Disclaimer: This article provides general information regarding taxation and legal issues for cross-border employees and is intended for educational purposes only. It does not constitute legal, financial, or tax advice. Laws and regulations vary significantly by jurisdiction and individual circumstances. Readers should consult with qualified tax advisors and legal professionals for specific guidance.

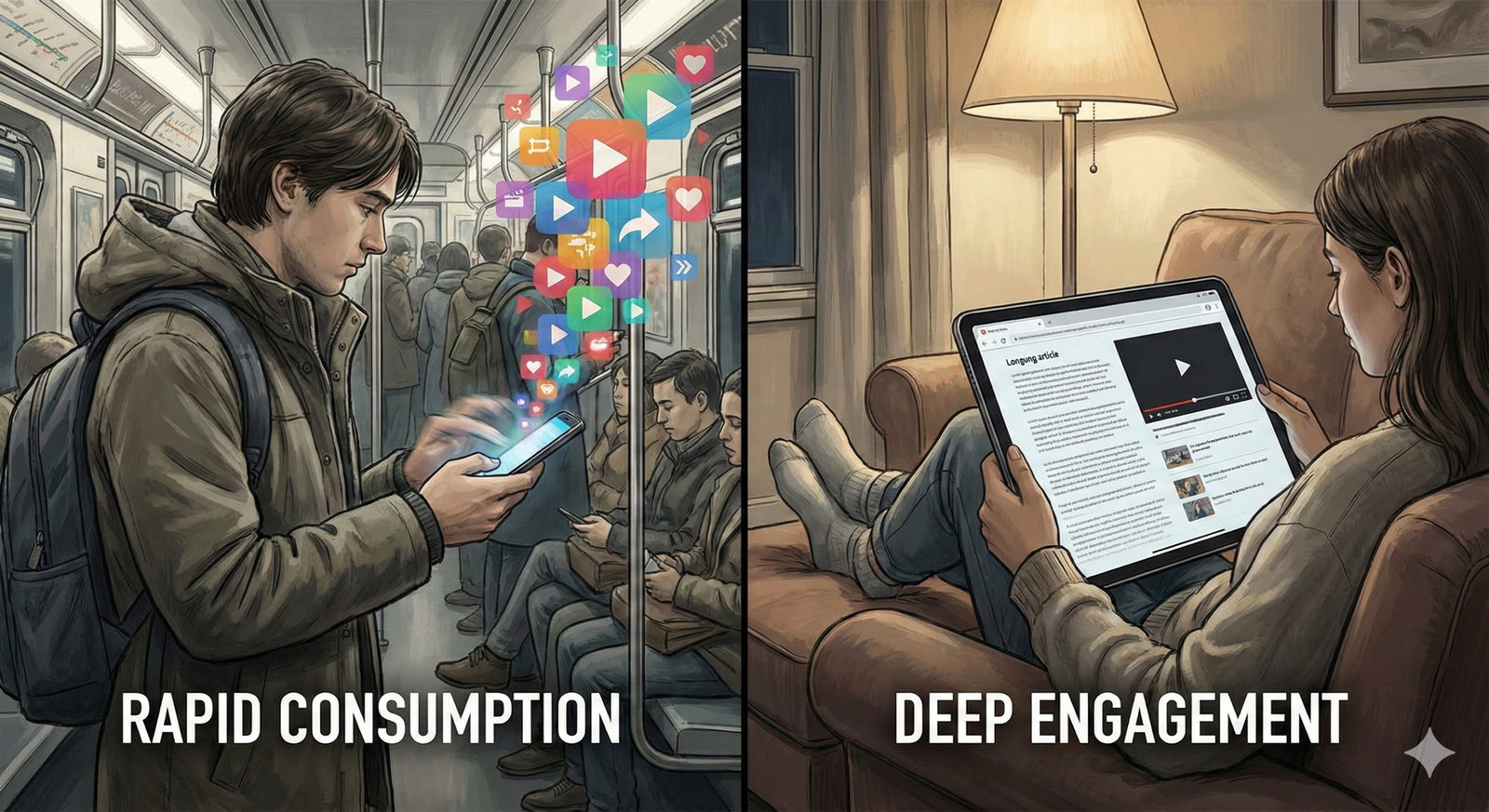

The rise of “work from anywhere” policies has fundamentally reshaped the global workforce. What began as a necessity during the pandemic has evolved into a permanent feature of the modern economy. However, while technology allows us to work from a beach in Bali or a cabin in the Swiss Alps, international tax codes and labor laws have not moved as quickly as our Zoom connections.

For employees and employers alike, cross-border employment—where an individual lives in one country but works for an employer based in another—creates a complex web of obligations. Navigating this landscape requires understanding where you owe tax, which country’s labor laws protect you, and how to avoid the costly trap of double taxation.

In this guide, “cross-border employees” refers to individuals who perform their work duties in a country different from where their employer is legally domiciled. This includes digital nomads, cross-border commuters (frontier workers), and long-term remote workers.

Key Takeaways

- Physical Presence Matters: Tax liability is often triggered by where you physically perform the work, not just where the company is based or where the money is deposited.

- The 183-Day Rule is a Guideline, Not a Shield: Simply staying under 183 days in a country does not automatically exempt you from taxes; other factors like “center of vital interests” play a huge role.

- Social Security vs. Income Tax: These are often governed by different rules. You might owe income tax in one country and social security contributions in another.

- Permanent Establishment Risk: A remote employee can accidentally create a taxable presence for their employer in a foreign country, leading to massive corporate tax liabilities.

- Labor Laws are Sticky: You cannot easily contract out of the mandatory employment rights (like holidays and minimum wage) of the country where the employee lives.

1. Defining the Cross-Border Employee

Before diving into taxes, it is crucial to categorize the type of arrangement, as the legal implications differ vastly.

The Remote Worker

This is currently the most common scenario. An employee moves to a different country (permanently or for an extended period) while continuing to work for their original employer. For example, a software developer employed by a London firm who moves to Spain.

The Cross-Border Commuter (Frontier Worker)

This individual lives in one country but travels daily or weekly to work in another. This is common in regions like the EU (e.g., living in France, working in Switzerland) or between the US and Canada. Specific bilateral treaties often govern these workers to simplify their tax burden.

The Posted Worker

This is an employee sent by their employer to work in another country for a limited period. In the European Union, “posted worker” status has specific legal definitions and protections regarding social security and minimum pay.

The Digital Nomad

Often a freelancer or contractor, but increasingly a full-time employee hopping between jurisdictions. The transient nature of digital nomadism makes determining tax residency particularly difficult and risky.

2. Tax Residency and the “183-Day Rule”

The foundation of international taxation is residency. Most countries tax their residents on their worldwide income, while non-residents are typically taxed only on income sourced within that country.

Understanding the 183-Day Rule

A widely cited concept is the “183-day rule.” Generally, if you spend more than 183 days (roughly six months) in a country within a tax year (or sometimes a rolling 12-month period), you are considered a tax resident.

However, relying solely on this count is a dangerous simplification.

- Domestic Rules: Some countries have much shorter thresholds. For example, you might become a tax resident much faster if you have a permanent home available to you.

- Qualitative Tests: Many jurisdictions look at your “center of vital interests.” Even if you spend only 100 days in a country, you could be deemed a resident if your family (spouse, children) lives there, your primary economic assets are there, or you belong to local social organizations.

Statutory Residence Tests

Countries like the UK have complex Statutory Residence Tests (SRT) that combine the number of days spent with “ties” to the country (accommodation, family, work). It is not a simple binary switch; it is a sliding scale. As of 2025, many countries have tightened these definitions to capture revenue from the mobile workforce.

3. Double Taxation: The Risk and The Relief

Double taxation occurs when two countries claim the right to tax the same income. This usually happens when:

- Source vs. Residence: You live in Country A (residence) but work for a company in Country B (source). Country A taxes you because you live there; Country B taxes you because the money comes from there.

- Dual Residency: You meet the residency criteria for both countries simultaneously.

Double Taxation Treaties (DTTs)

Most nations have bilateral tax treaties to prevent this. These treaties usually follow the OECD Model Tax Convention. They provide “tie-breaker” rules to determine a single tax residence.

The Tie-Breaker Hierarchy typically looks like this:

- Permanent Home: Where do you have a permanent home available to you?

- Center of Vital Interests: Where are your personal and economic relations closer?

- Habitual Abode: Where do you usually stay?

- Nationality: Which country are you a national of?

- Mutual Agreement: If all else fails, the tax authorities of both countries negotiate.

Relief Methods

If you are taxed in both jurisdictions, treaties usually provide relief through one of two methods:

- Exemption Method: The income taxed in the source country is exempt from tax in the residence country.

- Credit Method: The residence country taxes the income but grants a credit for the tax already paid to the source country. You generally pay the higher of the two rates.

Example in Practice: If you live in Portugal (20% tax rate for NHR, hypothetically) but work for a US company (effectively 30%), and the US taxes that income, Portugal may give you a credit for the tax paid to the US. If the US tax was higher, you owe nothing extra to Portugal. If the US tax was lower, you pay the difference to Portugal.

4. Social Security Coordination

A common misconception is that social security follows income tax. It does not. Social security rules determine where you build up your pension, health insurance, and unemployment benefits rights.

The Territoriality Principle

The general rule is that you pay social security in the country where you physically work, regardless of where you live or where your employer is.

Inside the EU/EEA/Switzerland

The EU has strict coordination rules (Regulation 883/2004). You should only pay social security in one country at a time.

- A1 Certificate: If you are posted abroad for up to 24 months, or work in multiple countries (multi-state worker), you can apply for an A1 certificate (or similar Certificate of Coverage). This allows you to keep paying social security in your home country and be exempt in the host country.

Outside the EU (Bilateral Agreements)

Countries often have “Totalization Agreements” with major trading partners (e.g., US-UK, US-Canada). These agreements function similarly to EU rules, allowing detached workers to remain in their home system for a limited time (often 5 years).

The Trap: If there is no agreement between the two countries (e.g., a US citizen working remotely from a country with no totalization agreement), the employee and employer might be liable for social security contributions in both countries. This creates a massive “double charge” that can amount to 20-30% of the salary, with no benefit to the employee.

5. Corporate Risk: Permanent Establishment (PE)

For the employer, the biggest risk of cross-border remote work is creating a “Permanent Establishment” (PE).

What is a Permanent Establishment?

A PE is a fixed place of business through which the business of an enterprise is wholly or partly carried on. If a company triggers a PE in a foreign country, it becomes liable for corporate income tax in that country on the profits attributable to that PE.

How Remote Workers Trigger PE

Traditionally, a PE was a branch office or a factory. Today, a single employee’s home office can constitute a PE if:

- Fixed Place of Business: The employee works from a home office that is “at the disposal” of the company (e.g., the company requires them to work there because it provides no other office).

- Dependent Agent: The employee has the authority to conclude contracts on behalf of the company and habitually exercises that authority.

Scenario: A Sales Director moves to France and works from home. They negotiate and sign contracts for their US employer. French tax authorities may argue that the US company now has a taxable presence in France, demanding a share of corporate profits and retrospective tax filings.

Mitigation: Companies often restrict cross-border remote roles to non-revenue-generating positions or strictly prohibit employees from signing contracts while abroad.

6. Employment Law and Worker Rights

You cannot simply choose which country’s employment laws apply. Mandatory local labor laws usually override the contract.

The “Rome I” Regulation (and global equivalents)

In the EU, the Rome I Regulation states that while parties can choose the law of the contract, that choice cannot deprive the employee of the protection of mandatory rules of the country where they habitually carry out their work.

Implications:

- Minimum Wage & Overtime: If the employee moves to a country with a higher minimum wage or stricter overtime rules, the employer must comply.

- Termination: Many countries (e.g., France, Germany, Brazil) have strong protection against dismissal. An “at-will” employment clause from a US contract will likely be void and unenforceable for an employee living in Germany.

- Holidays and Leave: The employee is entitled to the public holidays and annual leave requirements of their host country.

- Health and Safety: The employer retains a duty of care. This is challenging when the workplace is a home office in another continent. Employers may need to conduct virtual risk assessments.

7. Data Protection and Cybersecurity

Working across borders involves transferring data across borders.

GDPR and Data Transfer

If an employee in the EU accesses personal data hosted on a server in the US (or vice versa), this constitutes a data transfer.

- EU Compliance: The General Data Protection Regulation (GDPR) restricts data transfers to countries outside the EEA unless they have “adequacy decisions” or specific safeguards (like Standard Contractual Clauses) are in place.

- Security Risks: Accessing corporate networks from public Wi-Fi in varying jurisdictions increases cybersecurity vulnerabilities. Companies must enforce strict VPN usage, multi-factor authentication (MFA), and device encryption policies for cross-border staff.

8. Practical Solutions: How to Hire Compliantly

Given the risks of PE, double taxation, and legal non-compliance, companies typically use one of three models to hire cross-border employees.

A. Employer of Record (EOR)

An EOR is a third-party service provider that legally employs the worker in their local country. The EOR handles payroll, taxes, social security, and compliance with local labor laws. The original company retains day-to-day management of the employee’s work.

- Pros: Fast setup, full compliance, no PE risk (usually).

- Cons: Expensive (fees per employee), the worker technically belongs to another entity.

B. Foreign Subsidiary

The company establishes a legal entity (branch or subsidiary) in the employee’s country.

- Pros: Total control, clear corporate structure.

- Cons: High administrative burden and cost. Only viable if there are multiple employees in that location.

C. Contractor Model

The individual is hired as an independent contractor (B2B relationship) rather than an employee.

- Pros: Low admin, no tax withholding for the company.

- Cons: High risk of misclassification. If tax authorities decide the contractor is actually a “disguised employee” (because they work fixed hours, have one client, and are managed closely), the company faces massive fines and back taxes.

9. Common Mistakes and Pitfalls

“Flying Under the Radar”

Many employees move abroad without telling their HR department, assuming “if I use a VPN, they won’t know.” This is colloquially known as “stealth expatting.”

- The Risk: If caught, the employer faces immediate tax and social security liabilities. The employee may be fired for breach of contract and policy.

Ignoring State/Provincial Taxes

In federal countries like the US, Canada, or Switzerland, moving across a border doesn’t just change federal tax; it changes state/canton tax. A New York company employing someone in California must register in California and withhold California taxes.

The “Digital Nomad Visa” Misunderstanding

Many countries now offer Digital Nomad Visas (DNVs). While these solve the immigration issue (right to stay), they do not always solve the tax issue. You generally still become a tax resident if you stay long enough, unless the DNV specifically offers a tax holiday (which some, but not all, do).

10. Checklist for Cross-Border Compliance

If you are an employee planning to work abroad, or an employer authorizing it, run through this checklist:

| Category | Action Item |

| Immigration | Does the employee have the legal right to work in the host country? (Tourist visas rarely permit work). |

| Tax Residency | Have you determined where the employee will be tax resident based on the 183-day rule and domestic laws? |

| Payroll | Does the employer need to run a shadow payroll in the host country to withhold taxes? |

| Social Security | Is there a Totalization Agreement? Has an A1 certificate (or equivalent) been applied for? |

| PE Risk | Does the employee have the authority to sign contracts? Is their home office a fixed place of business? |

| Labor Law | Review the employment contract against local mandatory laws (termination, leave, wage). |

| Insurance | Does the company health insurance cover the employee in the new country? Is liability insurance valid? |

| Data Security | Are data transfer mechanisms compliant with local privacy laws (e.g., GDPR)? |

11. Conclusion: The Future is Hybrid, But Compliance is Fixed

The freedom of cross-border employment offers immense benefits: access to a global talent pool for companies, and unprecedented lifestyle flexibility for workers. However, the legal and tax frameworks governing this activity are rigid and often punitive to those who ignore them.

In 2026 and beyond, we can expect tax authorities to become more sophisticated in tracking remote workers through data sharing and digital entry/exit records. The “don’t ask, don’t tell” approach is no longer a viable strategy.

For employees, transparency with your employer is the best policy. For employers, investing in robust compliance frameworks—whether through internal expertise or EOR partnerships—is the cost of doing business in a borderless world.

Next Steps: If you are considering a cross-border move, review your current employment contract for “place of work” clauses and schedule a consultation with a tax advisor who specializes in both your home and host jurisdictions.

Frequently Asked Questions (FAQs)

1. Can I work remotely from another country on a tourist visa? Technically, usually no. Most tourist visas strictly prohibit “work,” encompassing remote work for a foreign employer. While enforcement varies, working on a tourist visa carries the risk of deportation or future entry bans. You should look for specific Digital Nomad Visas or work permits.

2. What happens if I work in a country for less than 183 days? You might avoid becoming a full tax resident, but you could still be liable for tax on the income earned during those days. Furthermore, if your “center of vital interests” (family, main home) is in that country, you could be deemed a resident even with fewer than 183 days.

3. Does my employer have to pay taxes in the country I work from? Potentially. If your presence creates a Permanent Establishment (PE), your employer may owe corporate tax on profits attributed to your work there. They may also be required to register as an employer and withhold payroll taxes (PAYE) from your salary.

4. What is a “shadow payroll”? A shadow payroll is a mechanism used to report compensation and withhold taxes in the host country while the employee remains on the home country’s payroll. It ensures compliance in both jurisdictions without actually paying the employee twice.

5. Who pays for my health insurance if I move abroad? Standard domestic health insurance policies rarely cover long-term residency abroad. You will likely need an international health insurance plan. In countries with mandatory public healthcare (like many EU nations), you may be required to contribute to the local system unless you have an exemption (like an A1 certificate).

6. Can I just be a contractor to avoid all this complexity? It simplifies things for the employer but adds complexity for you (you must handle all your own taxes and insurance). Also, if you treat the job like employment (fixed hours, one boss), local authorities may classify you as a “disguised employee,” leading to penalties for your client/employer.

7. How does the “183-day rule” work in the US? The US uses the “Substantial Presence Test.” You are a resident if you are present for 31 days in the current year and 183 days during a 3-year period (counting all days in the current year, 1/3 of days in the previous year, and 1/6 of days in the year before that). It is more complex than a simple 6-month count.

8. What is the difference between tax residency and legal residency? Legal residency refers to your right to enter and stay in a country (immigration status). Tax residency refers to your obligation to pay taxes there. You can be a tax resident without being a legal resident (e.g., overstaying a visa), and you can be a legal resident without being a tax resident (e.g., holding a Green Card but living abroad, though US citizens are taxed worldwide regardless).

9. Will I lose my pension if I move abroad? Not necessarily, but you might stop contributing to your home country’s state pension scheme. Totalization agreements often allow you to “combine” years worked in different countries to qualify for a pension, but the payout rules vary. You should check your specific social security status.

10. What is an Employer of Record (EOR)? An EOR is a third-party company that hires you legally in the country where you live. They act as your official employer for tax and legal purposes, while you perform work for the client company. This resolves most cross-border compliance headaches for the client.

References

- OECD (Organisation for Economic Co-operation and Development). Model Tax Convention on Income and on Capital. OECD Publishing. Available at: https://www.oecd.org/tax/treaties/model-tax-convention-on-income-and-on-capital-condensed-version-20745419.htm

- European Union. Social security coordination regulations (Regulation (EC) No 883/2004). Official Journal of the European Union. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A02004R0883-20140101

- Internal Revenue Service (IRS). Foreign Tax Credit. U.S. Government. Available at: https://www.irs.gov/individuals/international-taxpayers/foreign-tax-credit

- KPMG. Work from Anywhere: Tax and Legal Implications. KPMG International. Available at:

- Deloitte. Global Remote Work: Tax and Legal Considerations. Deloitte Insights. Available at:

- GOV.UK. Tax on foreign income. UK Government. Available at: https://www.gov.uk/tax-foreign-income

- PwC. Global Mobility and the Permanent Establishment Risk. PwC Publications. Available at: https://www.pwc.com/gx/en/services/people-organisation/publications/global-mobility-permanent-establishment.html

- European Commission. Posted Workers Directive. Employment, Social Affairs & Inclusion. Available at: https://ec.europa.eu/social/main.jsp?catId=471