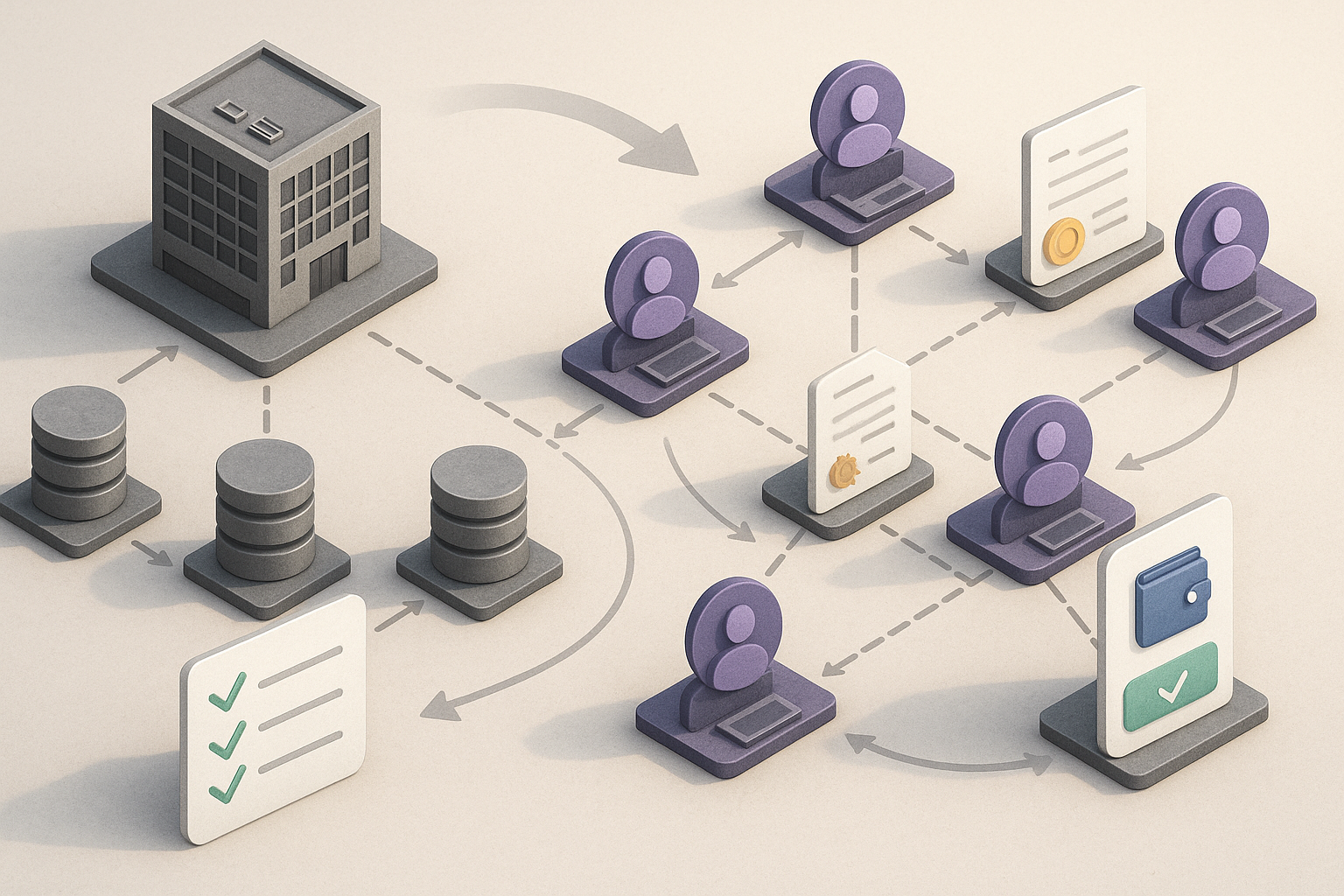

Setting up a DAO is the work of turning a shared mission into a self-governing, internet-native organization where rules are encoded in smart contracts and decisions are made collectively. In simple terms, a decentralized autonomous organization (DAO) is a collectively owned group that coordinates with on-chain rules and transparent voting rather than relying on a single leader. That means treasury movements, membership rights, and proposal outcomes are governed by code and community process rather than personal discretion. Your goal is not just to launch tokens or open a chat server; it’s to architect durable participation, clear incentives, and a pragmatic operating rhythm the community can actually sustain. This guide is educational, not legal, tax, or investment advice; for specific circumstances, consult qualified professionals. For quick orientation, the steps are: define purpose, choose a model, design tokenomics, select a legal wrapper, set up the treasury, choose governance mechanics, assemble the tooling stack, ship audited contracts, plan your launch, onboard contributors, manage risk, and measure what matters. Following them will help you move from idea to a functioning, community-led organization with fewer surprises and cleaner execution.

1. Nail the Mission and Member Promise

Your DAO should start with a mission that can be stated in one paragraph and a member promise that explains what participants get in exchange for their time, capital, or creativity. This is the anchor for everything that follows: governance choices, token design, treasury policy, community norms, even branding. Begin by writing the “why” as if you were addressing a prospective member who knows nothing about you: what problem do you solve, for whom, and how does a decentralized structure create better outcomes than a traditional org? Then define the member promise as the concrete value members can count on—access, upside, voice, learning, relationships, or tooling. A crisp mission and promise also make it far easier to say no to off-mission proposals later; if a proposal doesn’t add to the promise, it shouldn’t pass. Treat this step as a long-term safeguard against governance drift: the stronger the mission clarity, the less you’ll need to micromanage downstream mechanics.

Mini-checklist

- Problem fit: Can you describe the core problem in two sentences?

- Decentralization rationale: Why a DAO versus a company, nonprofit, or co-op?

- Member value: What do members reliably gain in their first week and first quarter?

- Scope boundaries: What won’t the DAO do—even if a vote could approve it?

- North-star metrics: Which outcomes signal you’re honoring the promise?

Common mistakes

- Vague “change the world” missions that don’t map to concrete decisions.

- Promising income instead of participation and opportunity.

- Confusing a token’s price with the DAO’s actual impact.

Close this step by writing a one-page “mission & promise” doc you’ll reference in every major decision. It’s your constitution’s preamble in plain language, not legalese.

2. Choose a DAO Model and Scope of Authority

Pick the structural model that best matches your mission and risk profile, and specify exactly what authority the DAO will hold. Popular archetypes include protocol DAOs (parameter changes and upgrades), service DAOs (deliver work to clients), grants DAOs (fund public goods), collector/investment DAOs (curate or invest), and community DAOs (membership experiences). The key isn’t labels—it’s clarity about which decisions are on-chain votes versus team-level execution, and where expert delegates or committees should operate. Write down what the DAO must vote on (constitution changes, treasury movements over a threshold), what it may vote on (program budgets), and what it delegates (day-to-day ops). If your model touches financial instruments or public markets, expect tighter compliance obligations and higher process rigor. Scope creep is common, so codify explicit boundaries now to protect community attention and avoid endless, low-signal proposals later. Good models evolve, but they start opinionated.

How to do it

- Define a RACI-style matrix for governance (what requires token-holder vote, what a council handles, what core contributors execute).

- Decide whether delegates or subDAOs will own specific domains (e.g., treasury, partnerships).

- Pre-commit to a consolidation review: every quarter-cycle evaluate which powers should centralize or decentralize.

Pitfalls

- Allowing token votes on micro-decisions that stall execution.

- Over-centralizing under the banner of “efficiency,” creating misaligned expectations.

- Avoiding domain expertise—complex areas benefit from elected stewards.

End with a scope charter: one page covering decision rights, escalation paths, and the threshold where proposals must go to a full vote.

3. Design Tokenomics That Reward Contribution, Not Just Holding

Tokenomics is the incentive system that aligns long-term participation with shared outcomes. For most DAOs, governance tokens grant voting power; for some, they also confer access or utility. Use well-audited standards (for fungible tokens, ERC-20 is the common base) and resist bespoke code unless you have a strong reason and a larger audit budget. Start by modeling total supply, initial distribution, emissions, and vesting such that you avoid early concentration and create clear contributor pathways. Document precisely how voting power is computed—token-weighted, delegated, or reputation-based—because your incentive design and your governance design must agree. Avoid emissions schedules that outpace real utility; it’s better to fund contributors and programs than to flood markets. If your token has any chance of being perceived as an investment contract, seek legal counsel before distribution.

Numbers & guardrails

- Illustrative supply: 100,000,000 governance tokens.

- Genesis allocation (example): 20% treasury, 25% community incentives, 20% contributors (with 12-month cliff, 36-month vest), 25% strategic partners, 10% reserve.

- Float discipline: Target ≤ 20% circulating in the first quarter post-launch to reduce governance capture risk.

- Delegation baseline: Encourage ≥ 40% of circulating supply to be delegated to active voters within the first cycle.

Common mistakes

- Shipping tokenomics before governance and treasury policies exist.

- Vesting cliffs that are too short, inviting churn rather than stewardship.

- Over-indexing on price action; optimize for participation first.

Synthesize the design with a living “Token Policy” doc: it should be boring, clear, and written for humans, not just Solidity developers.

4. Pick a Legal Wrapper and Address Compliance Early

A legal wrapper can provide limited liability, contracts capability, and a clearly recognized interface with the off-chain world. Options vary by jurisdiction, from LLC-based wrappers to unincorporated associations and cooperative forms. In the United States, regulators have clarified that certain token sales can fall under securities laws depending on facts and circumstances; do not assume “it’s a DAO” means “it’s exempt.” Some U.S. states offer DAO-specific LLC paths with naming and operating requirements, and formal entity formation may be necessary if the DAO will employ people, rent services, or hold fiat accounts. Outside the U.S., approaches differ widely; many founders engage local counsel to compare trade-offs among cost, liability protection, and reporting duties. The pragmatic approach: define what activities you’ll do off-chain, then choose the wrapper that makes those activities safe and boring. Always treat KYC/AML, tax, and employment as real issues—not afterthoughts.

How to do it

- Map activities (hiring, grantmaking, custody of fiat) to a wrapper that supports them.

- Draft an operating agreement aligned with your constitution and proposal process.

- Decide where IP sits (entity vs. open source) and how licenses are handled.

Mini case (jurisdictional example)

- Naming & filings: One state-level path requires an entity name including “DAO LLC” and specific filing forms.

- Costs & cadence: Example filings indicate a triple-digit formation fee and annual reporting cadence.

- Takeaway: Administrative friction is manageable if planned early; misalignment with your on-chain rules is what causes pain.

Close this step by publishing a plain-language “Legal & Compliance Summary” for members that explains what the wrapper does and does not cover.

5. Build a Safe Treasury With Multisig Controls and Spending Rules

The treasury is the DAO’s lifeblood; set it up to minimize single points of failure while keeping operations smooth. A well-audited multisig wallet with role-based ownership and transaction simulation is the standard starting point for custody, with on-chain policies controlling spend limits and signer thresholds. Design a diversification strategy that fits your burn rate and risk tolerance: a mix of your governance token, major assets, and stablecoins is typical for operational stability. Codify policies for grants, vendor payments, and streaming compensation, and separate long-term reserves from working capital. Most importantly, define what happens if something goes wrong—freeze mechanisms, incident response, and how emergency powers are invoked and sunset. A treasury that’s “safe by default” prevents governance proposals from turning into operational fires.

Numbers & guardrails

- Signer set: Start with a 3-of-5 or 4-of-7 policy; require at least one signer from each domain (ops, governance, engineering).

- Runway buffer: Maintain 9–12 months of stablecoin runway for predictable payments.

- Spend limits: Enforce daily/weekly spend caps; anything above triggers a full vote.

Mini-checklist

- Create a main treasury and a separate grants wallet.

- Enable transaction simulation and spending policies.

- Log every transfer with a human-readable reason in a public ledger channel.

End with a “Treasury Policy” doc your voters can reference, so proposals are judged against known rules rather than gut feel.

6. Specify Governance Mechanics: Proposals, Quorum, and Voting Methods

Write down, in exact terms, how ideas become proposals, how votes are counted, and when outcomes are legitimate. Choose your voting venue (for many, an off-chain snapshot of token balances with on-chain execution steps is practical) and specify voting types: single choice, approval, ranked choice, or weighted. Define quorum (minimum participation) and thresholds (what passes) with numbers; vague language undermines legitimacy. Encourage delegation so informed voters carry more responsibility while still remaining accountable to the wider community. Publish a standard proposal template covering motivation, budget, milestones, and success criteria. Finally, set a cadence: proposal windows, discussion periods, voting periods, and execution windows. Treat governance like product management: predictable, well-specified, and boring in the best way.

Quorum & threshold quick reference (example)

| Decision type | Quorum | Passing threshold | Voting period |

|---|---|---|---|

| Parameter tweak | 3% of circulating voting power | >50% yes | 3–5 days |

| Budget ≤ working-cap limit | 4% | >50% yes | 5–7 days |

| Budget > working-cap limit | 5% | ≥60% yes | 7–10 days |

| Constitutional change | 8% | ≥66% yes | 10–14 days |

Numbers & guardrails

- Encourage ≥ 30% of circulating voting power to be delegated to active participants within the first cycle.

- Establish a cooldown (e.g., 7 days) before an approved proposal executes, allowing emergency review.

- Real-world example: one DAO sets a 35,000,000-vote quorum with simple majority—large numbers alone don’t guarantee legitimacy without clear templates and discussion phases. docs.cow.fi

Close by publishing your “Proposal Lifecycle” diagram and a template so contributors know exactly how to participate from idea to execution.

7. Assemble a Tooling Stack That Fits Your Process

Choose tools that reinforce your governance and ops design rather than define it. At minimum you’ll need: a treasury and custody solution, a voting platform, contributor management, discussions, documentation, and analytics. Start with purpose-built DAO frameworks that offer modular governance and plugins if you prefer a higher-level scaffold; otherwise, compose best-in-class tools for each layer. Whatever you choose, verify support for roles, permissions, and migration—your stack should evolve without handcuffing you. Favor tools with open standards and active ecosystems; proprietary traps slow you down when you need to switch. Write a one-pager per tool explaining what it does, who administers it, and how members access it. The right stack reduces friction, clarifies roles, and makes participation feel rewarding rather than bureaucratic.

Suggested layers

- Governance & voting: Off-chain proposals with verifiable snapshots; support for multiple voting types and strategies.

- Treasury & execution: Multisig with policy controls and transaction simulation.

- Docs & specs: A public knowledge base with a living constitution and policies.

- Coordination: Chat, forums, and task boards with clear channels and labels.

- Bounties & grants: Lightweight intake, KYC where needed, progress tracking.

Mini-checklist

- Provision SSO where possible; onboard with least-privilege permissions.

- Document admin recovery paths for each tool.

- Schedule quarterly “tooling reviews” to prune unused services.

Wrap this step by publishing a “Stack Map”—a simple diagram your members can follow from idea to execution.

8. Ship Contracts You Can Trust: Testing, Audits, and Upgradability

If your DAO deploys or interacts with smart contracts, invest in testing and audits like your legitimacy depends on it—because it does. Use well-audited libraries for token standards and access control to avoid reinventing the wheel. Write comprehensive unit and integration tests, simulate malicious behavior, and set clear upgrade paths that balance safety with flexibility. Establish a deployment checklist that covers ownership of upgrade proxies, timelocks, pausable guards, and emergency controls. Consider a bug bounty program to incentivize external scrutiny. Finally, write human-readable docs for your contracts so voters and contributors can understand what’s at stake in governance proposals touching code. When governance controls code, clarity and correctness are community goods, not nice-to-haves.

How to do it

- Base contracts on reputable libraries (e.g., token standards, access control).

- Add timelocks and pausable modifiers to critical actions.

- Simulate upgrades on a testnet and run differential tests before mainnet deployment.

Mini-checklist

- Ownership map (who controls what, how transfers happen).

- Upgrade plan (when, by whom, under which vote).

- Incident playbook (freeze, patch, postmortem, restore).

Finish by recording hashes, addresses, and change logs in your public docs so the community can verify every critical artifact.

9. Plan Your Launch and Genesis Proposals Deliberately

A good launch creates clarity, not chaos. Decide how initial tokens or memberships will be distributed and how the first decisions will be made. Publish a plain-language explainer, a risk summary, and the first genesis proposals members can vote on immediately (e.g., ratifying the constitution, electing stewards, approving the first quarter’s budget). If you’re doing an airdrop or allowlist, explain eligibility and anti-sybil measures clearly. Calibrate circulating supply and liquidity so that governance cannot be captured by a few addresses in the first week. Launch communications should answer the top ten questions you expect: what to do first, how to delegate, where to ask for help, and how to propose work. Treat launch as the start of your governance culture, not just a marketing event.

Numbers & guardrails

- Eligibility: For an airdrop, aim for 3,000–10,000 qualified addresses with clear anti-sybil checks.

- Genesis quorum: Set an achievable but meaningful quorum (e.g., 3–5% of circulating voting power) to avoid stalled governance.

- Liquidity: Seed a modest pool; avoid over-liquifying governance tokens early.

Mini-checklist

- Publish three genesis proposals (constitution, budget, delegates).

- Open delegation and provide a delegate discovery page.

- Run a 48-hour dry run vote to debug UX before live decisions.

End by documenting “Day 1 actions” for members so excitement turns into participation, not confusion.

10. Onboard and Grow Contributors With Clear Paths and Fair Rewards

Onboarding is where many DAOs win or lose momentum. Design a welcoming path that gets a newcomer from “curious” to “productive” in one week with clear roles, starter bounties, and a buddy system. Make the process transparent: what skills are needed, where work is posted, how compensation works, and how performance is reviewed. Use lightweight reputation signals or non-transferable badges to show reliable contribution without turning everything into a token market. Document compensation bands for recurring roles and transparent criteria for bonuses. Keep rewards tied to deliverables and outcomes rather than hours; decentralization shouldn’t mean ambiguity. When contributors feel the path is fair and legible, they stop lurking and start building.

Numbers & guardrails

- Conversion funnel (example): 1,000 sign-ups → 400 complete onboarding → 120 complete a first bounty → 40 become active contributors by week four.

- Compensation policy: Cap any single contributor’s monthly compensation at ≤ 2% of monthly budget to prevent over-concentration.

- Bounty sizing: Keep “first bounties” small (sub-day tasks) so wins are quick and reputational risk is low.

How to do it

- Publish an onboarding map: join, verify, pick a track, ship a micro-task, get feedback, claim reward.

- Rotate a small team of mentors; reward mentorship explicitly.

- Hold a monthly “new member vote walkthrough” to demystify governance.

Close by maintaining a public “Contributor Portal” that lists tracks, skills, expectations, and current openings—keep it accurate and up to date.

11. Manage Risk With Controls, Playbooks, and Culture

Risk management is a culture as much as a checklist. Start with access control: least privilege for wallets, tools, and repos; rotate keys on contributor exits; and document recovery procedures. Add monitoring to your treasury and governance so abnormal activity is visible within minutes, not days. Enforce spending policies and signer thresholds at the contract level rather than relying on social norms. Maintain an incident playbook with roles, communication templates, and a timeline so responders don’t improvise under stress. Finally, cultivate a culture where raising concerns is rewarded and postmortems are blameless but action-oriented. With the right controls and norms, your DAO can move fast without breaking trust.

Numbers & guardrails

- Spend controls: Daily cap per wallet (e.g., ≤ 1% of monthly budget) unless a governance vote authorizes more.

- Key rotation: Rotate signer keys on a fixed cadence or within 24 hours of role changes.

- Bug bounties: Maintain an always-on bounty with severity-based payouts; publish triage times (e.g., first response within 12 hours).

Mini-checklist

- Quarterly “chaos drills” for treasury actions and governance proposals.

- Dual-channel incident comms (public updates and private coordination).

- Clear emergency powers with explicit sunset clauses.

Synthesize the above into a “Risk Register” the community can inspect and improve over time.

12. Measure What Matters and Iterate Deliberately

Governance only improves when you measure participation, throughput, and outcomes. Track proposal counts, pass rates, quorum attainment, voter concentration, delegation coverage, treasury runway, and contributor retention. Define rolling targets so you can tell whether experiments help or hurt. Establish quarterly reviews where stewards report progress, propose parameter changes, and archive dead processes. Publish dashboards in your docs and make your raw data downloadable for community analysts. Borrow proven patterns from mature DAOs but evaluate them against your mission and size; you’re aiming for legitimacy, not ceremony. Over time, your organization should get more legible, not more complex.

Numbers & guardrails

- Participation: Aim for 10–25% of circulating voting power participating in ordinary votes and ≥ 30% for constitutional changes.

- Delegation: Target ≥ 40% of circulating supply delegated to active voters.

- Throughput: Keep proposal pass rate between 50–80%; lower suggests spam or misalignment, higher suggests rubber-stamping.

Mini-checklist

- Quarterly metrics post with trends and proposed parameter tweaks.

- Archive or sunset processes that add ceremony without outcomes.

- “Experiment charter” template: hypothesis, metric, decision date.

Close by setting a fixed review cadence so governance evolves intentionally rather than drift under ad-hoc fixes.

Conclusion

Setting up a DAO is less about splashy launches and more about building a sturdy operating system for collective action. When you clarify the mission and member promise, choose a model that fits your goals, design tokenomics that reward contribution, and install a secure treasury, you reduce complexity later when proposals and programs multiply. Governance mechanics, a thoughtful tooling stack, and audited contracts turn ideals into durable practice, while deliberate onboarding and fair rewards make contribution intrinsically rewarding. Risk management and measurement keep you honest and ensure that the community’s scarce attention funds the work that matters most. Treat this guide as a living framework: ship the basics, publish your rules, then iterate in public as the community learns. If you’re ready to translate strategy into action, start by drafting your mission and member promise today—then move, step by step, through the rest of the playbook.

FAQs

1) Do I need a legal entity to run a DAO?

Not always, but if you plan to sign contracts, employ contributors, or hold fiat assets, a wrapper such as an LLC or association can provide limited liability and a clear off-chain interface. Different jurisdictions handle DAOs differently, and some offer DAO-specific paths. The safe path is to map your activities to a wrapper that supports them and to consult qualified legal counsel for specifics.

2) Are governance tokens always securities?

No. Regulators evaluate facts and circumstances, and some tokens can be deemed securities even if issued by a DAO. If your token has profit expectations tied to others’ efforts, seek legal advice before distribution. Clear utility and participation design help, but they are not substitutes for compliance analysis under applicable law.

3) What’s the fastest way to start voting?

Many DAOs begin with off-chain voting that reads token balances at a snapshot block and computes outcomes using configured strategies, then pair that with on-chain execution via multisig or modules. This keeps gas costs low while still giving clear outcomes. Publish templates and thresholds so members know the rules from day one.

4) How big should my signer set be?

Start with a 3-of-5 or 4-of-7 policy so you balance security with availability. Require representation from different domains to avoid collusion and include transaction simulation and spend policies to reduce human error. Review the signer set on a fixed cadence or when roles change.

5) Which token standard should I use for governance?

For fungible governance tokens, ERC-20 remains a widely used standard with robust, audited implementations and tooling. Starting from a reputable library lowers your surface area for bugs and simplifies audits, delegation mechanics, and distribution tooling. Avoid bespoke token logic unless you have a compelling reason.

6) What quorum and thresholds should I set?

Pick numbers that your current, real community can achieve while still conveying legitimacy. For routine budgets, a quorum around a few percent of circulating voting power with simple majority often works; for constitutional changes, raise both quorum and threshold. Publish these values and revisit them as your voter base changes.

7) How do I keep contributors engaged long term?

Create clear paths from newcomer to steward, compensate fairly against transparent bands, and reward mentorship and delivery rather than attendance. Offer micro-tasks for quick wins, then escalate scope with trust. Keep recognition visible and pair financial rewards with durable reputation signals such as badges or attestations.

8) What happens if a critical proposal passes with a bug?

Use cooldowns before execution, on-chain timelocks, and clear emergency powers with sunset clauses. These give responders time to catch issues and act without undermining legitimacy. After any incident, run a blameless postmortem and update controls, tests, and templates so failures become learning fuel rather than recurring risks.

9) Do I need audits if I only use battle-tested libraries?

Yes. Even with trusted libraries, your integration, configuration, and upgrade paths introduce unique risks. Commission at least one external review, maintain a bug bounty, and document every contract address and permission. Good audits are an investment in trust, not just a checkbox.

10) How much should I diversify the treasury?

As a rule of thumb, hold enough stable assets to cover nine to twelve months of predictable expenses. Keep governance tokens for alignment and upside, but don’t let operational stability depend on market swings. Use spending policies and separate working capital from long-term reserves so you’re never forced to sell in unfavorable conditions.

11) Can a small DAO use delegation effectively?

Absolutely. Delegation concentrates attention without centralizing power: voters choose active delegates, publish rationales, and can re-delegate at any time. Provide a delegate discovery page and encourage delegates to publish weekly summaries so passive holders stay informed and the system remains accountable.

12) How do I know if governance is “working”?

Look for steady quorum attainment, healthy debate that stays on-mission, predictable proposal throughput, and visible delivery after votes. Publish dashboards with participation and execution metrics, run periodic reviews, and adjust parameters deliberately. Borrow patterns from mature DAOs but keep your own feedback loops tight.

References

- What is a DAO? Ethereum.org — (no date listed). ethereum.org

- Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: The DAO. U.S. Securities and Exchange Commission — July 25, 2017. SEC

- Decentralized Autonomous Organization (DAO) FAQs. Wyoming Secretary of State — Revised March 9, 2022. sos.wyo.gov

- DAO LLC — Articles of Organization. Wyoming Secretary of State — (form currently published). sos.wyo.gov

- Snapshot Documentation (Voting types). Snapshot — January 17, 2025. Snapshot Docs

- Snapshot Docs (Overview). Snapshot — December 12, 2024. Snapshot Docs

- Safe Docs. Safe — October 10, 2025. Safe Docs

- ERC-20 — OpenZeppelin Contracts. OpenZeppelin — (no date listed). OpenZeppelin Docs

- Maker Governance 101. MakerDAO — (no date listed). makerdao.com

- Aragon Docs. Aragon — (no date listed). docs.aragon.org