Financial technology (fintech) has democratized access to banking, investing, and payments, offering speed and convenience that traditional banking struggled to match for decades. However, this digital velocity has a shadow side: it provides fertile ground for sophisticated cybercriminals. As of January 2026, the speed at which money moves globally has rendered traditional, manual security measures obsolete. The industry’s answer is AI for fraud detection in fintech—a dynamic, self-learning approach that evolves faster than the criminals attacking it.

In this comprehensive guide, we explore how Artificial Intelligence (AI) and Machine Learning (ML) are reshaping financial security. We will move beyond the buzzwords to examine the architectural shift from static rules to adaptive intelligence, the specific algorithms powering these defenses, and the critical balance between ironclad security and a frictionless user experience.

Key Takeaways

- Shift from Static to Dynamic: Traditional rule-based systems (“if transaction > $10,000, flag it”) are too rigid. AI models learn from millions of data points to identify subtle patterns invisible to human analysts.

- Real-Time Capability: Modern fraud detection must occur in milliseconds—during the transaction authorization window—not days later in a post-settlement report.

- Behavioral Focus: Beyond passwords and PINs, AI analyzes how a user behaves (typing speed, swipe patterns) to verify identity continuously.

- Reduction of False Positives: One of AI’s biggest value propositions is distinguishing between a traveler buying coffee abroad and a thief using a stolen card, preventing customer frustration.

- The “Black Box” Challenge: As models get more complex, explaining their decisions to regulators (Explainable AI) becomes a critical compliance requirement.

Who This Guide Is For (and Who It Isn’t)

This guide is designed for fintech product managers, CTOs, compliance officers, and risk analysts who need a deep understanding of how AI integrates into security stacks. It is also suitable for students and tech enthusiasts looking to understand the practical application of ML in finance.

- It is for: Readers seeking a detailed breakdown of technologies, implementation strategies, and operational challenges.

- It is NOT for: Those looking for a basic definition of “what is fraud” or those seeking legal advice on specific banking regulations in their local jurisdiction.

The Evolution of Financial Security: Why Rules Failed

To understand why AI is necessary, we must first look at the limitations of the systems it replaces. For decades, banks relied on Rule-Based Systems. These were logical statements hard-coded into the transaction processing engine.

Example of a Rule-Based Approach:

- Rule 1: Deny any transaction over $5,000 if it originates from a country on the operational high-risk list.

- Rule 2: Flag any account that makes more than 5 transactions in 10 minutes.

While transparent and easy to audit, rules are binary and brittle.

- High False Positives: A legitimate customer buying expensive furniture might trigger Rule 1 and have their card declined.

- Reactive Nature: Rules only stop known threats. If a fraudster figures out that the limit is 5 transactions, they will execute 4 and stop. Rules cannot “learn” new behaviors without manual updates.

- Maintenance Nightmare: As fraud evolves, the rulebook grows into thousands of conflicting lines of logic, slowing down the system and making it impossible to manage.

The AI Advantage: Adaptive Security Architecture AI for fraud detection in fintech introduces the concept of adaptive security. Instead of hard barriers, AI uses probabilistic scoring. It looks at context. It asks: “Does this $5,000 purchase fit the historical profile of this specific user?” If the user usually buys high-end furniture, the AI might approve it. If the user has never spent more than $50 at a time, the AI might challenge it with a biometric check.

Core Mechanisms: How AI Detects Fraud

At its heart, AI fraud detection relies on data—massive amounts of it. The process generally follows a pipeline: Ingestion → Feature Engineering → Model Scoring → Decision.

1. Data Ingestion

The system pulls data from multiple sources in real-time:

- Transaction Data: Amount, currency, merchant category, time of day.

- Device Telemetry: IP address, device ID, browser version, operating system, screen resolution, battery level.

- User Data: Account age, balance history, average spending velocity.

- Network Data: Links between accounts (e.g., ten different accounts logging in from the same device).

2. Feature Engineering

Raw data is rarely useful on its own. It must be converted into “features” that a machine learning model can understand. This is often where the magic happens.

- Raw: Transaction time is 2:00 AM.

- Feature: “Distance from user’s average sleep time.”

- Raw: IP address is in New York.

- Feature: “Velocity of location change” (e.g., user was in London 1 hour ago; physical travel is impossible).

3. Machine Learning Algorithms

Different types of fraud require different mathematical approaches.

Supervised Learning

This is the most common approach for pattern recognition where historical data is labeled. The bank has a dataset of 1 million transactions, where 990,000 are marked “Legit” and 10,000 are marked “Fraud.” The model trains on this data to learn the characteristics of fraud.

- Random Forests / Decision Trees: These create a multitude of “if-then” decision paths. They are robust, handle missing data well, and are relatively easy to explain.

- Logistic Regression: A statistical method used to predict the probability of a binary outcome (Fraud vs. Not Fraud). It is simple and fast but struggles with complex, non-linear relationships.

- Gradient Boosting (e.g., XGBoost): Currently the industry standard for tabular data. It builds models sequentially, with each new model correcting the errors of the previous one. It offers high accuracy for credit card fraud detection.

Unsupervised Learning

What happens when a new type of fraud emerges that has never been labeled? This is where unsupervised learning shines. It looks for anomaly detection without needing prior examples.

- Clustering (K-Means, DBSCAN): The algorithm groups transactions based on similarity. If a cluster of transactions appears far away from the “normal” clusters, it is flagged as an anomaly.

- Isolation Forests: This algorithm explicitly isolates anomalies rather than profiling normal data points. It is highly effective at spotting outliers in high-volume datasets.

Deep Learning and Neural Networks

For unstructured data or extremely complex relationships, neural networks mimic the human brain.

- Recurrent Neural Networks (RNNs) & LSTMs: These are excellent for sequential data. They can “remember” a user’s sequence of actions. For example, a user checking their balance three times before a large transfer might be normal, but a user changing their password and immediately transferring funds is suspicious.

- Graph Neural Networks (GNNs): These are revolutionizing anti-money laundering (AML) compliance. They map relationships between entities (nodes) and transactions (edges). They can spot a “money mule” ring where funds are moved through dozens of accounts to hide their origin.

4. The Decision Engine

The model outputs a risk score (e.g., 0 to 100).

- 0–10: Low risk (Approve automatically).

- 11–80: Medium risk (Challenge with 2FA or biometric scan).

- 81–100: High risk (Decline and alert the fraud team).

Critical Use Cases in Fintech

AI is not a monolith; it is applied differently depending on the specific threat vector.

Real-Time Transaction Monitoring

This is the “front line” of defense. Every time a card is swiped or a digital payment is initiated, the system must decide within milliseconds whether to approve it.

- The Challenge: Latency. The model must run its inference without slowing down the checkout process.

- The AI Solution: Specialized low-latency architectures (Edge AI) that can process features and return a score in under 300 milliseconds.

Synthetic Identity Fraud

This is one of the fastest-growing financial crimes. Fraudsters combine real information (like a stolen Social Security Number) with fake information (a made-up name and address) to create a “Frankenstein” identity. They build credit with this identity over months before “busting out” with a massive loan they never intend to repay.

- Why Rules Fail: The ID looks real on paper. The credit checks pass.

- How AI Helps: AI looks for subtle inconsistencies. Does the email address age match the person’s age? Does the social media footprint exist? Are there deep linkages between this “new” person and known fraud devices?

Anti-Money Laundering (AML)

Criminals use complex webs of transactions to “clean” dirty money. Traditional AML relies on threshold reporting (e.g., flagging anything over $10,000), which criminals easily evade by “structuring” or “smurfing” (breaking amounts into smaller chunks).

- Graph Analytics: AI visualizes the flow of funds across the entire banking network. It can identify cyclical patterns—money that leaves Account A, moves through B, C, and D, and returns to a company owned by A—a classic laundering sign.

Account Takeover (ATO)

ATO occurs when a fraudster gains access to a legitimate user’s credentials (via phishing or credential stuffing).

- Behavioral Biometrics: This is the best defense against ATO. Even if the attacker has the correct password and OTP, they act differently. They might use keyboard shortcuts (Ctrl+C, Ctrl+V) to paste a password, whereas the real user types it. They might hold the phone at a different angle. AI detects these behavioral mismatches and locks the account.

The False Positive Paradox

In the world of fintech, a false positive (declining a legitimate transaction) can be as damaging as a false negative (allowing fraud).

- Reputational Damage: A customer embarrassed at a dinner party because their card was declined is likely to switch banks.

- Lost Revenue: Every declined valid transaction is lost interchange revenue for the bank and lost sales for the merchant.

How AI Reduces False Positives

AI provides contextual awareness.

- Holistic Profiles: Instead of just seeing “Transaction in Thailand,” the AI sees “User bought an airline ticket to Thailand two weeks ago.” The location is expected, not suspicious.

- Feedback Loops: When a customer calls to say, “That was me,” the system labels that data point as a false positive. The machine learning model retrains on this feedback, learning that specific behavior (e.g., buying gas at 2 AM) is normal for that specific user.

- Risk-Based Authentication (RBA): Instead of a hard block, AI triggers a “step-up” challenge. If the risk is borderline, the app asks for a fingerprint scan. This allows the user to prove their identity without the transaction being outright rejected.

Implementation Challenges

Adopting AI for fraud detection in fintech is not as simple as installing software. It involves significant operational hurdles.

1. Data Quality and Silos

AI is only as good as the data it feeds on. In many legacy banks, credit card data sits in one server, savings account data in another, and loan data in a third. These “silos” blind the AI. A modern Data Lake or warehouse architecture is required to unify these streams so the model can see the full picture.

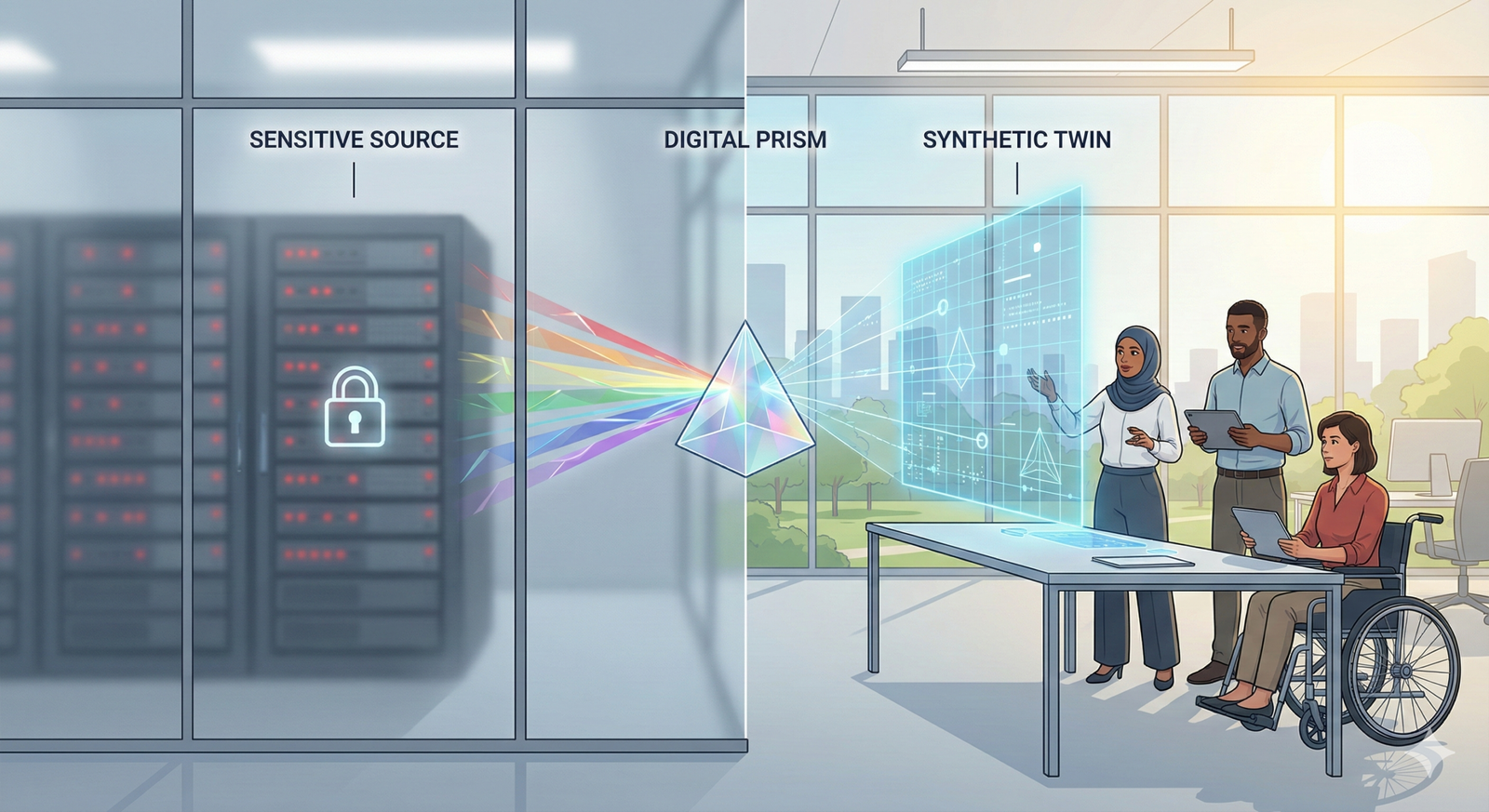

2. The “Cold Start” Problem

When a new fintech launches, it has no historical fraud data to train its models.

- Solution: many startups rely on Consortium Data—pooled, anonymized data from thousands of other merchants and banks provided by fraud prevention vendors. This allows a new bank to benefit from the collective intelligence of the ecosystem.

3. Adversarial AI

As of 2026, we are seeing the rise of “Adversarial AI.” This involves criminals using their own machine learning models to probe defense systems. They might ping a transaction endpoint millions of times with slight variations to map out the bank’s detection threshold.

- Defense: Fintechs must use GANs (Generative Adversarial Networks) to simulate attacks against their own systems, essentially stress-testing their AI with another AI to find weaknesses before criminals do.

4. Regulatory Compliance and Explainability

Regulations like GDPR in Europe and various US state laws give consumers the right to an explanation when an automated decision affects them (e.g., denial of credit).

- The Black Box Problem: Deep learning models are notoriously opaque. It is hard to say exactly why a neural network rejected a transaction.

- XAI (Explainable AI): This is a critical field of development. Techniques like SHAP (SHapley Additive exPlanations) values allow data scientists to reverse-engineer a model’s decision, producing a human-readable reason (e.g., “Transaction denied because velocity was 500% higher than average AND device was unrecognized”).

Emerging Trends in Fintech Security

The landscape is shifting rapidly. Here are the trends dominating the conversation in 2025–2026.

Generative AI: The Double-Edged Sword

Generative AI tools are being used by fraudsters to create hyper-realistic phishing emails and deepfake voice clones to bypass biometric voice verification.

- The Defense: Fintechs are deploying “Deepfake Detection” AI that analyzes audio and video for digital artifacts and inconsistencies invisible to the human ear or eye.

Federated Learning

Traditionally, banks had to pool data into a central server to train AI, creating a privacy risk. Federated Learning allows the AI model to travel to the data. The model visits the local device or local bank branch server, learns from the data there, and brings back only the learnings (mathematical weights), not the private data itself. This is a massive breakthrough for privacy-preserving fraud detection.

Self-Healing Systems

We are moving toward systems that not only detect fraud but automatically patch the vulnerabilities that allowed it. If an AI detects that a specific API endpoint is being exploited for scraping data, it could theoretically trigger a firewall rule to rate-limit that endpoint without human intervention.

Best Practices for Implementation

For organizations looking to deploy AI for fraud detection, a strategic approach is vital.

1. Start with a Hybrid Model

Do not turn off the rule-based system overnight. Run the AI model in “shadow mode” (where it scores transactions but doesn’t block them) to benchmark its performance against the legacy system. Once confidence is high, switch to a hybrid model where rules handle the obvious cases and AI handles the gray areas.

2. Prioritize Data Governance

Ensure that the data feeding the AI is clean, labeled correctly, and free from inherent biases. If the historical data contains bias (e.g., unfairly targeting certain demographics), the AI will learn and amplify that bias, leading to regulatory fines and PR disasters.

3. Focus on the Feedback Loop

The operational team (human analysts) and the data science team must talk. The operational team reviews the high-risk alerts. Their decisions (confirming fraud or marking as false positive) are the most valuable data points for retraining the model. This feedback loop must be automated and continuous.

Conclusion

AI for fraud detection in fintech is no longer a “nice-to-have” innovation; it is the baseline requirement for doing business in a digital-first economy. The volume and velocity of modern transactions have simply outpaced the human capacity to review them.

By leveraging machine learning algorithms, real-time transaction monitoring, and behavioral biometrics, fintechs can build a defensive perimeter that is adaptive and resilient. The goal is not just to stop fraud, but to do so invisibly—protecting the user’s assets without impeding their life.

As we look ahead, the battle between fraudsters and defenders will essentially be a battle of algorithms. Those who invest in adaptive security architecture and explainable AI will survive the onslaught; those who rely on static rules will be overwhelmed. The future of fintech trust depends on the intelligence of the code guarding the vault.

Next Steps: If you are upgrading your fraud stack, begin by auditing your current “False Positive Rate” and “Fraud Detection Rate.” If your false positives are above 5% or your detection rate is below 95%, it is time to evaluate a pilot program for a machine-learning-based solution.

FAQs

What is the difference between rule-based and AI-based fraud detection?

Rule-based detection uses static logic (e.g., “block transactions over $5,000 from Country X”). It is rigid and generates many false positives. AI-based detection uses machine learning to analyze massive datasets, identifying complex patterns and anomalies in real-time. AI is adaptive, meaning it learns from new fraud trends automatically, whereas rules must be manually updated.

How does machine learning reduce false positives in fintech?

Machine learning looks at the context of a user’s behavior rather than just hard limits. It builds a unique profile for each customer. If a customer engages in unusual activity (like traveling), the AI can correlate this with other data points (e.g., an airline ticket purchase) to validate the transaction, rather than blocking it outright. This precision drastically reduces the number of legitimate transactions that are declined.

What are behavioral biometrics?

Behavioral biometrics analyze how a user interacts with a device, not just what they know (like a password). This includes typing cadence (keystroke dynamics), mouse movements, touchscreen swipe pressure, and the angle at which a smartphone is held. These unique physical habits are extremely difficult for fraudsters to mimic, even if they have stolen the user’s login credentials.

Is AI fraud detection expensive to implement for small fintechs?

Building a proprietary AI fraud engine from scratch is expensive and requires a large data science team. However, most small to mid-sized fintechs use third-party “Fraud-as-a-Service” platforms. These vendors provide pre-trained models via API, making powerful AI detection accessible without high upfront development costs.

Can AI detect synthetic identity fraud?

Yes, AI is highly effective against synthetic identity fraud. Since synthetic identities are often cobbled together from disparate real and fake data, they lack the deep, organic digital history of a real person. AI models can detect these “thin files,” analyze relationships between data points (e.g., a Social Security number linked to multiple names), and flag inconsistencies that humans would miss.

What is the role of Deep Learning in fraud detection?

Deep Learning, specifically utilizing Neural Networks, is used for complex, unstructured data. It excels in recognizing patterns in image data (for verifying ID documents in KYC processes) and sequential data (analyzing the timeline of user actions to predict malicious intent). It allows the system to find non-linear relationships that simpler algorithms might miss.

How does AI handle regulatory compliance like GDPR?

AI presents a challenge for compliance because complex models can be “black boxes.” To comply with regulations like GDPR, which grant users the “right to explanation,” fintechs use Explainable AI (XAI) techniques. These tools interpret the model’s output, providing clear, human-readable reasons for why a specific decision (like declining a loan) was made.

What is “human-in-the-loop” in AI security?

“Human-in-the-loop” refers to a system where AI handles the vast majority of transactions, but gray-area cases (medium risk) are escalated to human analysts for review. The human decision is then fed back into the AI system to train it. This combines the speed of AI with the nuanced judgment of human experts.

References

- Bank for International Settlements (BIS). (2024). Project Aurora: The power of data and AI to combat money laundering. Retrieved from https://www.bis.org

- Federal Reserve (Fed). (2023). Synthetic Identity Fraud Mitigation Toolkit. Retrieved from https://www.federalreserve.gov

- Financial Action Task Force (FATF). (2021). Opportunities and Challenges of New Technologies for AML/CFT. Retrieved from https://www.fatf-gafi.org

- National Institute of Standards and Technology (NIST). (2023). Artificial Intelligence Risk Management Framework (AI RMF 1.0). Retrieved from https://www.nist.gov

- IEEE Transactions on Neural Networks and Learning Systems. (2022). Deep Learning for Financial Fraud Detection: A Survey. Retrieved from https://ieeexplore.ieee.org

- Association of Certified Fraud Examiners (ACFE). (2024). Report to the Nations: Global Study on Occupational Fraud and Abuse. Retrieved from https://www.acfe.com

- McKinsey & Company. (2023). The future of digital identity and fraud prevention. Retrieved from https://www.mckinsey.com

- Experian. (2025). Global Identity & Fraud Report. Retrieved from https://www.experian.com

- European Commission. (2024). EU AI Act Compliance Guide for Financial Institutions. Retrieved from https://digital-strategy.ec.europa.eu