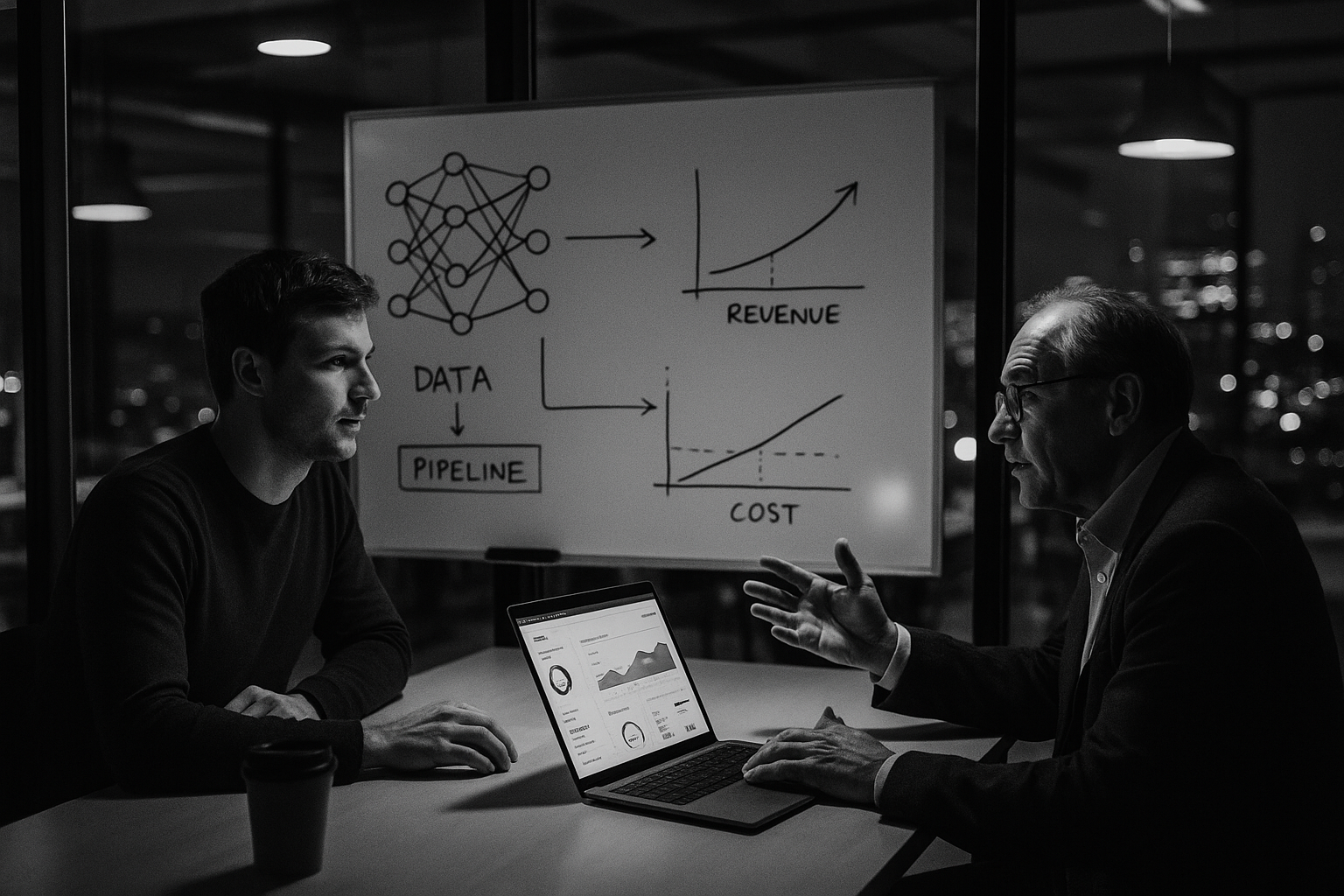

Reaching a unicorn valuation isn’t magic; it’s a repeatable set of choices that great founders make under intense pressure. In plain language, the road to unicorn is about finding and scaling a product that many customers love, with unit economics that let you grow faster than you burn. The founders of billion-dollar startups will tell you that most “overnight successes” were the product of unglamorous experiments, relentless customer feedback, and disciplined math. Put simply: identify a painful problem, deliver a must-have solution, build a growth engine that compounds, and protect your margins as you scale. This guide distills 11 lessons that successful founders rely on—from product-market fit and pricing to sales process, metrics, and compliance—so you can move faster with fewer missteps. For financial, legal, or employment decisions, treat the following as educational guidance and consult qualified professionals.

Fast path overview: Map a niche, validate the pain, measure product-market fit, pick the right go-to-market motion, make unit economics work, prove repeatability, instrument metrics, professionalize hiring, raise toward milestones, localize responsibly, and avoid common traps. Do that, and you maximize the odds that your company compounds into something category-defining.

1. Define a Painkiller Problem and a Narrow Beachhead

Start by solving a must-fix problem for a sharply defined group, not a vague “everyone.” A painkiller product displaces an existing budget or workflow because not using it is measurably costly or risky. Founders of billion-dollar startups often began with a niche beachhead where they had an unfair advantage—access, insight, or lived experience—and only expanded once they owned it. The goal is not total addressable market bragging rights; it’s winning a tiny market so completely that expansion becomes inevitable. Early on, you’re searching for intensity of demand, not breadth. When customers chase you, tolerate missing features, and refer peers without being asked, you’re on track. That clarity lets you prioritize, tell a crisp story, and avoid building for edge cases too soon. It also anchors pricing, messaging, and a roadmap you can actually ship.

How to do it

- Write a one-sentence problem statement that names the user, the job, and the harm of failure.

- Identify 1–2 critical jobs-to-be-done; defer everything else.

- Recruit 15–30 design partners who feel the pain weekly and will trial prototypes.

- Instrument before/after metrics (minutes saved, defects reduced, revenue unlocked).

- Track a simple must-have question: “How disappointed would you be if this went away?”

Numbers & guardrails

- In early discovery, aim for ≥10 live interviews with decision-makers and ≥15 with users.

- If <30% of prospects self-qualify as “problem-right-now,” your beachhead is still too broad.

- A credible beachhead should support $1–3 million in potential annual contract value across your first 100 target accounts (or an equivalent consumer scale within your niche).

Synthesis: A precise, painful problem and a narrow beachhead create gravitational pull. Win there, and expansion becomes a plan—not a hope.

2. Measure Product-Market Fit with Leading Indicators

You don’t guess at product-market fit (PMF); you measure it with behavior and a small set of survey-based signals. Successful founders combine cohort retention patterns with a “must-have” score to avoid false positives. A flattening retention curve within your target segment usually indicates real value, while a continuously declining curve signals a leaky bucket to fix before paid growth. Complement that with a single question—“How would you feel if you could no longer use the product?”—and track the share who answer “very disappointed.” When that share clears a meaningful threshold and key usage cohorts flatten at non-trivial levels, you’ve earned permission to scale the acquisition engine. Until then, resist the temptation to outspend weak retention. Founders who scale before PMF routinely end up with high burn, high churn, and demoralized teams.

How to do it

- Create weekly cohort charts for your core action (not logins).

- Survey active users at a consistent cadence; avoid re-surveying the same individuals.

- Segment by persona and use case; PMF can be archetype-specific.

- Put PMF metrics on the team’s single source of truth dashboard.

- Make one product OKR that ties directly to the PMF signal (e.g., “very disappointed” share).

Numbers & guardrails

- A flattening retention curve within core users is a strong PMF clue; continuously declining curves suggest you’re not there yet. Sequoia’s data team outlines these archetypes clearly.

- As a leading indicator, teams often target ≈40% “very disappointed” in PMF surveys, popularized by operators who used it to operationalize PMF.

Mini case: One founder tracked “very disappointed” at 22%, focused on the segment that loved the product, doubled-down on the top benefit, removed adoption blockers, and moved the score to 58%, alongside visibly stronger retention.

Synthesis: PMF is the gate. Retention patterns plus a must-have score form the earliest, most actionable greenlight for scale.

3. Pick Founder-Market Fit—and Make It Your Edge

Founder-market fit (FMF) means your background gives you unfair insight or access to the customer or domain. Unicorn founders often lived the problem for years and can credibly recruit peers, craft resonant messaging, and move faster on nuanced decisions. FMF also makes “doing things that don’t scale” feel natural: high-touch onboarding, white-glove support, and manual workflows you’ll automate later. These unscalable acts are not detours; they’re the fastest route to clarity. Your early customers experience the product’s “magical moment” more quickly, you collect higher-fidelity feedback, and your roadmap gets obvious. FMF helps you say no to features that dilute your wedge and yes to the one or two that make the product indispensable. Investors and candidates sense this authenticity; it compounds into narrative momentum.

How to do it

- Map your credibility assets (past role, network, research, personal pain).

- List three founder-only motions you can run (e.g., hands-on installs, custom pilots).

- Write a contrarian thesis that follows from your experience and test it in the field.

- Capture verbatims from early users and turn them into messaging and onboarding flows.

- Keep a “don’t scale yet” list; automate only after behavior stabilizes.

Tools/Examples

- Manual installs, concierge onboarding, or building for one lighthouse customer are classic early tactics attributed to iconic founders. Paul Graham

Synthesis: Your lived context is a multiplier. Use it to find truth faster and design the product customers can’t live without.

4. Choose the Right Go-to-Market Motion (and Sequence It)

Not every unicorn is product-led; not every enterprise winner is sales-led. The right motion depends on your buyer, ACV, implementation complexity, and required proof to close. A product-led growth (PLG) motion excels when individual users can self-serve to value and virality exists; a sales-led motion shines with complex implementations, multiple stakeholders, and high ACVs. Many successful founders blend motions over time: PLG to seed usage and generate product-qualified leads (PQLs), then overlay product-led sales for expansion, or start sales-led and progressively reduce friction with self-serve experiences. The mistake is copying a motion that doesn’t fit your buying process. Instead, map your buyer journey and instrument conversion at each step so you know what to scale—and what to stop.

How to do it

- Draw the buyer map: who feels the pain, who signs, who blocks.

- Decide whether the first value can be achieved without a human.

- If PLG, define your activation and PQL triggers; if sales-led, choose a qualification framework (e.g., MEDDICC).

- Align pricing with your value metric and expansion motions.

- Sequence: nail one motion, then layer the second deliberately.

Numbers & guardrails

- Many teams aim for 3–5× pipeline coverage relative to target, flexed by win rates and cycle length.

- Benchmark guidance often treats 3:1 LTV:CAC as a healthy minimum; CAC payback targets vary by segment (SMB <12 months, mid-market <18, enterprise <24).

Synthesis: Fit GTM to how your buyers actually buy. Then scale the motion that matches their path to value.

5. Build a Repeatable Sales Process Before You Add Fuel

Founders who scaled to unicorn status usually proved repeatability before throwing bodies and budget at the funnel. Repeatable means: a clear ICP, consistent qualification, reliable stage definitions, realistic exit criteria, and forecasting that improves with data. Without this backbone, pipeline inflates, forecasts slip, and morale drops. A good process makes average sellers productive and top performers exceptional, while revealing where the product or messaging still needs work. It also gives you the managerial insight to invest confidently in demand gen, enablement, and adjacent geographies. Crucially, repeatability allows you to predict the unit economics of adding each new rep, bringing rigor to headcount plans and expansion bets.

How to do it

- Adopt a qualification framework (e.g., MEDDICC) and coach toward it weekly.

- Define stage exit criteria that include documented pain, economic buyer access, and mutual close plans.

- Track win rate, average contract value, and sales cycle by segment.

- Create call libraries of real wins/losses; turn patterns into playbooks.

- Instrument post-demo NPS or similar to catch product gaps early.

Numbers & guardrails

- Many orgs treat 3–5× coverage as a planning baseline; increase coverage if win rates fall or cycles lengthen.

- Watch rep ramp time: target the month when quota-bearing reps reliably break even on fully loaded cost.

Mini case: If your team runs a 25% win rate and a 90-day cycle, planning 4× coverage for the quarter creates buffer for slippage; a $1 million target implies $4 million in qualified pipeline entering the period, not counting new adds during the quarter.

Synthesis: Sales repeatability is a bet you can underwrite. When it exists, scaling headcount is an investment—when it doesn’t, it’s a gamble.

6. Make Unit Economics Non-Negotiable

Unicorn-bound companies treat unit economics as a design constraint, not a retrospective report. Gross margin, LTV:CAC, and payback govern how fast you can grow without constantly refueling. In practical terms, this means pricing to value, controlling variable costs, and aligning acquisition with long-term retention and expansion. Reliable CAC payback targets differ by segment—tighter for SMB, looser for enterprise—and should be gross-margin adjusted. LTV:CAC is best treated as a directional lens; many founders prefer focusing on payback and net dollar retention to drive decisions week to week. Aggressive growth is wonderful when it compounds into profitable cohorts; it’s dangerous when it masks poor retention or mispriced packaging.

How to do it

- Price on a value metric that correlates with outcomes and scales with usage.

- Track gross margin drivers early (support intensity, infrastructure, onboarding).

- Model payback by segment and experiment toward targets.

- Review cohorts monthly; use cohort profit curves to avoid LTV mirages.

- Tie sales comp to collectable revenue and healthy expansion, not just bookings.

Numbers & guardrails

- Many investors cite 3:1 LTV:CAC as a rough threshold for health; treat it as directional, not dogma.

- Segment guidance: SMB <12 months, mid-market <18, enterprise <24 for CAC payback, using gross-margin-adjusted ARR.

Mini case: A company selling at $36,000 ACV with 80% gross margin and a $24,000 blended CAC has a gross-margin-adjusted payback of roughly 10 months ($36,000 × 0.8 = $28,800 / $24,000 ≈ 1.2 years of value to repay CAC; monthly ARR ≈ $3,000; payback ≈ $24,000 / $2,400 ≈ 10 months). With payback under a year and net dollar retention above 110%, they can reinvest confidently.

Synthesis: When unit economics work, growth fuels itself. When they don’t, every new dollar of revenue digs a deeper hole.

7. Design Culture for Speed and Quality at Scale

Hypergrowth exposes cultural cracks. Unicorn founders are deliberate about the behaviors they reward: customer obsession, ownership, and high-quality decisions made quickly. That shows up in tight feedback loops between product and go-to-market, crisp writing standards, and managers who coach rather than traffic-cop. They keep the org as simple as possible—few couplings, clear interfaces—and push context so teams can act without waiting. They also define leadership principles that scale hiring and performance without politicizing decisions. Most importantly, they protect slack for craftsmanship where it matters most, so you don’t win speed at the expense of reliability or trust.

How to do it

- Write operating principles that are specific enough to guide tradeoffs.

- Implement written decision memos with clear owners, options, and risks.

- Keep manager-to-IC ratios healthy; invest early in enablement and analytics.

- Conduct pre-mortems on critical launches; fix the biggest points of fragility.

- Track lead time to ship and defects escaping to customers as quality indicators.

Mini checklist

- Customers first: Is this choice improving time-to-value?

- Simple beats clever: Can we remove a step?

- Write it down: Would a one-pager unblock multiple teams?

- Own the outcome: Who is the directly responsible individual?

Synthesis: Culture is the invisible architecture of compounding execution. Build it to move fast and get things right.

8. Raise Toward Milestones—Not Vanity

Fundraising accelerates what’s already working; it can’t replace fundamentals. Unicorn founders focus each round on a specific milestone: ship the thing, prove PMF in a segment, demonstrate repeatability, or scale efficiently. The story is a straight line from painful problem to must-have solution to credible market, told with the metrics that matter for your stage. Great narratives pair vision with receipts: cohorts, payback, retention, expansion, and a model that shows how new dollars convert to durable ARR or gross profit. They also manage dilution intentionally, preserving enough ownership to keep options open. The best use capital to de-risk, not to chase whimsy.

How to do it

- Define one milestone the next round will indisputably prove.

- Build a clean data room: cohort tables, revenue recognition, pipeline, churn reasons.

- Craft a metrics-first deck; product slides explain why the numbers happen.

- Share forward plans: hiring map, experiments, and what you’ll kill if they fail.

- Know your capital efficiency and how each dollar becomes ARR or gross profit.

Numbers & guardrails

- Investors scrutinize CAC payback, net retention, gross margin, and growth endurance to gauge durability and efficiency—targets and ranges vary by segment, but efficiency improves markedly as you scale.

Synthesis: Capital is a multiplier. Point it at a milestone that compounds value and tells the market you’re inevitable.

9. Instrument the Metrics That Actually Predict Outcomes

Winners choose a small set of leading and lagging metrics that drive decisions, not dashboards. At a minimum, track activation, engagement, retention, expansion, and payback by segment. In B2B, include pipeline coverage, win rates, and sales cycle; in consumer, include virality (K-factor) and habit formation. For many SaaS unicorns, net dollar retention (NDR) becomes the North Star once PMF stabilizes; expansion from existing customers is typically cheaper and compounding. Cohort analysis beats blended metrics. When you can read your system at a glance, you can intervene earlier, reduce waste, and scale with confidence.

How to do it

- Build a weekly metrics review: one page, same order, with owner commentary.

- Use triangle retention and flattening curves to gauge product health.

- Track pipeline coverage and win rate by segment to forecast capacity needs.

- Keep CAC payback front-and-center; LTV:CAC remains a directional health check.

- Make NDR a core board metric; tie cross-sell and pricing to it. OpenView’s benchmarks show how expansion dynamics shift over time. OpenView

Compact table: Metrics & guardrails

| Metric | Practical guardrail | Why it matters |

|---|---|---|

| Activation rate | Clear, event-based threshold | Predicts retention and PQL volume |

| CAC payback | SMB <12 mo, Mid-market <18, Enterprise <24 | Capital efficiency & runway |

| Pipeline coverage | 3–5× target (adjust by win rate/cycle) | Forecast confidence & hiring pace |

| Net dollar retention | Aim for ≥100%; 110–120%+ is strong | Compounding revenue base Bessemer Venture Partners |

| Retention curve shape | Flattening in ICP cohorts | PMF confirmation |

Synthesis: A handful of metrics, read the same way each week, will keep you honest and moving.

10. Localize and Comply Early Where It Counts

International growth and enterprise deals require credibility on privacy, security, and payments. Founders who reach unicorn status treat compliance as a growth enabler, not a blocker. If you handle personal data, understand GDPR principles for lawful processing and cross-border transfers, and the rights and notices expected under CCPA. For security-sensitive customers, map your work to recognized standards and be candid about scope and roadmap. You don’t need every certification on day one, but you do need a plan that aligns with your target buyer. Simple choices—data residency, vendor reviews, DPA templates—can accelerate procurement and reduce late-stage surprises that derail revenue.

How to do it

- Document your lawful bases, data flows, and cross-border transfer mechanisms.

- Prepare a clear DPA and security packet; align with ISO/IEC 27001 controls over time.

- For US consumers, be ready to support right to know, delete, opt-out, and limit sensitive data use where applicable. California DOJ

- Localize payments, tax/VAT, and support hours for priority regions.

- Assign a security & privacy owner; track requests and close times.

Numbers & guardrails

- Expect enterprise buyers to ask for security questionnaires and evidence of control operation; create a lightweight trust center page to reduce deal friction.

- For privacy requests, measure acknowledgment time and resolution time; keep both predictable and prompt.

Synthesis: Treat trust as a feature. A pragmatic compliance plan unlocks markets and speeds up signatures.

11. Avoid the Pitfalls That Stall Hypergrowth

Most failed scale-ups fall into predictable traps. They chase too many segments before winning one, confuse activity with progress, and hire ahead of clarity. Others grow top-line at any cost with weak retention, assuming fundraising will always be an option. Still others build platforms before wedges, dilute ownership with undisciplined rounds, or neglect culture until quality slips. The common thread is losing the thread—forgetting the core customer and the math that made the business work. Unicorn founders maintain a ruthless focus on what compounds and a healthy paranoia about what breaks at the next order of magnitude.

Common mistakes

- Premature scale: Spending to mask weak retention.

- Platform too early: Fragmented roadmap; nothing becomes excellent.

- Headcount as a strategy: Hiring without repeatable processes.

- Vanity metrics: Celebrating signups while cohorts quietly decay.

- No stop rules: Continuing failed experiments because they’re sunk costs.

Mini checklist

- Does this initiative increase retention, expansion, or margin in a measurable way?

- Have we killed two things for every big new bet?

- Are we still the best solution for our beachhead?

- What breaks at 10× the current scale—and who owns the fix?

Synthesis: Great companies scale what works and prune what doesn’t. Discipline turns momentum into inevitability.

Conclusion

The road to unicorn runs through a sequence of hard but navigable checkpoints: obsessive problem focus, measurable product-market fit, a GTM motion that fits how your buyers buy, unit economics that get better with scale, and a culture that ships quality quickly. When you read founder stories closely, you’ll notice fewer silver bullets and much more evidence of disciplined iteration: dozens of user conversations, uncomfortable but clarifying experiments, and weekly metrics that tell the truth. If you adopt these 11 lessons—and keep your eyes on retention, payback, and expansion—you’ll avoid the most expensive mistakes and compound the wins that actually matter. Start today by writing your problem statement, picking your first ten design partners, and defining the one metric that will make the next quarter unambiguous. Now, pick your beachhead, set your PMF signal, and ship the smallest thing that makes someone say “don’t take this away.”

FAQs

1) What is the fastest way to tell if I have product-market fit?

Use a leading indicator like a “must-have” survey alongside cohort retention. If the share of users who would be very disappointed without your product is high and your target cohort retention curves flatten rather than decline, you’re close. Expect some noise; segment by persona and use case to find where fit is strongest first. First Round

2) How do I choose between PLG and sales-led growth?

Map the buyer’s path to first value. If individual users can self-serve to value quickly and share organically, start PLG and harvest PQLs. If implementation is complex, multiple stakeholders are involved, or the ACV is high, prioritize sales-led with rigorous qualification. Many winners blend both over time; the sequence depends on your product and buyer. Meddicc

3) What’s a healthy LTV:CAC ratio—and should I care more about payback?

Many investors treat 3:1 as a directional threshold, but CAC payback is often more actionable: design for <12 months in SMB, <18 in mid-market, and <24 in enterprise, gross-margin-adjusted. Obsessing over LTV inputs can be misleading; make decisions on real payback and cohort behavior. Andreessen Horowitz

4) How much sales pipeline coverage do I need?

A practical baseline is 3–5× target, adjusted by win rates and cycle length. If your win rate is lower or your cycle is longer, increase coverage. The key is honesty about stage definitions and exit criteria so “coverage” reflects qualified opportunities, not wishful thinking. HubSpot

5) Which metrics matter most at the scaling stage?

Track activation, engagement, retention, expansion (NDR), and CAC payback by segment. Use cohort and triangle charts, not just blended averages. In many models, strong NDR becomes the compounding engine once PMF is established.

6) How do I price a new product credibly?

Tie pricing to a value metric the customer cares about (seats, usage units, outcomes) so expansion scales with realized value. Run lightweight experiments: present tiered packages, test fences, and track not only win rate but also payback and expansion. Revisit pricing when NDR stalls or your cost structure changes.

7) When should I expand to a second segment or geography?

Only after you own your beachhead with repeatable acquisition, onboarding, and expansion—and your unit economics hold. Document your playbook, then port it with minimal changes. Localize payments and support hours for priority regions, and ensure your privacy and security posture can withstand enterprise scrutiny. European Commission

8) Do I need formal security certifications to sell to enterprises?

Not immediately, but aligning with recognized frameworks (e.g., ISO/IEC 27001) and publishing a clear trust center with policies, subprocessors, and security controls shortens cycles. Plan your roadmap and be transparent about what’s in scope. ISO

9) What’s the biggest cause of wasted spend in growth?

Pouring money into acquisition before retention stabilizes. A declining retention curve means your funnel is a sieve. Until cohorts flatten at reasonable levels for your use case, treat paid growth as an experiment, not a strategy. Sequoia Capital Articles

10) How do I keep culture strong as we add headcount quickly?

Codify a few operating principles tied to real tradeoffs, insist on clear written decisions, and keep teams small with crisp interfaces. Track lead time to ship and customer-visible defects; both are cultural health signals. Make managers coaches; reward ownership and customer outcomes rather than activity.

References

- Andreessen, M. “The Only Thing That Matters.” Pmarchive. June 25, 2007. https://pmarchive.com/guide_to_startups_part4.html

- Vohra, R. “How Superhuman Built an Engine to Find Product-Market Fit.” First Round Review. https://review.firstround.com/how-superhuman-built-an-engine-to-find-product-market-fit/

- Sequoia Capital Data Science Team. “Retention.” Sequoia Capital Articles. https://articles.sequoiacap.com/retention

- Bessemer Venture Partners. “Scaling to $100 Million.” BVP Atlas. https://www.bvp.com/atlas/scaling-to-100-million

- OpenView. “2023 SaaS Benchmarks Report.” OpenView Partners. https://openviewpartners.com/2023-saas-benchmarks-report/ (PDF: https://faas.co.il/wp-content/uploads/2023/08/OpenView-SaaS-Benchmarks-Report-2023.pdf)

- HubSpot. “Sales Pipeline Coverage – Definition, FAQs & How HubSpot Helps.” HubSpot Glossary. https://www.hubspot.com/glossary/sales-pipeline-coverage

- International Organization for Standardization. “ISO/IEC 27001:2022 — Information Security Management Systems — Requirements.” ISO. 2022. https://www.iso.org/standard/27001

- California Department of Justice, Office of the Attorney General. “California Consumer Privacy Act (CCPA).” Updated March 13, 2024. https://oag.ca.gov/privacy/ccpa

- European Commission. “Principles of the GDPR.” European Commission. https://commission.europa.eu/law/law-topic/data-protection/rules-business-and-organisations/principles-gdpr_en

- Graham, P. “Do Things That Don’t Scale.” paulgraham.com. July 2013. https://paulgraham.com/ds.html