Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute financial, investment, legal, or tax advice. Financial decisions should be made in consultation with qualified professionals. The landscape of financial technology and regulation is rapidly evolving; ensure you verify specific regulations in your jurisdiction.

Artificial intelligence (AI) has moved beyond the realm of theoretical computer science to become the central nervous system of modern finance. From the milliseconds-fast decisions of high-frequency trading to the complex assessment of loan eligibility, AI in financial services is reshaping how money moves, how risk is calculated, and how institutions interact with customers.

For decades, the financial sector relied on statistical models and human intuition. Today, machine learning algorithms process petabytes of unstructured data—news articles, social media sentiment, satellite imagery, and transaction histories—to uncover patterns invisible to the human eye. This shift is not merely about automation; it is about augmenting human intelligence to create a more efficient, secure, and inclusive financial system.

In this comprehensive guide, we explore the three critical pillars of this transformation: algorithmic trading, credit scoring, and risk management. We will examine how these technologies work in practice, the benefits they offer, and the significant ethical and regulatory challenges they present.

Key Takeaways

- Algorithmic Trading Evolution: AI has evolved from simple rule-based execution to complex predictive models that utilize natural language processing (NLP) to gauge market sentiment.

- Credit Inclusion: Machine learning models are enabling lenders to use “alternative data” (rent payments, utility bills) to score “credit invisible” individuals, potentially expanding financial inclusion.

- Proactive Risk Management: AI shifts risk management from reactive damage control to proactive threat detection, particularly in anti-money laundering (AML) and fraud prevention.

- The “Black Box” Challenge: A major hurdle in financial AI is explainability—regulators and consumers need to know why an AI made a specific decision, not just the outcome.

- Human-AI Collaboration: The most successful implementations involve “human-in-the-loop” systems where AI handles data processing and humans handle high-stakes judgment calls.

Scope of This Guide

In Scope:

- Machine learning and deep learning applications in banking, trading, and lending.

- The mechanics of algorithmic trading, credit scoring, and risk management.

- Operational benefits and ethical/regulatory challenges.

- Current trends as of early 2026.

Out of Scope:

- Specific investment recommendations or stock picks.

- Detailed coding tutorials for building trading bots.

- Comprehensive reviews of specific consumer banking apps or credit cards.

What is AI in Financial Services?

Before diving into specific verticals, it is essential to understand the underlying technology. In the context of financial services, AI generally refers to the use of machine learning (ML), natural language processing (NLP), and increasingly, generative AI, to perform tasks that historically required human cognition.

Unlike traditional software that follows strict, pre-programmed “if-then” rules, modern AI models learn from data. They improve over time without being explicitly reprogrammed for every new scenario.

The Shift from Statistical to Predictive

Traditional finance relied heavily on linear regression and historical averages. If a borrower had a certain income and debt level, they fit into a specific box. AI introduces non-linear analysis. It can correlate thousands of variables simultaneously, identifying that a borrower with a fluctuating income but a strong history of regular micro-savings might actually be a lower risk than someone with a steady income but erratic spending habits.

Core Technologies Driving Change

- Machine Learning (ML): Used for credit scoring and fraud detection, finding patterns in historical data to predict future outcomes.

- Natural Language Processing (NLP): Used in trading to read earnings reports and news feeds instantly, and in customer service via chatbots.

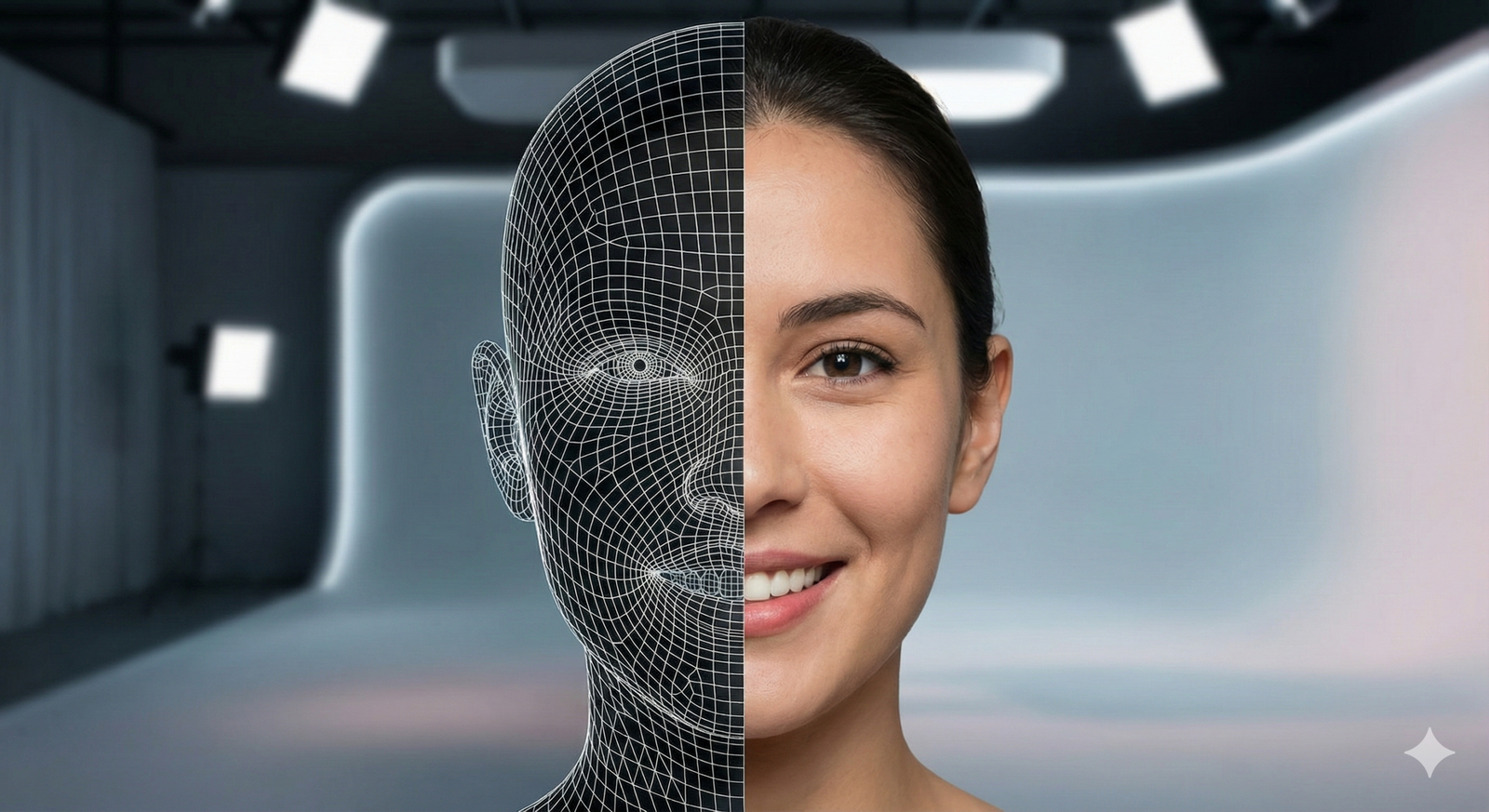

- Computer Vision: Used in insurance (analyzing photos of car accidents) and identity verification (facial recognition for KYC).

- Generative AI: Used to create personalized financial advice summaries and automate code generation for trading strategies.

Pillar 1: Algorithmic Trading and AI

Algorithmic trading is the use of computer programs to execute trades at speeds and frequencies that are impossible for a human trader. While “algos” have existed for decades, the integration of AI has transformed them from execution tools into decision-making engines.

How AI Trading Works

Traditional algorithms execute orders based on defined instructions (e.g., “Buy 100 shares if the price drops below $50”). AI-driven trading involves predictive modeling.

- Data Ingestion: The system ingests massive datasets, including market prices, volume, macroeconomic indicators, and alternative data.

- Feature Extraction: The model identifies which factors (features) are currently driving the market.

- Strategy Generation: The AI tests millions of scenarios to determine the probability of a price movement.

- Execution: The trade is placed via smart order routing to minimize market impact and transaction costs.

High-Frequency Trading (HFT) vs. AI Investing

It is important to distinguish between HFT and broader AI investing strategies.

- High-Frequency Trading (HFT): This relies primarily on speed (latency). HFT firms use co-located servers to execute trades in microseconds, capitalizing on tiny price discrepancies between exchanges (arbitrage). AI is used here to optimize the speed of execution and predict short-term order flow.

- AI Investing/Swing Trading: These models may hold positions for minutes, days, or months. They focus on identifying undervalued assets or structural market shifts. For example, a hedge fund might use AI to analyze satellite imagery of retail parking lots to predict a retailer’s quarterly earnings before they are announced.

Sentiment Analysis and NLP

One of the most powerful applications of AI in trading is Natural Language Processing (NLP). Markets are moved by information, and information is often text-based.

- News Aggregation: AI models scan thousands of news sources globally in real-time.

- Contextual Understanding: The AI determines if a headline is positive, negative, or neutral. It can distinguish between “Company X sued by Company Y” (bad) and “Company X sues Company Y” (potentially neutral/good).

- Federal Reserve Signals: Advanced models analyze the transcripts of Federal Reserve speeches, detecting subtle shifts in tone regarding interest rates that human analysts might miss.

Risks in AI Trading

- Flash Crashes: Because AI models often rely on similar datasets, they may all decide to sell simultaneously during a volatility spike, cascading into a market crash.

- Overfitting: A model might perform perfectly on historical data (backtesting) because it “memorized” the past, but fail exclusively in real-time markets when conditions change.

Pillar 2: AI in Credit Scoring and Lending

Credit scoring is the gatekeeper of financial opportunity. It determines who gets a mortgage, who gets a business loan, and at what interest rate. AI is revolutionizing this field by moving beyond the limited data points used in traditional FICO-style scoring.

Traditional vs. AI-Driven Scoring

- Traditional Scoring: Relies heavily on credit history (past loans, credit cards), payment history, and credit utilization. This creates a “chicken and egg” problem: you need credit to get credit. Young people and immigrants often have “thin files” and are rejected despite being financially responsible.

- AI-Driven Scoring: Utilizes machine learning to analyze a broader spectrum of data. It looks for correlations between non-obvious behaviors and repayment reliability.

The Role of Alternative Data

AI models can ingest and analyze alternative credit data to assess creditworthiness. In practice, this looks like:

- Utility and Rent Payments: Consistent payment of electricity, water, and rent is a strong predictor of mortgage repayment, yet traditional scores often ignore it.

- Cash Flow Analytics: By connecting to a user’s bank account (via Open Banking APIs), AI analyzes income stability, spending habits, and savings density, rather than just debt levels.

- Digital Footprints: In some jurisdictions, lenders analyze device data, browsing behavior, or mobile phone usage patterns. (Note: This is highly regulated and restricted in regions like the EU and North America due to privacy concerns).

Benefits for Lenders and Borrowers

- Increased Approval Rates: By seeing the “full picture,” lenders can approve solvent borrowers who were previously invisible to the system.

- Dynamic Pricing: Interest rates can be tailored to the specific risk profile of the individual in real-time, rather than placing them in a broad tier.

- Speed: AI enables instant decision-making. Small business loans that used to take weeks to underwrite can now be approved in minutes.

The Bias and Fairness Dilemma

While AI promises objectivity, it can inadvertently perpetuate bias. If historical lending data contains bias (e.g., a specific demographic was historically denied loans due to redlining), the AI model trained on that data will learn to replicate that bias.

- Proxy Variables: Even if you remove “race” or “gender” from the dataset, the AI might find proxies. For example, a zip code or a specific university might correlate strongly with a protected class.

- Algorithmic Fairness: Responsible AI requires “fairness constraints” where developers actively test models to ensure outcomes are equitable across different demographic groups.

Pillar 3: Risk Management and Fraud Detection

Risk management is the defensive shield of financial services. Banks lose billions annually to fraud, cyberattacks, and operational failures. AI serves as an always-on sentinel, capable of monitoring billions of transactions simultaneously.

Fraud Detection and Prevention

Traditional fraud detection relied on rule-based systems (e.g., “If a transaction occurs in a different country, flag it”). These rules produced many false positives, frustrating customers.

AI approaches include:

- Anomaly Detection: Unsupervised learning algorithms establish a baseline of “normal” behavior for every specific user. If a user who typically spends $50 at local grocery stores suddenly spends $2,000 on electronics at 3 AM in a different time zone, the AI flags it immediately.

- Pattern Recognition: AI creates complex “feature maps” of fraudulent behavior. It might notice that a coordinated ring of fraudsters creates accounts using similar IP address clusters or typing cadences.

- Biometric Authentication: AI powers voice recognition and behavioral biometrics (how you hold your phone, how fast you type) to verify identity continuously, not just at login.

Anti-Money Laundering (AML) and KYC

Banks are under immense regulatory pressure to prevent money laundering.

- Transaction Monitoring: AI reduces false positives in AML alerts. Instead of flagging every transfer over $10,000, AI looks for “structuring” (breaking large transfers into small ones) and maps relationships between sender and receiver to identify shell companies.

- Know Your Customer (KYC): AI automates the verification of ID documents, checking holograms and matching faces to ID photos with higher accuracy than human clerks.

Market and Credit Risk Management

Beyond fraud, banks face market risk (the risk of investments losing value).

- Stress Testing: AI simulates thousands of potential economic crashes (e.g., a pandemic, a housing crisis, a tech bubble burst) to predict how a bank’s portfolio would perform.

- Predictive Analytics: AI helps banks predict which corporate borrowers are likely to default before they miss a payment, allowing the bank to restructure the loan proactively.

Who This Is For (and Who It Isn’t)

This guide is designed for:

- Financial Professionals: Analysts, traders, and risk managers looking to understand the technological shifts threatening or enhancing their roles.

- Fintech Entrepreneurs: Innovators seeking to identify gaps in the market where AI solutions can be applied.

- Students and Academics: Those studying finance or computer science who need a foundational understanding of the intersection of these fields.

- Investors: Individuals wanting to understand the mechanics behind “robo-advisors” and algorithmic funds.

This guide is NOT for:

- Day Traders seeking “Get Rich Quick” Bots: This article discusses the technology, not specific proprietary black-box signals.

- Hardcore Developers: While we discuss concepts, we are not providing Python code for LSTM networks or Reinforcement Learning agents.

Key Components of an AI Financial Strategy

For institutions implementing AI, success depends on more than just the algorithm. It requires a robust ecosystem.

1. Data Infrastructure

AI is only as good as the data it feeds on. Financial institutions often suffer from “data silos,” where credit card data is separated from mortgage data. A unified data lake is a prerequisite for effective AI.

2. Computational Power

Training complex models requires significant GPU resources. Many firms are moving to hybrid cloud environments to handle the computational load while keeping sensitive data secure on-premise.

3. Talent Acquisition

There is a war for talent. Quants (quantitative analysts) effectively need to be data scientists. Financial firms are competing with Google and Meta for the same pool of AI engineers.

4. Governance Framework

Institutions must establish an “AI Governance Council” to oversee model deployment, ensuring ethical standards, compliance with laws like the EU AI Act, and monitoring for model drift (when a model’s accuracy degrades over time).

Common Mistakes and Pitfalls

Implementing AI in financial services is fraught with difficulty. Here are the most common failures.

The “Black Box” Problem

In finance, “computer says no” is not an acceptable answer. If a mortgage is denied, regulations (like the Equal Credit Opportunity Act in the US) often require the lender to explain why.

- The Pitfall: Using “Deep Learning” models (neural networks) that are highly accurate but opaque. No one can trace exactly which neuron triggered the rejection.

- The Solution: Using “Explainable AI” (XAI) techniques, such as SHAP (SHapley Additive exPlanations) values, which highlight exactly which factors contributed most to the decision.

Over-Reliance on Historical Data

Financial markets are not stationary; they evolve.

- The Pitfall: Training a trading model on data from a bull market (e.g., 2010-2020). Such a model might fail catastrophically during a high-interest-rate environment or a recession.

- The Solution: Continuous retraining and the use of synthetic data to simulate market conditions that haven’t happened yet but could happen.

Ignoring the Human Element

- The Pitfall: Assuming AI can fully replace human judgment. AI is poor at understanding context outside its dataset (e.g., a sudden geopolitical war that hasn’t impacted prices yet but is about to).

- The Solution: Hybrid models. AI provides the signal and the probability; the human trader or loan officer makes the final call on edge cases.

Regional Considerations and Regulations

The application of AI in finance varies significantly by region due to regulatory environments.

United States

The US has a fragmented regulatory landscape. The SEC monitors trading algorithms, while the CFPB (Consumer Financial Protection Bureau) focuses on fairness in credit scoring. There is a strong emphasis on preventing disparate impact (unintentional discrimination) in lending models.

European Union

The EU is leading the world in AI regulation with the EU AI Act.

- High-Risk Classification: The Act classifies AI used for credit scoring and evaluation of creditworthiness as “High Risk.”

- Compliance: This imposes strict requirements on data quality, transparency, human oversight, and robustness. Fintechs operating in Europe must build “compliance by design” into their algorithms.

Asia-Pacific

Countries like Singapore and China are aggressively adopting AI in fintech. China, for instance, has integrated social behavior data into credit scoring (Social Credit) to a degree that is culturally and legally distinct from Western models. Singapore focuses heavily on AI for regulatory compliance (RegTech) to maintain its status as a trusted financial hub.

Future Trends: What Lies Ahead?

As of 2026, several emerging trends are defining the next phase of AI in finance.

Generative AI in Wealth Management

Large Language Models (LLMs) are evolving into sophisticated financial assistants. Instead of a generic dashboard, investors can ask, “How would a 2% interest rate hike impact my bond portfolio?” and receive a conversational, data-backed answer, complete with generated charts.

Quantum-AI Hybrids

While still in early stages, the integration of quantum computing with AI holds the promise of solving optimization problems—such as portfolio balancing across thousands of assets—in seconds, a task that currently takes supercomputers hours.

Decentralized AI (DeFi Integration)

As Decentralized Finance (DeFi) matures, we are seeing the rise of “on-chain” AI agents—autonomous smart contracts that manage liquidity and execute trades based on AI logic directly on the blockchain, removing the need for centralized intermediaries.

Conclusion

AI in financial services has graduated from an experimental buzzword to a fundamental infrastructure requirement. In algorithmic trading, it is converting volatility into opportunity through predictive power. In credit scoring, it is democratizing access to capital by looking beyond outdated metrics. In risk management, it provides the vigilance necessary to protect an increasingly digital global economy.

However, the power of AI brings a commensurate responsibility. The financial industry operates on trust. If AI models become discriminatory black boxes or trigger market instabilities, that trust erodes. The future belongs not just to the institutions with the best algorithms, but to those that can implement them with transparency, fairness, and robust human oversight.

For financial professionals and organizations, the next step is clear: audit your current readiness. Are your data silos connected? Is your governance framework ready for the EU AI Act? And most importantly, are you using AI to replace your workforce, or to empower them to make smarter decisions?

FAQs

How does AI differ from traditional quantitative trading?

Traditional quantitative trading relies on static mathematical models and pre-defined rules set by humans. AI trading, specifically machine learning, adapts and evolves its rules by finding new patterns in data without explicit programming, allowing it to adjust to changing market conditions dynamically.

Is AI in credit scoring legal?

Yes, using AI for credit scoring is legal, provided it complies with fair lending laws (like the ECOA in the US). Lenders must ensure their models do not discriminate based on race, gender, religion, or other protected characteristics, and they must be able to explain adverse decisions to applicants.

What is “Alternative Data” in finance?

Alternative data refers to non-traditional information used to assess creditworthiness or investment potential. Examples include rent and utility payment history, mobile phone usage patterns, social media sentiment, satellite imagery of retail traffic, and shipping logistics data.

Can AI replace human financial advisors?

AI acts as a “robo-advisor” for asset allocation and portfolio rebalancing, which is highly effective for many investors. However, for complex estate planning, tax strategy, and emotional coaching during market downturns, human advisors remain essential. The industry is moving toward a hybrid model.

What is the biggest risk of using AI in finance?

The biggest risk is “model bias” and the “black box” problem. If a model makes a discriminatory lending decision or executes a disastrous trade, and the operators cannot explain why it happened due to the model’s complexity, it creates legal liability and systemic risk.

How does AI help with anti-money laundering (AML)?

AI helps with AML by analyzing vast networks of transactions to identify complex patterns indicative of money laundering, such as “smurfing” (breaking large cash deposits into smaller ones). It significantly reduces the rate of false positives compared to older rule-based systems, allowing compliance teams to focus on real threats.

Does AI cause stock market volatility?

It can. High-frequency trading algorithms powered by AI can react to news or price changes in microseconds. If many algorithms are programmed with similar logic, they might all sell simultaneously, exacerbating market drops and contributing to “flash crashes.”

What skills are needed to work in AI finance?

Careers in this field typically require a blend of financial knowledge and technical skills. Proficiency in programming languages like Python (and libraries like pandas, Scikit-learn, TensorFlow), understanding of statistics, data science, and knowledge of financial markets and regulations are crucial.

How is Generative AI used in banking?

Generative AI is used to power advanced customer service chatbots that can handle complex queries, draft personalized financial reports for clients, summarize lengthy regulatory documents, and even generate code for internal banking software.

What is “RegTech”?

RegTech (Regulatory Technology) is a subset of fintech that uses AI and big data to help financial service companies comply with regulations efficiently. It automates reporting, monitoring, and compliance checks, reducing the cost and risk of regulatory fines.

References

- OECD (Organisation for Economic Co-operation and Development). (2021). Artificial Intelligence and Machine Learning in Financial Services. Retrieved from

- Financial Stability Board (FSB). (2017). Artificial intelligence and machine learning in financial services: Market developments and financial stability implications. Retrieved from

- Bank of England. (2022). Machine learning in UK financial services. Retrieved from https://www.bankofengland.co.uk/report/2022/machine-learning-in-uk-financial-services

- U.S. Securities and Exchange Commission (SEC). (2023). Speech: AI and Finance. Retrieved from (General landing page for ongoing updates).

- European Commission. (2024). The AI Act. Retrieved from https://digital-strategy.ec.europa.eu/en/policies/regulatory-framework-ai

- McKinsey & Company. (2023). The economic potential of generative AI: The next productivity frontier. Retrieved from https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-economic-potential-of-generative-ai-the-next-productivity-frontier

- International Monetary Fund (IMF). (2023). Powering the Digital Economy: Opportunities and Risks of Artificial Intelligence in Finance. Retrieved from https://www.imf.org/en/Publications

- CFPB (Consumer Financial Protection Bureau). (2023). Tech Sprint on Electronic Disclosures and AI. Retrieved from https://www.consumerfinance.gov/

- FINRA (Financial Industry Regulatory Authority). (2022). Artificial Intelligence (AI) in the Securities Industry. Retrieved from

- The Alan Turing Institute. (2021). AI in Financial Services. Retrieved from https://www.turing.ac.uk/research/interest-groups/ai-financial-services