If you’re exploring NFTs for collecting, creative patronage, or digital identity, this nft collectors guide gives you a practical, safety-first path from zero to confident owner. In plain language: NFTs are unique tokens that prove ownership of digital items, most commonly created with the ERC-721 or ERC-1155 standards on Ethereum and compatible networks. This guide walks you through wallet setup, due diligence, secure purchasing, thoughtful selling, and long-term storage—so you can take part without avoidable mistakes.

Quick definition: An NFT is a blockchain-based token that represents something unique; it’s “non-fungible,” meaning not interchangeable one-for-one like a coin or bill. Standards like ERC-721 and ERC-1155 define how NFTs work across apps and marketplaces.

Skimmable step list:

• Define your goals and budget

• Choose a chain and token standard

• Set up a secure wallet

• Fund the wallet and plan for gas

• Verify projects and creators

• Inspect contracts and metadata

• Use safe minting and approvals

• Buy with care

• List and sell strategically

• Store with layered security

• Track portfolio and provenance

• Plan recovery, inheritance, and exit

Important note (not financial advice): NFTs are speculative and regulations vary by country. This guide is educational—consult a qualified professional for legal or tax questions. For taxes, many jurisdictions treat digital-asset income and gains as taxable; learn your local rules.

1. Clarify your collecting goals and budget

Start by stating what you want to collect and why—art you love, in-game assets you’ll use, membership passes with utility, or historical pieces you believe will be culturally important. A clear thesis helps you avoid impulse buys and overexposure. Write down: the themes you care about, how you’ll evaluate authenticity and provenance, how long you intend to hold, and what would make you sell. Then translate your thesis into a budget that accounts not only for purchase prices but also for network transaction costs (“gas”), marketplace fees on sales, and the one-time cost of hardening your security (e.g., hardware wallet). Fee structures and standards exist to make NFTs interoperable, but costs still vary by chain and marketplace, so planning ahead protects you from forced decisions.

How to do it

- Write a short collecting policy: target categories, acceptable marketplaces, max spend per item.

- Split funds into “buy,” “fees,” and “security” buckets so an unexpected gas spike doesn’t derail a purchase.

- Pre-decide your exit conditions (profit targets, utility deadlines, or red-flag triggers).

- Keep a simple log (sheet or app) for buys/sells, contract addresses, and notes.

- Align purchases with available storage setup (see Section 10) before you buy.

Numbers & guardrails (example)

Suppose you allocate 2.0 ETH total to start. Reserve 0.1–0.2 ETH for gas and approvals, 0.02–0.05 ETH for revoking old approvals, and up to a few hundred dollars’ equivalent for a hardware wallet if you don’t already have one. Your “buy” bucket then governs what you bid or pay. Marketplace fees on a later sale (e.g., 1% on some platforms, creator fees vary) will reduce proceeds—plan for them now.

Tie-back: A written thesis and realistic budget make later choices—chain selection, wallets, listings—more disciplined and safer.

2. Choose the right blockchain and token standard

Pick your primary network and understand its NFT standards. Ethereum remains the reference network for ERC-721 (one-of-one NFTs) and ERC-1155 (semi-fungible or batch-mintable NFTs). ERC-721 emphasizes uniqueness; ERC-1155 supports both unique and editioned items efficiently, reducing costs for creators and sometimes for collectors. Many NFTs live on Ethereum Layer-2 networks (L2s) that settle to Ethereum but aim for lower fees and faster finality. The point isn’t that one chain is “best,” but that your goals (tooling, community, liquidity, and fees) align with your choice.

Why it matters

- Interoperability: Standards enable wallets, marketplaces, and explorers to recognize your token.

- Costs & speed: L2s can be materially cheaper per transaction than Layer-1. (Fee levels vary; always check the current gas environment.)

- Liquidity & tooling: Ethereum’s ecosystem offers mature explorers (Etherscan), contract verification, and approval checkers.

Tools/Examples

- Etherscan for token standards and contract verification.

- OpenZeppelin docs for ERC-721/1155 implementation details that shape how collections behave. OpenZeppelin Docs

Numbers & guardrails

- ERC-721: one token ID = one unique item.

- ERC-1155: one contract can hold many token IDs; each ID may have a supply of 1 or multiple editions. Efficient for gaming and drops.

Tie-back: Matching your chain and standard to your thesis reduces friction across buying, storage, and future selling.

3. Set up a secure wallet (and back it up properly)

Your wallet is where you hold keys that control NFTs. Software (“hot”) wallets are convenient but exposed to device risks; hardware (“cold”) wallets sign transactions on a dedicated device so private keys never leave it. Write down and securely store your seed/recovery phrase; never share it. Consider adding a passphrase where supported, and store backups in separate, safe places. Bookmark wallet URLs to avoid phishing and triple-check every transaction prompt—blockchains are unforgiving of mistakes.

Why it matters

- Key custody: Whoever controls the seed phrase controls the assets. Keep it offline and private. ethereum.org

- Hardware wallets: Transactions are signed inside the device; the key isn’t exposed to your computer or phone.

- Scam prevention: Most “support” DMs are social-engineering. Avoid off-platform contact and remote access requests.

Mini-checklist

- Initialize a hardware wallet; record seed + optional passphrase on paper/steel, not screenshots.

- Create a fresh “minting/buying” hot wallet and a separate “vault” wallet (cold or multisig) for long-term holds.

- Bookmark official sites; use a password manager; enable device PINs/biometrics.

- Test with a tiny transaction before moving significant assets.

Numbers & guardrails

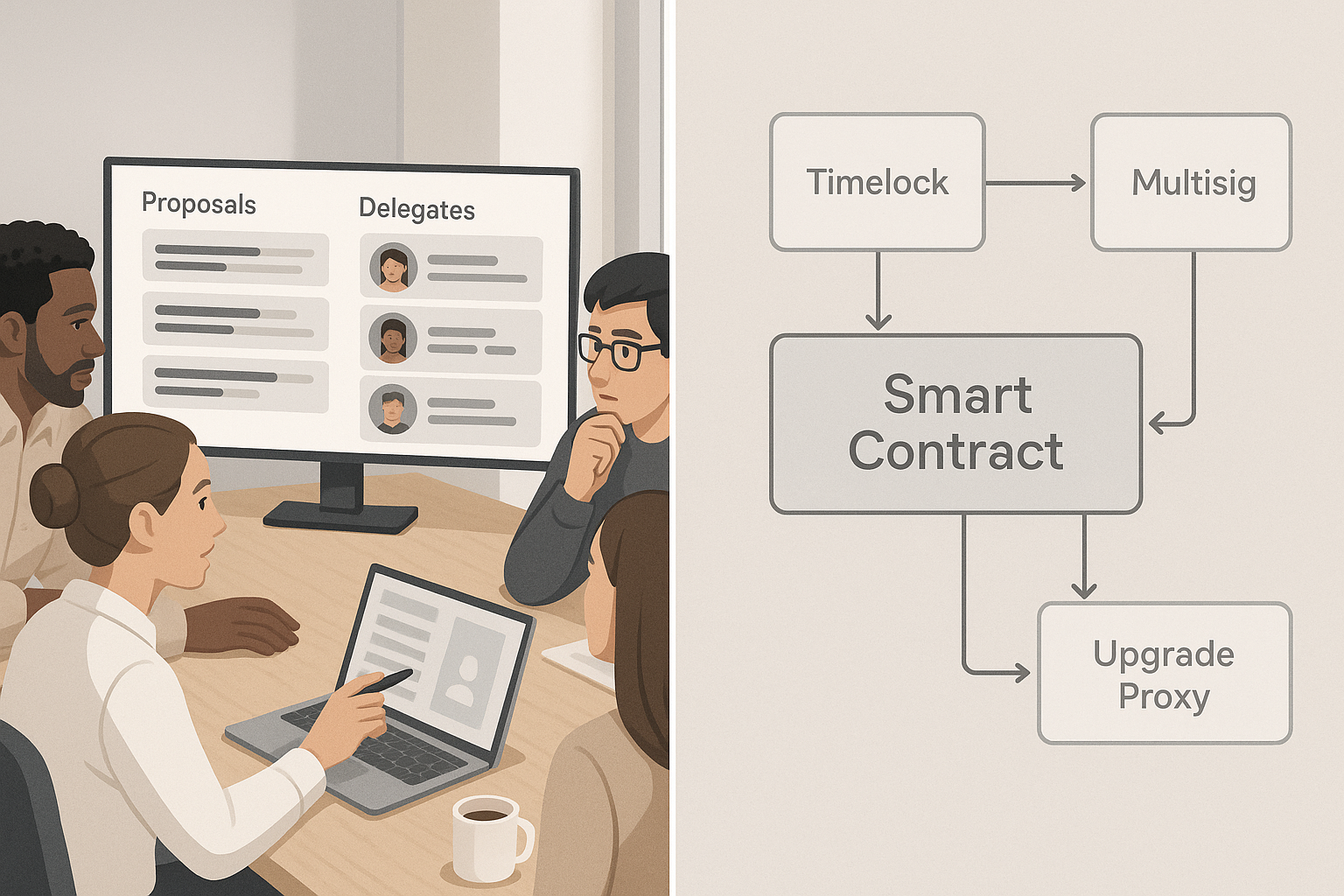

- Many collectors use a two-wallet model: a hot wallet for interactions and a cold wallet for storage. For higher stakes, a 2-of-3 multisig (Section 10) can further reduce single-key risk.

Tie-back: A hardened wallet setup is the foundation for every step that follows.

4. Fund your wallet and plan for gas

To buy NFTs you’ll need the chain’s native token for transaction fees (“gas”), plus any payment token the marketplace uses. On Ethereum and many L2s, that’s ETH; some listings accept alternatives. Fees fluctuate based on network demand. Plan enough headroom to cover approvals, purchases, listings, transfers, and occasional revocations. On L2s, recent upgrades have focused on lowering typical fees; still, check live conditions before you transact.

How to do it

- Acquire funds via your preferred on-ramp or exchange; withdraw to your wallet on the correct network.

- Keep a small buffer for approvals and revokes (Section 7).

- If moving from L1 to L2, bridge only what you need and note bridge times.

Numbers & guardrails (illustrative math)

If a mint requires 0.05 ETH and the marketplace purchase requires an ERC-20 approval, estimate: one approval + one purchase + one transfer. Add a cushion for a revoke later. On some L2s, these may total a few low-cost transactions; on busy L1, the same sequence can be materially higher. Always confirm fee prompts before signing.

Tie-back: Fee headroom prevents failed transactions and lets you act when opportunities meet your thesis.

5. Verify projects, creators, and communities before you buy

Good due diligence blends on-chain checks with off-chain context. Confirm the official contract address from the project’s verified channels; impersonators often copy names and symbols, but not contract addresses. Review whether the contract is verified on a reputable explorer; verification lets you and others read source code and interfaces. Cross-check social channels for consistent messaging, and beware of brand-new accounts pushing “urgent” mints. Finally, examine historical activity: irregular minting patterns, unusual transfer spikes, or wallets funneling funds in suspicious ways are red flags.

How to do it

- Start from the project’s official site or marketplace page; copy the contract address directly.

- On Etherscan, check the Contract tab: verified code, read functions, events, and total supply.

- Look for independent mentions by credible sources; avoid anonymous “paid promo” threads.

Common mistakes

- Clicking “mint” links in DMs.

- Buying from look-alike collections with the same art but a different contract.

- Assuming a blue check everywhere equals safety; always verify addresses.

Tie-back: A few minutes of verification can prevent irreversible purchases and scams.

6. Inspect the smart contract and the NFT’s metadata

Beyond legitimacy, look at how the NFT is implemented. Verified contracts improve transparency; metadata location determines long-term access to the image or media. Prefer content addressing (e.g., IPFS CIDs) and robust pinning over fragile, single-server links. Some marketplaces support “frozen” metadata features that help creators lock content references. For collectors, understand whether traits are immutable, when reveals happen, and how royalties are configured in the contract or enforced by marketplaces.

Why it matters

- Contract transparency: Lets the community audit behavior (mint limits, transfer rules, admin powers).

- Metadata durability: IPFS CIDs refer to the content itself; with proper pinning, multiple nodes can serve it.

Tools/Examples

- IPFS docs for best practices (wrap files in directories, pin metadata).

- Explorer “Read/Write” tabs: view tokenURI, ownerOf, royalty info where implemented. Ethereum (ETH) Blockchain Explorer

Tie-back: Understanding the contract and metadata helps you judge permanence, provenance, and resale prospects.

7. Use safe minting and approvals (and revoke what you don’t need)

Most NFT interactions ask you to approve a contract to transfer a token on your behalf. Approvals are normal, but they persist until revoked; malicious or over-broad approvals can expose assets. Before minting or buying, confirm the site URL, read prompts carefully, and scope approvals to the minimum needed. Periodically review and revoke old approvals using explorers or specialized tools; revoking costs a small transaction fee but reduces attack surface.

Mini-checklist

- Prefer “single-use” or token-specific approvals when available.

- Avoid blind signing; check “spender” addresses and limits.

- Use tools like Revoke.cash or an explorer’s Token Approval Checker to audit and revoke.

- After interacting with unfamiliar contracts, re-audit approvals.

Numbers & guardrails

Expect to pay a small network fee to revoke each approval; on lower-fee networks this is minor, but always confirm gas before proceeding. The reduction in risk is often worth it.

Tie-back: Approval hygiene is a recurring safety habit that protects your collection over time.

8. Execute the purchase responsibly

When you’re ready to buy, use reputable marketplaces or direct contract calls you understand. Confirm the collection’s official page, the exact token ID, and the price. Watch for “gasless” signing flows that prepare orders you later settle on chain; these are common and safe when used correctly. If participating in auctions, set a hard top price; if buying at fixed price, double-check currency and network. On confirmation screens, review fee line-items—marketplace fee, creator fee (if enforced), and gas. Some platforms publish fee schedules; creator fees can vary by collection and enforcement model.

How to do it

- Navigate from verified links; avoid third-party mirrors.

- Review listing details: token traits, ownership history, and contract address on the item page’s explorer link.

- Prefer paying from your “buy” wallet and then transferring to your “vault” wallet (Section 10).

Numbers & guardrails (illustrative math)

If you buy an NFT listed at 0.50 ETH, your total cost is listing price + gas. If later you sell it at 0.80 ETH on a marketplace that charges 1% and the collection enforces a 5% creator fee, you’ll receive roughly 0.80 × (1 − 0.01 − 0.05) = 0.752 ETH before gas. Fee policies differ by platform and collection—always check the current terms.

Tie-back: Careful review at checkout prevents wrong-network purchases and mispriced bids you can’t reverse.

9. List and sell with a clear plan (pricing, fees, and timing)

Selling well starts before you list. Decide whether a fixed price or timed auction fits market conditions and your goals. Fixed price favors certainty; auctions can discover higher prices but introduce timing risk. Set a duration that matches buyer activity in that collection and remember: relisting resets visibility for some platforms. Price relative to recent comparable sales and trait desirability, and factor in fees and royalties so you know your break-even. Platforms publish fee policies, while creator earnings may be set per collection or in the contract.

Mini-checklist

- Comps: Check floor price and trait-specific recent sales.

- Mode: Choose fixed price vs. auction based on volatility and interest. OpenSea

- Duration: Long enough for discovery; short enough to prompt decisions.

- Net math: Include marketplace + creator fees in your calculation.

One small table (illustrative)

| Item | Rate | On 1.00 ETH sale |

|---|---|---|

| Marketplace fee | 1% | 0.010 ETH |

| Creator fee | 5% | 0.050 ETH |

| Estimated net (before gas) | — | 0.940 ETH |

Fee policies and creator-fee enforcement vary by platform and contract; confirm current terms before listing.

Tie-back: A pricing plan that accounts for fees avoids surprises and helps you exit with intent.

10. Store NFTs with layered security (cold storage, multisig, vaults)

After purchase, move valuable NFTs to stronger custody. A common pattern is a hot “buy” wallet → cold “vault” wallet. For higher value or team-owned assets, consider a multisig smart account that requires multiple approvals to move tokens (e.g., 2-of-3). Multisig reduces single-key failure risk and enables role separation; with modern smart-account tooling you can batch actions and even collect signatures off-chain before executing. Keep your seed phrase or multisig owner keys stored separately, and maintain an inventory log with contract addresses and token IDs stored offline.

Why it matters

- Eliminates single points of failure: A single compromised device won’t immediately endanger assets. ethereum.org

- Operational safety: Off-chain signature collection and simulation tools help you double-check transactions before broadcasting.

Numbers & guardrails (example)

Set a 2-of-3 multisig with one hardware wallet at home, one in secure storage, and one held by a trusted co-signer. Configure spending limits on the “hot” wallet and require multisig approval for transfers above your threshold to the vault. Modern safe-account systems document these thresholds and approvals in the contract itself.

Tie-back: Layered custody keeps day-to-day convenience while protecting what you care about most.

11. Track your portfolio and provenance like an auditor

Treat your collection like a mini-treasury. Keep a ledger of token IDs, purchase dates, counter-parties, and contract addresses. Use explorers to verify ownership history (transfers, mints, burns), and periodically export CSVs from marketplaces or explorers for reconciliation. Approval checkers show who can move your assets; regular audits catch stale permissions and forgotten listings. For media durability, record IPFS CIDs or equivalent content hashes, and consider pinning important items yourself or via a service. Ethereum (ETH) Blockchain ExplorerRevoke.cash

Numbers & guardrails

- Quarterly hygiene: review approvals and revoke anything not in active use.

- Metadata note: IPFS CIDs are content-addressed; if one gateway is slow, others may still serve the same CID, especially if it’s pinned.

Tools/Examples

- Explorer exports and token trackers for activity snapshots; marketplace dashboards for open listings and offers. Ethereum (ETH) Blockchain Explorer

Tie-back: A lightweight audit routine preserves provenance and reduces operational risk over the long haul.

12. Plan for recovery, inheritance, and exit

Think ahead to “what if” scenarios: device loss, illness, or simply moving on from NFTs. Document recovery steps for your heirs or trusted executors without revealing secrets outright—store sealed instructions and keep them updated when you rotate keys. Consider social-recovery or smart-account options that let designated guardians help recover control without exposing your seed phrase. If you plan to sell down, schedule phased disposals with price targets and tax records. Many tax authorities consider digital-asset income and gains taxable; keep clean records and consult a professional.

How to do it

- Maintain two sealed envelopes (or secure digital vaults): one with the what (inventory, contracts, vault addresses), one with the how (recovery process, where backups are stored).

- Explore smart accounts with social-recovery features or multisig thresholds that support “break-glass” procedures without exposing day-to-day keys.

- Pre-write a short “disposition plan” for how and when to sell or transfer pieces.

Numeric mini-case (illustrative)

You hold 10 NFTs across two wallets. Your plan sets: (a) emergency access via a guardian-assisted recovery to the vault account; (b) sale thresholds for 3 pieces; (c) a once-per-quarter audit to revoke unnecessary approvals. The plan reduces “panic” actions and gives heirs a path if needed.

Tie-back: A recovery and exit plan protects both the art you love and the people you care about.

Conclusion

Collecting NFTs can be rewarding—artistically, culturally, and sometimes financially—but it pays to approach it with a method, not a mood. You started by defining a thesis and budget, chose a chain and standards that fit, then built a wallet setup that separates convenience from custody. You learned how to verify creators and contracts, use approvals safely, buy and list with intention, and store with layered security. Finally, you planned for audits, recovery, and exit so that your collection remains resilient. Put these 12 steps into practice, and you’ll navigate the space with clarity and confidence—ready to enjoy the work while avoiding the avoidable. Ready to begin? Pick your wallet model, write your thesis, and take your first small, deliberate step.

FAQs

1) What’s the simplest way to avoid NFT scams?

Start from official links and verify the contract address on a reputable explorer before interacting. Impersonators can copy names and symbols but not the contract address. Bookmark trusted sites, never click “urgent mint” DMs, and review approvals regularly using approval-checker tools. ethereum.org

2) ERC-721 vs. ERC-1155—does it matter for collectors?

Yes. ERC-721 represents one-of-one items (each token ID is unique), while ERC-1155 supports both unique and editioned items efficiently in one contract. Understanding this helps you value supply, editions, and mint mechanics.

3) Should I use a hardware wallet for NFTs?

For valuable holdings, a hardware wallet is a strong default: private keys stay on the device and never touch your computer or phone. Pair it with a “two-wallet” model (hot for minting, cold for storage) to reduce risk further. Fellowship of Ethereum Magicians

4) What are token approvals and why should I revoke them?

Approvals let a contract move your tokens on your behalf—useful, but potentially risky if left open. Periodically audit and revoke unneeded approvals; it costs a small fee and lowers exposure to malicious contracts. Ledger

5) How do marketplace and creator fees affect my sale?

Marketplaces may charge a platform fee, and collections may set creator earnings. Policies vary by platform and enforcement model; always check current terms so you can price to your target net proceeds.

6) How do I check an NFT’s metadata and media permanence?

Look for IPFS CIDs or similar content-addressed links rather than single-server URLs. IPFS best practices include wrapping files in directories and pinning to ensure persistence across nodes and gateways.

7) Are taxes relevant when I sell or receive NFTs?

In many jurisdictions, digital-asset income and gains are taxable. Keep detailed records of cost basis, fees, and proceeds. Consult a local tax professional because rules and reporting vary.

8) What’s a multisig, and do I need one?

A multisig is a smart-contract account that requires multiple approvals to execute a transaction. For higher-value collections or shared treasuries, a 2-of-3 or 3-of-5 setup reduces single-key risk and supports better governance.

9) How can I buy on L2 and still benefit from Ethereum security?

Ethereum L2s batch transactions and settle to Ethereum, often with lower fees. You still use familiar standards and explorers, but you’ll bridge funds and interact with L2-specific tooling. Check fee conditions and bridge carefully. Investopedia

10) What’s “gasless” signing—does it move my NFTs?

Some platforms collect signatures off-chain to form orders that are later settled on-chain. It’s normal; just confirm the details before broadcasting the final transaction. Smart-account systems also support collecting multisig signatures off-chain to reduce overhead.

11) How often should I audit my collection?

Quarterly is a good rhythm: reconcile holdings vs. logs, check approvals, and verify that metadata links still resolve. Pin critical items yourself or via a pinning service for durability.

12) What if I lose my seed phrase?

Without a seed phrase (or recovery design), access is typically lost. To reduce this risk, use robust backups and consider social-recovery or multisig options that allow guardians or multiple keys to help you regain control without exposing secrets.

References

- “ERC-721 Non-Fungible Token Standard,” Ethereum.org (Sep 17, 2025). ethereum.org

- “ERC-1155 Multi-Token Standard,” Ethereum.org (Sep 16, 2025). ethereum.org

- “Ethereum Security and Scam Prevention,” Ethereum.org (Oct 18, 2025). ethereum.org

- “Ethereum Wallets,” Ethereum.org (n.d.). ethereum.org

- “OpenSea Fees,” OpenSea Docs (n.d.). OpenSea Developer Documentation

- “What fees do I pay on OpenSea?” OpenSea Support (n.d.). OpenSea Help Center

- “How to Verify Contracts,” Etherscan Information Center (Mar 21, 2025). Etherscan Information Center

- “Token Approval Checker,” Revoke.cash (n.d.). Revoke.cash

- “Best Practices for Storing NFT Data Using IPFS,” IPFS Docs (Oct 9, 2025). IPFS Docs

- “Content Identifiers (CIDs),” IPFS Docs (Oct 9, 2025). IPFS Docs

- “Safe Smart Account Overview,” Safe Docs (Oct 10, 2025). Safe Docs

- “Gas-less Signatures,” Safe Help Center (n.d.). help.safe.global

- “Digital Assets,” Internal Revenue Service (Sep 16, 2025). IRS

- “Account Abstraction,” Ethereum.org (Oct 6, 2025). ethereum.org