Choosing among SaaS subscription billing services can feel like a maze: gateways, subscription platforms, and “merchant of record” options all promise revenue growth, lower churn, and fewer compliance headaches. This guide gives you a practical, human-first comparison of the top five options—Stripe, Braintree, Chargebee, Recurly, and Paddle—so you can pick with confidence. In one sentence: subscription billing services are tools that automate recurring payments, invoicing, proration, taxes, dunning (retries and reminders), and analytics so you can monetize reliably at scale. Because you’re dealing with payments, taxes, and accounting, here’s a brief, neutral disclaimer: this article is educational, not legal, tax, or accounting advice—consult qualified professionals for decisions that affect compliance or financial reporting.

Before we dive deep, here’s a quick, skimmable path to a smart decision:

- Map your model (seats, tiers, usage) and target markets.

- Decide your stack shape: gateway + billing layer vs. all-in-one merchant of record.

- List “musts” (SCA/3DS, tax, proration, coupons, metered billing, trials) and “nice-to-haves.”

- Estimate dunning/retry strategy, refund/chargeback policies, and revenue reporting needs.

- Pilot with a sandbox, simulate edge cases, and only then migrate live subscriptions.

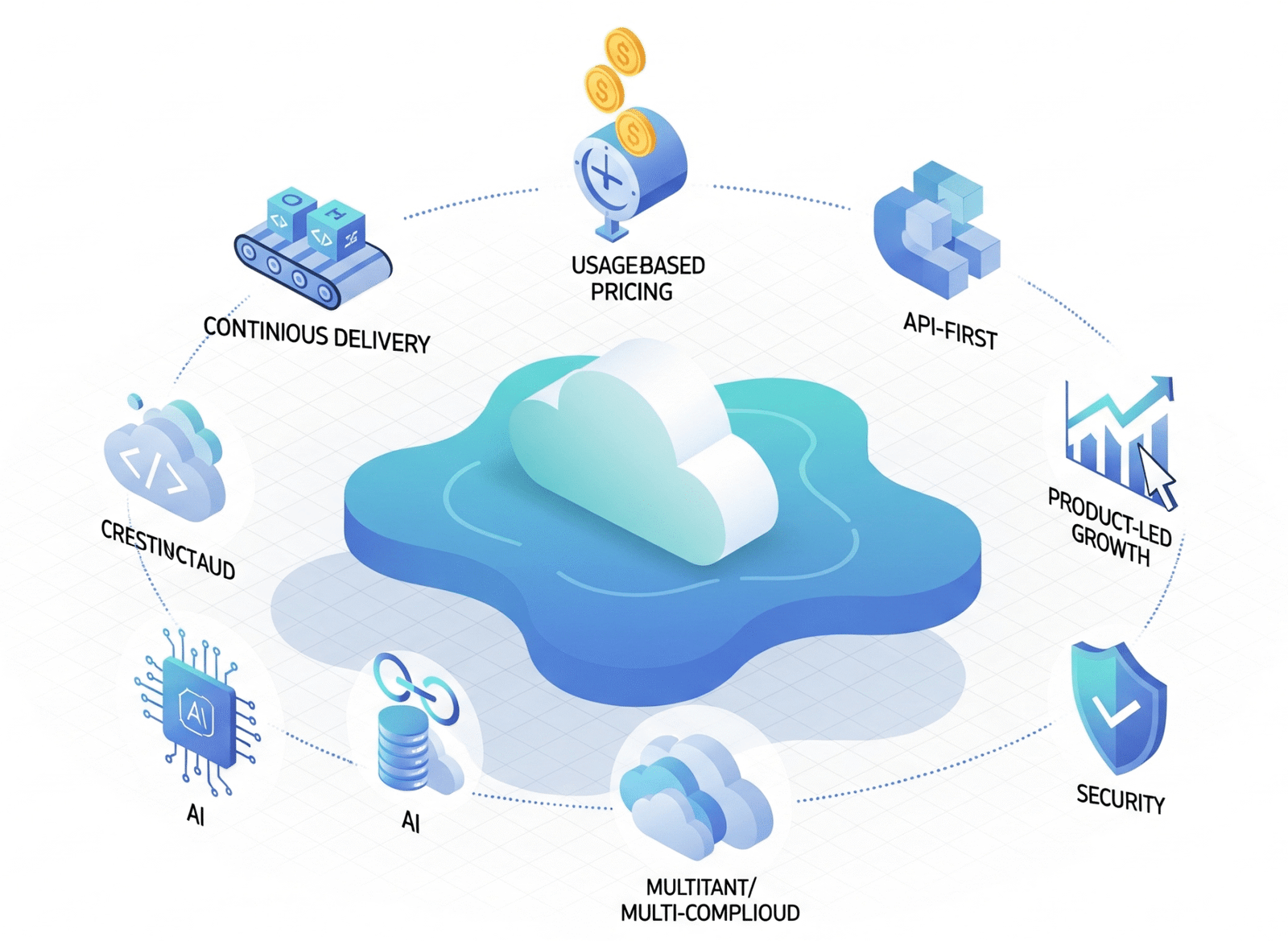

A single platform rarely fits every stage forever; what matters is the fit between your pricing model, identity/checkout UX, tax footprint, and back-office workflows. The sections below explain the five leading routes, where each shines, and the traps to avoid.

A compact snapshot you can scan

| Service | Best fit in a sentence | Model | Built-in tax handling | Analytics & revenue tools |

|---|---|---|---|---|

| Stripe Billing | Flexible self-serve + API-first growth with many pricing models | Payment gateway + billing | Add-on (Stripe Tax) | Strong native analytics; revenue recognition add-on |

| Braintree Subscriptions | Deep PayPal ecosystem access with solid card vaulting | Payment gateway with subscriptions | Limited native; external for full tax | Basic subscription tools; relies on downstream BI |

| Chargebee | Layered subscription management across multiple gateways | Billing platform (plugs into gateways) | Integrations; tax features in product | Mature catalog, dunning, invoicing, reporting |

| Recurly | Subscription ops at scale with payment orchestration | Billing platform (multi-gateway) | Integrations; tax features in product | Advanced dunning, experiments, revenue tools |

| Paddle | Minimal ops via merchant of record (MoR) model | MoR (reseller) | Handles VAT/GST/sales tax for you | Strong checkout, tax docs, platform analytics |

1. Stripe Billing: API-first flexibility for fast-moving SaaS

Stripe Billing is best when you want a developer-friendly gateway with rich subscription features that cover seats, tiers, add-ons, trials, coupons, and usage-based pricing in one stack. You get a polished Checkout, customer portal, and APIs for metered billing, proration, and sophisticated invoicing, plus optional modules for tax calculation and revenue recognition. If you value rapid experiments—changing plans without migrations, running trials, or charging by events (API calls, GB, minutes)—Stripe’s product catalog and webhooks make it straightforward. You also benefit from a large ecosystem of examples, libraries, and community knowledge that shortens build time and reduces integration risk. In short: when you want one vendor for processing + billing + UX surfaces, Stripe is the default baseline many teams compare to.

- How to deploy well

- Define products/prices first; treat “product” and “price” as API objects to avoid hard-coding.

- Use Checkout or Elements for PCI scope reduction and SCA-ready flows.

- Turn on automatic proration, dunning, and smart retries; tune grace windows.

- Add a customer portal to reduce support load for plan changes, payment updates, and invoices.

- Layer Stripe Tax if you sell across regions; add Revenue Recognition for ASC 606/IFRS 15 workflows.

Numbers & guardrails

- Dunning cadence: common patterns are 3–5 automated retries over 3–10 days, then email reminders and card updater requests.

- Trials: a 7–30 day trial with email nudges at mid-trial and pre-expiry typically balances conversion and churn risk.

- Usage metering: report usage hourly or daily to avoid bill-shock; cap at 110–120% of expected use to catch anomalies before billing.

Mini case

A developer tools startup sells at $29/month with optional usage at $0.10 per 1,000 events. With 1,000 subscribers and average usage of 150,000 events each, expected MRR is $29,000 plus $15,000 usage. After enabling smart retries and card updates, the team reduces involuntary churn from 4.2% to 2.9%, recovering about $1,950 monthly. They also shift heavy users to a higher tier by analyzing price/usage deltas in Stripe’s analytics, lifting ARPU by 8–12% without changing acquisition spend.

Tools/Examples

- Subscription lifecycles, pricing models, trials, proration, and analytics are documented in Stripe’s guides and APIs.

Synthesis: Choose Stripe Billing when you want a single-vendor stack with strong developer ergonomics, flexible billing models, and a low-friction customer portal; it scales from launch to growth without boxing you in.

2. Braintree Subscriptions: lean recurring billing with PayPal reach

Braintree Subscriptions fit teams that want reliable card vaulting and recurring billing while tapping the PayPal user base for conversion lift. As a gateway-first platform, Braintree’s recurring billing lets you define plans, store payment methods in the vault, and charge on schedule with basic proration and add-on support. Its sweet spot is companies that already standardize on the PayPal ecosystem (e.g., for one-time and subscription payments) and need a consistent risk, dispute, and settlement workflow. If you prioritize PayPal and PayPal OneTouch adoption, you’ll likely get more immediate checkout familiarity across global audiences.

- How to deploy well

- Create plans via API or Control Panel; assign vaulted payment methods on subscription creation.

- Use 3D Secure/PSD2 tooling to keep European flows compliant; test liability shift results.

- Expose self-service cancellation and payment updates to customers; reduce “ticket churn.”

- Export subscription data into your BI to model MRR/ARR, cohorts, and reactivation.

Numbers & guardrails

- SCA/3DS: expect minor friction; design for passive authentication where feasible and whitelist trusted beneficiaries via card network features when available.

- Retries: start with 3–4 retries spaced 1–7 days; add email reminders tied to failed attempts.

Mini case

A consumer productivity app with 50,000 monthly subscribers notices drop-offs at checkout in regions where bank authentication prompts are frequent. They roll out 3DS with clearer copy and a retry button, then instrument step-level analytics. Checkout completion increases by 2–4 percentage points with no spike in fraud. They keep Braintree Subscriptions and PayPal to maintain users’ preferred methods, and route reporting to their data warehouse for deeper LTV analysis.

Tools/Examples

- Braintree’s official docs cover plan setup, the subscription object, and control-panel workflows; they also note compatibility limits with Marketplace.

- For SCA/PSD2 context and exemptions, review regulator and expert guidance.

Synthesis: Pick Braintree Subscriptions if PayPal access and a gateway-centric stack are top priorities; pair it with your own analytics and tax stack for a complete solution.

3. Chargebee: versatile subscription management that plugs into your gateways

Chargebee shines when you need a dedicated subscription management layer that can sit on top of Stripe, Braintree, Adyen, and other processors. It’s built for complex catalogs—multiple product families, grandfathered plans, advanced proration logic, coupons, credit notes, and multi-step sign-up flows with trials, approvals, or sales-led invoicing. If you’re migrating from homegrown billing or a gateway’s lightweight subscriptions, Chargebee offers structured objects and workflows that reduce edge-case fragility (mid-cycle upgrades/downgrades, multiple add-ons, and plan swaps). Its dunning, invoicing, and tax features cover a lot of ground natively and via integrations, and the admin UI helps finance, support, and product collaborate without developer bottlenecks.

- How to deploy well

- Model your catalog in Chargebee first; mirror only IDs in your app to avoid drift.

- Use hosted checkout for PCI and SCA; switch to drop-in components or API as you grow.

- Configure granular proration rules (immediate vs. end-of-term) to match your value promise.

- Turn on email sequences for payment failures and trial lifecycle; define grace periods by plan.

- Integrate your data warehouse for cohorting, price tests, and ARPU analysis.

Mini case

A B2B SaaS with 2,500 accounts sells a $99 base plan plus $15 per active seat. Mid-term seat changes caused monthly invoice disputes and revenue leakage. After moving to Chargebee with seat-based pricing objects and automatic proration, billing-related tickets drop by ~40%, and time-to-close for the finance team improves by 25–35%. They run a $199 premium tier experiment; cohorts show a 7% uplift in net revenue retention, driven by better alignment to heavy-user value.

Numbers & guardrails

- Proration: for business plans, immediate proration on seat increases is common; end-of-term proration for downgrades avoids confusion.

- Invoicing: align Net-15/Net-30 payment terms with dunning windows and suspension logic.

- Trial-to-paid: conversion improves when you collect a payment method on signup and send 2–3 targeted nudges before expiry.

Tools/Examples

- Chargebee’s docs and API references detail subscriptions, invoices, coupons, and bulk operations; the admin guides show day-to-day usage patterns.

Synthesis: Choose Chargebee to normalize complexity across multiple gateways and give non-engineering teams a robust console; it’s a strong choice for scaling catalogs and reducing billing errors.

4. Recurly: subscription operations with payment orchestration and churn control

Recurly targets companies that want subscription operations at scale—not just billing, but payment orchestration, dunning intelligence, and workflow automation that spans teams. It supports multiple gateways, smart routing, and revenue recovery tooling designed to reduce involuntary churn. Product managers appreciate catalog flexibility, while finance and RevOps like revenue recognition integrations and reconciliation-friendly exports. Recurly often appeals to mid-market and enterprise SaaS that need high-availability billing and a vendor focused on optimizing recovery from network and card failures across geographies and issuers.

- How to deploy well

- Use Recurly’s catalog for all price logic; keep your app opinionated but dumb about billing math.

- Configure gateway failover and routing rules early; measure improvements in approval rates.

- Run dunning experiments (message timing, retry spacing, payment-update CTAs) and standardize across plans.

- Export to your lake/warehouse for churn, expansion, and cohort modeling.

Numbers & guardrails

- Recovery: a realistic target is 1–3 percentage points reduction in involuntary churn with tuned retries and account updater features.

- Routing: intelligent gateway routing can yield basis-point gains in authorization; measure over at least 2–3 billing cycles before declaring victory.

- Ops load: teams often reallocate hours per week from manual invoice correction to customer insights when catalogs and proration are centralized.

Tools/Examples

- Recurly’s product pages and docs outline subscription management, churn management, and orchestration capabilities for technology and operations roles.

Synthesis: Select Recurly when operational excellence and payment orchestration matter as much as catalog features; it’s engineered to smooth out the messy edges of recurring payments at scale.

5. Paddle: merchant of record (MoR) that removes tax and compliance heavylifting

Paddle is distinctive because it’s a Merchant of Record (MoR): Paddle becomes the legal seller, handling payment processing, global taxes (VAT, GST, US state sales tax), invoicing, and tax remittance for you. This model shrinks your compliance surface—especially useful for small finance teams selling globally or those without in-house tax expertise. If you need to launch in many countries fast, or want to avoid registering, filing, and remitting taxes in dozens of jurisdictions, MoR can be compelling. The trade-off is less granular control over some payment mechanics and the need to accept Paddle’s policies around refunds, chargebacks, and buyer support, which some teams embrace as a sensible outsourcing of risk.

- How to deploy well

- Validate your catalog and coupons align with Paddle’s tax and invoice rules.

- Design checkout and emails within Paddle’s customization boundaries; keep branding consistent.

- Document your refund/chargeback stance; ensure support processes route to Paddle where required.

- Run an A/B: Paddle MoR vs. gateway+billing stack in a non-core region to evaluate ops time saved.

Mini case

A founder-led startup sells globally with $120,000 in monthly gross sales across 80+ countries. After switching to Paddle, the team estimates dozens of hours per month saved on VAT/GST filings and chasing tax rule changes. Finance uses Paddle’s reports for revenue recognition mapping and audit trails. While some deep payment tweaks are less flexible than a DIY gateway stack, the time-to-launch in new regions drops from weeks to days, and support tickets about tax invoices decline meaningfully.

Numbers & guardrails

- Tax handling: Paddle calculates, collects, and remits VAT/GST/sales tax, and issues compliant invoices as the seller of record.

- Risk: Fraud and chargeback liability is primarily Paddle’s, within policy boundaries; read the MoR terms closely.

- Fit test: MoR shines when tax complexity > desire for fine-grained payment control; if you need custom routing or niche local methods, compare carefully.

Tools/Examples

- Paddle explains MoR responsibilities and how it handles VAT and other taxes on your behalf in its help center and blog.

Synthesis: Opt for Paddle if you want global sales without building a tax and compliance function; the MoR trade—control for simplicity—often pays off for lean teams.

Conclusion

Picking the right subscription billing path is less about ranking vendors and more about matching your business model and operational reality. If you want a single vendor for processing, billing, and user-facing surfaces with deep API control, Stripe Billing is the pragmatic default. If PayPal penetration matters and you prefer a gateway-centric approach, Braintree Subscriptions can be the smoothest adoption path. When your catalog is complex and you need a specialized subscription layer that spans gateways, Chargebee and Recurly offer strong admin experiences, dunning, and reporting that relieve engineering load. And if your priority is global reach with minimal compliance overhead, Paddle’s MoR model neatly removes VAT/GST complexity and much of the tax risk.

Whichever route you explore, insist on a sandboxed pilot, simulate proration and edge cases, confirm SCA readiness for European cards, align tax and invoicing rules with your finance team, and benchmark involuntary churn before and after dunning changes. That hands-on diligence prevents surprises and gives you credible evidence of impact. Your next step: shortlist two options, script five common lifecycle paths (new sign-up, upgrade, downgrade, payment failure, cancellation), and run them end-to-end—then choose the stack that feels boring, reliable, and accurate.

FAQs

1) What’s the practical difference between a payment gateway and a subscription management platform?

A payment gateway authorizes and settles payments (cards, wallets, bank transfers). A subscription management platform sits above or alongside the gateway, handling the lifecycle: plans, proration, trials, invoices, and dunning. Many gateways offer basic subscriptions, but dedicated platforms provide richer catalog logic, reporting, and workflows. If your pricing is simple and you want minimal vendors, a gateway’s native subscriptions can be enough; as complexity grows, a subscription platform reduces custom code and edge-case bugs.

2) How does a Merchant of Record (MoR) like Paddle change my responsibilities?

With MoR, the provider becomes the legal seller and assumes responsibility for calculating, collecting, and remitting indirect taxes (VAT, GST, state sales tax), issuing compliant invoices, and handling refund/chargeback obligations. You gain simplicity and reduced compliance burden, especially across many countries. The trade-off is accepting the MoR’s policies and having less granular control over payment routing or certain risk rules. For many lean teams selling globally, that trade is beneficial.

3) Which service is best for usage-based billing?

Stripe Billing, Chargebee, and Recurly all support metered/usage billing, with APIs to report usage events and price per unit over a billing period. The “best” is the one that matches your reporting cadence and tolerance for delayed data. As a rule of thumb, send usage at least daily, cap unusually high readings, and show customers a live usage meter in-app to avoid bill shock. If your usage data is delayed or lossy, no billing tool can save the customer experience.

4) How do I stay compliant with Strong Customer Authentication (SCA) under PSD2?

Use SCA-ready checkouts and 3D Secure where applicable, rely on exemptions for low-risk transactions when supported, and design your UX to clearly explain any bank prompts. Many providers (Stripe, Braintree, Recurly, Chargebee) support SCA flows via hosted pages, Elements, or 3DS settings. Monitor authorization rates before and after SCA rollouts and tune retries. If you sell in Europe, validate your flows against SCA rules and regulator guidance.

5) What about taxes—do I need Stripe Tax or a separate engine with Braintree/Chargebee/Recurly?

If you sell outside a single jurisdiction, you’ll likely need automated tax calculation. Stripe offers Stripe Tax; Chargebee and Recurly include tax features and integrations; Braintree typically involves an external tax solution for complex needs. If you want to avoid registrations and filings entirely, a MoR like Paddle handles tax end-to-end. Whichever path you pick, align invoice fields, credit notes, and refund accounting with your finance and audit requirements.

6) How should I test proration to avoid invoice disputes?

Create scenarios for mid-cycle upgrades/downgrades, seat changes, and add-on toggles. Compare immediate versus end-of-term proration; many B2B teams use immediate proration for upgrades and end-of-term for downgrades. Verify credit notes, tax re-calculation, and customer emails. Ask support and finance to review sample invoices for clarity. Then run the same tests in your staging and production sandboxes before touching live subscribers.

7) Can I switch later without re-collecting payment methods?

It depends. Moving from gateway subscriptions to a platform (or vice versa) may require token migrations, where vaulted payment methods are securely transferred between providers. Plan for a dual-run period, communicate transparently with customers, and consider incentives to update cards if migrations are partial. Providers often have formal migration playbooks; request them early and budget engineering and support time accordingly.

8) What metrics should I watch after launch?

Track MRR/ARR, net revenue retention (NRR), involuntary vs. voluntary churn, authorization rate, dunning recovery rate, days sales outstanding (DSO) for invoices, and support ticket volume tied to billing. Create a baseline, then measure the delta after enabling card updater services, retry logic, and improved invoice clarity. If you sell globally, break metrics down by region to spot SCA or local-payment frictions.

9) Do I need revenue recognition features for SaaS?

If you produce GAAP or IFRS financials, you must recognize revenue under ASC 606/IFRS 15 rules. Many platforms integrate with revenue recognition tools or offer built-in modules. For simple monthly subscriptions, recognition is often straight-line across the service period; for multi-element arrangements (setup fees, bundled services, usage), you’ll want software that creates auditable schedules and supports disclosures.

10) What’s the safest first step if I’m unsure?

Shortlist two providers that match your risk profile (e.g., Stripe vs. Chargebee, or Recurly vs. Paddle). Script five lifecycle paths—new sign-up, upgrade, payment failure, plan swap, and cancellation—and run them in sandboxes. Review invoices, emails, and analytics with engineering, finance, and support in the room. Decide based on clarity, reliability, and total operational effort, not just a feature checklist.

References

- How subscriptions work — Stripe Documentation, Stripe. https://docs.stripe.com/billing/subscriptions/overview

- Billing — Product overview, Stripe. https://docs.stripe.com/billing

- Subscriptions — Braintree Developer Docs, PayPal/Braintree. https://developer.paypal.com/braintree/articles/guides/recurring-billing/subscriptions

- Recurring Billing Overview — Braintree, PayPal/Braintree. https://developer.paypal.com/braintree/docs/guides/recurring-billing/overview

- Subscriptions API — Chargebee, Chargebee. https://apidocs.chargebee.com/docs/api/subscriptions

- Working with Subscriptions — Chargebee Docs, Chargebee. https://www.chargebee.com/docs/billing/2.0/subscriptions/subscriptions

- Recurly — Product Pages & Docs, Recurly. https://recurly.com/product/

- Subscriptions — Recurly Docs Hub, Recurly. https://docs.recurly.com/recurly-subscriptions

- What is a Merchant of Record (MoR)?, Paddle. https://www.paddle.com/blog/what-is-merchant-of-record

- How Paddle handles VAT on your behalf, Paddle Help Center. https://www.paddle.com/help/sell/tax/how-paddle-handles-vat-on-your-behalf

- EBA clarifies the application of Strong Customer Authentication, European Banking Authority. https://www.eba.europa.eu/publications-and-media/press-releases/eba-clarifies-application-strong-customer-authentication

- ASC 606 — Revenue from Contracts with Customers (Summary), Financial Accounting Standards Board. https://fasb.org/page/PageContent

- IFRS 15 — Revenue from Contracts with Customers, IFRS Foundation. https://www.ifrs.org/issued-standards/list-of-standards/ifrs-15-revenue-from-contracts-with-customers/