Timelock, and process. https://docs.uniswap.org/contracts/v2/reference/Governance/governance-reference

- Uniswap — Process & Guide to Voting, Uniswap Docs — proposal flow and voting guide. https://docs.uniswap.org/concepts/governance/process

- Aave Protocol Documentation (Governance & Overview), Aave — protocol and governance docs. https://aave.com/docs

- ENS DAO — Governance Process & Overview, ENS Docs — DAO venues and process. https://docs.ens.domains/dao/

- Arbitrum DAO Constitution & Concepts, Arbitrum Foundation — constitutional governance for L2 chains. https://docs.arbitrum.foundation/dao-constitution

- Welcome to the Optimism Collective, Optimism — bicameral governance overview and forum. https://community.optimism.io/welcome/welcome-overview

- Gitcoin Governance Manual & Process, Gitcoin — steward roles, forums, and processes. https://manual.gitcoin.co/

- Nouns DAO — How It Works & Voting, Nouns — site and on-chain voting portal. https://nouns.wtf/

- Curve Resources (Governance, veCRV, Fee Splitter, crvUSD), Curve — governance structure and docs. https://resources.curve.fi/

- Mantle Network & Governance (BIT→MNT Migration), Mantle — network pages and governance posts. https://www.mantle.xyz/

- CityDAO Testimony, Wyoming Legislature — organizational mission and structure. https://wyoleg.gov/InterimCommittee/2022/S19-2022061411-02CityDAOTestimony.pdf

- PleasrDAO — About & Projects, PleasrDAO — collective’s mission and activity. https://pleasr.org/