“Decentralization of finance” describes moving financial functions from centrally controlled intermediaries to public, programmable networks where smart contracts execute rules transparently. Practically, you’re deciding between CeFi (centralized platforms that custody assets and provide a familiar service layer) and DeFi (permissionless protocols you access with a wallet, where you hold your own keys). This guide walks you through the trade-offs so you can pick the right model for a specific job, and combine them when that’s smarter. Nothing here is investment, legal, or tax advice; for personal decisions, consult qualified professionals. For quick navigation, the decision path usually looks like this:

- Define your job-to-be-done (buy/sell, earn yield, borrow, move funds).

- Choose custody model (custodial vs self-custody) based on risk tolerance and accountability needs.

- Check access/compliance needs (KYC, reporting, travel rule).

- Match the market structure (order book vs AMM) to the asset and liquidity pattern.

- Price the total cost (spreads, fees, gas, slippage, funding).

- Stress-test risks (counterparty, contract, oracle, governance, bridge).

- Pick tools, set guardrails (limits, alerts, coverage), and run a pilot.

Outcome preview: by the end, you’ll know exactly when CeFi is the safer convenience play, when DeFi is the programmable edge, and how to mix both without taking uncompensated risk.

1. Custody & control: who holds the keys—and what breaks when things break

The core divide is custody. In CeFi, a platform or broker controls private keys and books balances in your name, often within a regulated wrapper; your recovery path runs through contracts, customer support, and—depending on the asset—statutory protections. In DeFi, you control keys in a non-custodial wallet; the protocol “sees” only your address and the contract’s rules. That means direct control, composability, and no withdrawal queues—but also full responsibility for key security, approvals, and signing. The right choice hinges on your accountability needs, operational maturity, and who must be answerable if funds go missing.

How it works (plainly): in DeFi, a wallet (hardware, mobile, browser, or multi-sig) holds your private key; transactions are authorized by your signature and executed by smart contracts. In CeFi, deposits go to the platform’s wallets; you access services via an account, and the platform settles trades internally, then on-chain when needed. If a U.S. broker fails, SIPC may help recover missing securities and cash in securities accounts up to $500,000 (including $250,000 for cash). That protection does not extend to non-security crypto assets. DeFi has no SIPC; your safety net is good key hygiene, protocol security, and optionally on-chain cover products.

Numbers & guardrails

- SIPC coverage: up to $500,000 per separate capacity at an SIPC-member broker; includes $250,000 cash sub-limit.

- Non-security crypto held at brokers is not protected by SIPA; treat custody agreements and legal segregation terms as your first line of defense.

- Multi-sig baseline: 2-of-3 with a hardware wallet + wallet-as-a-service + emergency key reduces single-key compromise without adding too much friction. SIPC

Mini-checklist:

- If you need audit trails, recourse, or client asset attestations → start in CeFi.

- If you need programmable control, composability, and instant self-custody → start in DeFi.

Close the loop by documenting who’s accountable for keys and what your recovery plan looks like in each model.

Why it matters: custody defines your operational risk surface and the remedies available if something fails. Pick deliberately, then design everything else around that choice.

2. Access, onboarding & compliance: KYC, the Travel Rule, and permissioning

If you must onboard customers, reconcile identities, or meet reporting obligations, CeFi fits neatly: platforms perform KYC/AML, screen transactions, and implement Travel Rule requirements between virtual asset service providers (VASPs). DeFi apps, by design, are open interfaces; some front-ends geofence or add KYC for specific features, but the contracts underneath remain permissionless. That openness is powerful for inclusion and developer speed, yet it shifts compliance questions to where developers, integrators, or businesses touch users, custody, or fiat.

What to expect: the FATF standards (Recommendation 16’s “Travel Rule”) require VASPs to obtain, hold, and transmit sender/recipient information for virtual-asset transfers. Jurisdictions implement this unevenly, so cross-border interactions add counterparty checks. In the EU, MiCA introduces a harmonized licensing and conduct regime for crypto-asset service providers, with disclosures, complaints handling, and supervision. Your decision isn’t just “CeFi or DeFi”—it’s also “which jurisdiction and obligations” your stack inherits.

How to do it

- Map where you (or partners) become a VASP: fiat ramps, custody, order routing, hosted wallets, or operating a front end.

- Build a counterparty heat map for Travel Rule coverage; set fallbacks for transfers to non-compliant jurisdictions.

- For DeFi integrations, separate protocol (permissionless) from front-end (potentially permissioned) responsibilities.

Region note: the EU’s MiCA formalizes CASP obligations; other regions rely on existing financial rules plus guidance. Align product scope to the strictest regime you touch, then relax only if you can control geographies.

Synthesis: compliance realities often decide the model for you. If regulated onboarding and monitoring are core, lead with CeFi wrappers; if you’re building permissionless primitives, engineer front-end and business processes that respect global AML standards without breaking the protocol.

3. Transparency & auditability: on-chain truth vs proof-of-reserves

DeFi gives you a public ledger: positions, liquidations, liquidity pool states, and governance actions are verifiable by anyone with a block explorer. CeFi balances live in platform databases; you see your account, but not everyone else’s. To bridge that trust gap, some CeFi platforms publish Proof of Reserves (PoR)—cryptographic attestations (often with Merkle trees) that user liabilities are backed 1:1 by assets in custody. PoR helps, but it hinges on audit scope, inclusion of liabilities, and frequency; it’s not the same as real-time, programmatic collateral checks.

Numbers & guardrails

- On-chain: anyone can recompute balances from transactions; transparency is native.

- PoR: look for assets + liabilities proofs, user-verifiable inclusion (Merkle path), and independent attestations at predictable intervals.

- DeFi collateral: some protocols also use on-chain PoR oracles for asset-backed tokens and wrapped assets to halt actions if reserves fall short.

Tools/Examples

- Kraken publishes client-verifiable PoR with user-downloadable Merkle proofs.

- Chainlink Proof of Reserve offers automated reserve verification for fiat-backed tokens and cross-chain assets. blog.kraken.com

Synthesis: if you need continuous, public auditability, DeFi sets the bar; if you prefer custodial simplicity, demand PoR that proves liabilities, not just assets, and understand its limits.

4. Market structure & liquidity: order books vs AMMs (and impermanent loss)

CeFi typically runs central limit order books (CLOBs): you place bids/asks, a matching engine executes trades, and market makers provide depth. DeFi popularized automated market makers (AMMs) like constant-product pools where price moves with pool balances—no traditional order book required. AMMs democratize liquidity provision and enable long-tail markets, but liquidity providers face impermanent loss (IL) when prices move.

How it works

- Order books (CeFi): tight spreads on majors, deep liquidity during normal markets; potential fragmentation and internalization.

- AMMs (DeFi): price follows a curve (eg, xy = k*); any trade moves the price; concentrated liquidity variants improve capital efficiency on blue-chips.

Numeric mini-case (IL)

If a 50/50 pool has Token A double in price relative to Token B, a passive LP who started with equal value sees about –5.7% IL versus holding both assets. Larger moves widen the gap; fees can offset IL if volume is high. Guardrails: provide in tight ranges on correlated pairs, monitor fee income, and avoid thin pools for volatile pairs. ScienceDirect

Pitfalls

- Treating AMM spot ratios as robust price oracles in smart contracts → prone to manipulation in thin pools.

- Ignoring slippage: price impact rises non-linearly with trade size relative to pool depth. Uniswap Docs

Synthesis: pick CLOBs for tight execution on majors or when you need advanced order types; use AMMs for permissionless listing, composability, and programmable LP strategies—while managing IL and oracle risks.

5. Yields, lending & liquidations: where returns actually come from

CeFi “earn” products usually bundle lending, staking, or market-making behind the scenes; you see a rate, not the mechanism. DeFi exposes the plumbing: lending markets (e.g., pooled collateral with loan-to-value limits and automated liquidations), staking rewards from validating networks, or LP fees from AMMs. Transparency lets you price risk, but it also means you must set your own safety rails.

How to do it

- Pick over-collateralized lending for simplicity and predictable liquidation mechanics.

- Track utilization and variable rates; consider stable-rate options where available.

- For staking and liquidity provision, account for slashing, IL, and gas in your net APY.

Numbers & guardrails (illustrative)

- Many blue-chip lending markets target collateral factors around 60–80% depending on asset volatility; liquidation thresholds sit slightly above LTV caps.

- Example: if your LTV cap is 70% and the liquidation threshold 75%, borrowing $7,000 against $10,000 collateral gives ~$667 cushion before liquidations start if price slips.

- Set health factor alerts and auto-repay/auto-refill bots for volatile collateral.

Synthesis: DeFi lets you see and control the engine; CeFi simplifies decisions into a headline rate. Either way, borrow against liquid, reliable collateral and automate your downside protections.

6. Security & threat models: keys, contracts, and oracles

Security assumptions differ sharply. CeFi consolidates risk in custodial key management, internal controls, and platform operations; your mitigations are legal segregation, audits, insurance, and platform track record. DeFi distributes risk across smart contracts, keys, and oracles. Contracts can have logic bugs or economic design flaws, oracles can be manipulated, and wallet approvals can leak allowances.

Common mistakes

- Reusing hot wallets without hardware signing; neglecting allowance revocation after using dApps.

- Treating thin AMM pools as price sources; pairing volatile collateral with high leverage.

- Ignoring governance upgradability that can change protocol rules overnight.

Numbers & guardrails

- Use hardware wallets for signing; split roles with multi-sig for treasury operations.

- Favor protocols with formal audits, bug bounties, time-locked upgrades, and proven incident response.

- Understand oracle risk—prefer robust designs (e.g., time-weighted, multi-source feeds) over single-source spot reads.

Synthesis: CeFi concentrates risk in a few institutions; DeFi atomizes it across contracts and users. Neither is “risk-free”—they’re just different failure modes. Match controls to the model you pick.

7. Governance & upgrades: corporate charters vs token voting

Who decides fee switches, risk limits, or listings? CeFi follows corporate governance—boards, risk committees, regulators. DeFi delegates decisions to token holders via on-chain or off-chain voting that executes upgrades when thresholds are met. Token voting can be efficient but tends to concentrate power in large holders or delegates, raising “how decentralized is decentralized” questions.

How it works

- MakerDAO and Compound are classic templates: proposals, debate, voting, and timelocked execution; holders can delegate votes.

- Centralization reality: even in DeFi, practical control often accrues to core teams, multisigs, or large stakeholders (“decentralization illusion”). makerdao.comCompound

Numbers & guardrails

- Require quorum and timelocks; favor emergency pause powers governed by multi-sig with published signers.

- Use delegation markets to diversify voice; publish delegate platforms and rationales. docs.compound.finance

Synthesis: governance defines adaptability. If you need predictable, regulator-aligned change control, CeFi fits; if you want community-driven parameters and programmable policy, DeFi DAOs deliver—with vigilance on concentration risk.

8. Performance, speed & fees: finality, TPS, and layer-2s

CeFi abstracts the chain: internal ledgers make trading feel instant, with settlement batched on-chain later. DeFi pays the network cost at the point of use; throughput and fees depend on the base chain and whether you’re using layer-2 rollups that compress transactions. Expect base-layer fees to fluctuate with demand; L2s reduce costs substantially for routine use.

Numbers & guardrails

- Bitcoin handles only single-digit transactions per second; Ethereum layer-1 throughput is limited but L2s can scale to hundreds or more by rolling up transactions.

- For cost control, bundle actions (e.g., batched swaps), use L2s for routine activity, and reserve L1 for high-value settlement.

Mini-case: a simple DEX swap might cost cents on an efficient L2 when idle but rise during congestion; budgeting ceilings per action (e.g., “send if total < $X”) avoids fee shocks and failed transactions.

Synthesis: CeFi optimizes UX by hiding settlement; DeFi hands you raw rails and better economics at scale with L2s—if you plan for volatility in fees and confirmation times.

9. Regulatory exposure & geography: where each model fits

CeFi maps cleanly to financial-services regulation: licensing, disclosures, capital, reporting, and customer protection. DeFi maps imperfectly—standards setters acknowledge the need to address DeFi risks (liquidity, leverage, operational fragility, oracle reliance), yet enforcement targets the points of control (front-ends, teams, or custodial edges). If your product must operate across jurisdictions, assume you’ll inherit the strictest major-market regime you touch.

Region-specific notes

- EU (MiCA): harmonizes crypto-asset service provider rules; brings consumer protections and transparency requirements for many activities.

- Global (FATF): the Travel Rule applies to VASPs; implementation varies, and gaps increase counterparty risk.

- Supervisory views: global bodies (BIS/FSB/IMF) flag DeFi vulnerabilities—liquidity, leverage, and governance centralization.

Numeric guardrails

- Maintain jurisdiction matrices of KYC/Travel Rule status; set per-jurisdiction limits until obligations are clear.

- For DAOs, publish legal entity wrappers where needed; for CeFi partners, verify SIPC/FDIC messaging accuracy to avoid compliance misstatements. FINRA

Synthesis: think “compliance by design.” CeFi is usually the default for regulated distribution; DeFi demands careful boundary design and documentation.

10. Composability & integrations: money legos vs closed stacks

DeFi is composable: protocols snap together like “money legos,” letting you route collateral, borrow, hedge, and farm across apps in a single flow. That creates powerful network effects—and risk cascades when dependencies fail. CeFi offers integrations through APIs and partnerships but within each firm’s walled garden.

How to use it

- Chain only the pieces you understand: swap → lend → hedge is manageable; adding leverage + exotic farms multiplies unknowns.

- Prefer primitives with battle-tested contracts, clear upgrade paths, and monitoring hooks.

Why it matters

Composability accelerates product innovation and lets small teams assemble sophisticated services. But each added lego introduces failure modes; audits don’t compose automatically. Use allow-lists, rate limits, and circuit breakers in your own integrations. ethereum.org

Synthesis: composability is DeFi’s superpower and Achilles’ heel. Use it to build faster—but treat every dependency like a third-party vendor with change control.

11. User experience & support: hand-holding vs self-serve

CeFi optimizes for familiarity: email logins, fiat on-ramps, customer support, recurring buys, and consolidated tax forms. DeFi optimizes for sovereignty: no accounts, no gatekeepers, portable identity, and 24/7 access—if you can manage keys and read transaction prompts. The human factor is decisive: if your team or clients need live support and turnkey UX, CeFi wins; if they value autonomy and privacy, DeFi sings.

Mini-checklist

- Needs a help desk, chargebacks, or account recovery? Favor CeFi.

- Needs portability, open APIs, and censorship-resistant flows? Favor DeFi.

- Hybrid? Use CeFi for onboarding/fiat and DeFi for programmable back-end rails.

Synthesis: the “best” UX is the one people actually use correctly. Pilot with real users, then standardize on the model with fewer human errors under your constraints.

One-page chooser (compact table)

| Scenario | Lean CeFi when… | Lean DeFi when… |

|---|---|---|

| First-time crypto purchase | You want KYCed fiat on-ramp, support | You already have stablecoins or native assets in a wallet |

| High-value client funds | You need audited custody and statements | You require self-custody, granular policy, multi-sig |

| Frequent small transfers | Bank links, fee-free internal transfers | L2 fees are reliably low; you automate batching |

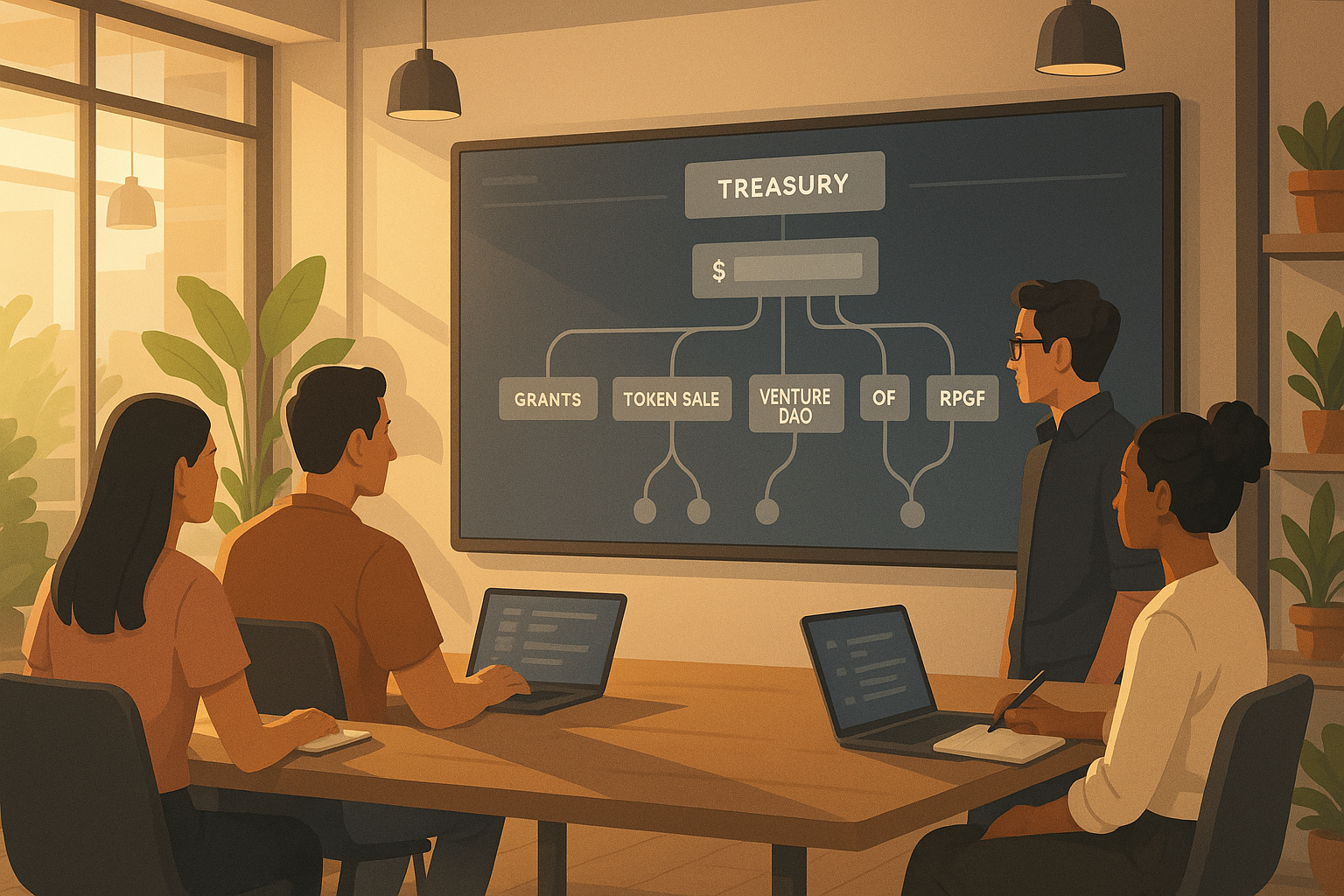

| Programmatic treasury | Bank integrations, simple approvals | Policy-controlled multi-sig, on-chain spending rules |

| Niche asset trading | Central listings and depth exist | AMM pools exist and you can price IL risk |

Conclusion

CeFi and DeFi aren’t rivals so much as tools in a shared toolbox. CeFi shines when you need regulated on-ramps, custodial accountability, and full-service UX; DeFi shines when you need programmable control, composability, and public auditability. The trick is to start from the job-to-be-done, pick the custody and compliance model that fits, and then price the costs and risks all the way through—execution, fees, oracle assumptions, governance, and support. Most durable operating models use both: a CeFi wrapper for onboarding and fiat connectivity, with DeFi rails under the hood for settlement, liquidity, and programmable treasury. Build your rails intentionally, set numeric guardrails (LTVs, fee caps, health-factor alerts), and keep a living runbook for incident response. Your next action: pick one use case (e.g., “pay contractors”), map the flow in both CeFi and DeFi, and run a $-limited pilot to validate costs, risks, and support load.

FAQs

1) Is decentralization of finance mainly about avoiding regulation?

No. It’s about changing where trust sits—moving from institutional control to protocol rules and self-custody. Regulation still applies where people or businesses provide services (exchanges, hosted wallets, front-ends). Many teams design “compliance at the edges” while keeping core protocols permissionless. FATF

2) Can Proof of Reserves replace on-chain transparency?

It helps, but it’s not identical. PoR proves assets (and ideally liabilities) at a snapshot or cadence, whereas on-chain state is continuously verifiable. Treat PoR as one control among many; prefer implementations with user-verifiable inclusion and clear auditor scope. Kraken

3) Why do people warn against using AMM pools as price oracles?

Thin pools can be manipulated with large trades or flash loans, pushing spot price temporarily and tricking dependent contracts. Robust oracle designs aggregate data across time and venues and resist single-block spikes. cyfrin.io

4) How fast is DeFi compared to CeFi?

CeFi feels instant because the platform updates internal ledgers and batches settlement later. DeFi speed depends on the base chain and whether you use a layer-2; rollups can process far more transactions at lower cost than the base layer, but fees and confirmation times vary with demand.

5) What protections exist if a brokerage fails?

In the U.S., SIPC may help recover missing securities and cash in securities accounts up to set limits. That protection doesn’t extend to non-security crypto assets; read platform terms and regulator guidance carefully.

6) Does DeFi have insurance?

Not insurance in the traditional sense, but there are on-chain cover products that pay out for defined smart-contract or protocol events. Coverage scope, triggers, and capacity vary; read the wording and avoid assuming universal protection. docs.nexusmutual.io

7) How do DeFi liquidations work—and why so fast?

Lending markets set collateral thresholds; if your health factor falls below a limit, keepers liquidate positions automatically according to contract rules. It’s transparent and predictable, but ruthless—set alerts and maintain buffers. Cube Exchange

8) Is DeFi governance really decentralized?

Sometimes, but power often concentrates in large holders, delegates, or multisigs, especially early on. Good protocols disclose admin powers, use timelocks, and invite broad participation; it’s still wise to assess who can change what, and how quickly.

9) Where do oracles fit, and why are they risky?

Oracles bridge off-chain data (prices, reserves) to on-chain contracts. If feeds are manipulated or fail, dependent apps can misprice collateral or mint unbacked assets. Favor diversified, time-weighted feeds and circuit breakers in your designs. Chainlink

10) Can I mix CeFi and DeFi safely?

Yes—many do. Common patterns: CeFi for fiat onboarding and reporting; DeFi for settlement and liquidity. The key is crisp boundaries, documented responsibilities, and alerts where the models meet (oracles, bridges, custody transfers).

References

- “DeFi risks and the decentralisation illusion.” Bank for International Settlements (Quarterly Review). 2021. https://www.bis.org/publ/qtrpdf/r_qt2112b.htm

- “Updated Guidance: A Risk-Based Approach to Virtual Assets and VASPs.” FATF. 2021. https://www.fatf-gafi.org/en/publications/Fatfrecommendations/Guidance-rba-virtual-assets-2021.html

- “Targeted Update on Implementation of the FATF Standards in relation to VAs and VASPs.” FATF. 2025. https://www.fatf-gafi.org/content/dam/fatf-gafi/recommendations/2025-Targeted-Upate-VA-VASPs.pdf.coredownload.pdf

- “Markets in Crypto-Assets (MiCA).” ESMA. n.d. https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica

- “What SIPC Protects” & “How SIPC Protects You.” SIPC. n.d. & 2015. https://www.sipc.org/for-investors/what-sipc-protects and https://www.sipc.org/media/brochures/HowSIPCProtectsYou-English-Web.pdf

- “Frequently Asked Questions Relating to Crypto Asset Activities.” U.S. SEC Staff Guidance. 2025. https://www.sec.gov/rules-regulations/staff-guidance/trading-markets-frequently-asked-questions/frequently-asked-questions-relating-crypto-asset-activities-distributed-ledger-technology

- “Ethereum wallets” & “Intro to Layer 2.” Ethereum.org. n.d. https://ethereum.org/wallets/ and https://ethereum.org/layer-2/

- “Automated Market Makers: Constant-Product Rule.” Cartea, Donnelly, Jaimungal (survey). 2022. https://www.math.toronto.edu/mcastro/AMM-survey.pdf

- “Uniswap v2 Oracles & Concepts.” Uniswap Docs. n.d. https://docs.uniswap.org/contracts/v2/concepts/oracles

- “OWASP Smart Contract Top 10: Price Oracle Manipulation.” OWASP. 2025. https://owasp.org/www-project-smart-contract-top-10/2025/en/src/SC02-price-oracle-manipulation.html

- “Chainlink Proof of Reserve.” Chainlink Education Hub. 2025. https://chain.link/education-hub/proof-of-reserves

- “Aave Risk Parameters (Governance Docs).” Aave/Community resources. n.d. https://github.com/aave/aave-v3-core (see collateral configuration and risk parameters)