(Disclaimer: This article is for informational purposes only and does not constitute financial advice. The strategies, trends, and examples discussed herein are observations of the current digital landscape. Financial decisions should always be made based on individual circumstances, ideally in consultation with a qualified financial professional.)

The landscape of financial education has shifted dramatically. Gone are the days when financial advice was the exclusive domain of suit-clad professionals in high-rise offices or dense textbooks gathering dust on library shelves. Today, financial literacy is being dispensed in 60-second bursts, set to trending audio, and delivered by relatable faces on smartphone screens. This is the era of “FinTok”—a portmanteau of Finance and TikTok—and it heralds the meteoric rise of financial influencers, or “finfluencers.”

This cultural shift represents a democratization of finance, making complex topics like investing, budgeting, and debt management accessible to demographics historically ignored by traditional institutions. However, it also introduces a “wild west” of unregulated advice, where verified expertise often competes with survivorship bias and high-risk speculation.

In this comprehensive guide, we will explore the mechanisms driving the FinTok phenomenon, the psychology behind its appeal, the varied content ecosystems within it, the regulatory battles heating up globally, and what this means for brands, creators, and consumers navigating the digital economy.

Key Takeaways

- Democratization of Access: FinTok has successfully lowered the barrier to entry for financial literacy, engaging Gen Z and Millennials who feel alienated by traditional banking institutions.

- The Trust Shift: Younger generations increasingly trust peer-to-peer advice and “parasocial” relationships with creators over institutional messaging.

- Content Variety: The ecosystem is vast, ranging from conservative budgeting hacks (like “cash stuffing”) to high-risk cryptocurrency trading and real estate flipping.

- Regulatory Scrutiny: Governments worldwide are cracking down on undisclosed sponsorships and unqualified advice, reshaping how influencers must operate.

- Brand Opportunity: For fintech and legacy brands, partnering with finfluencers offers a direct line to younger consumers, provided vetting processes are robust.

Defining the “FinTok” Phenomenon

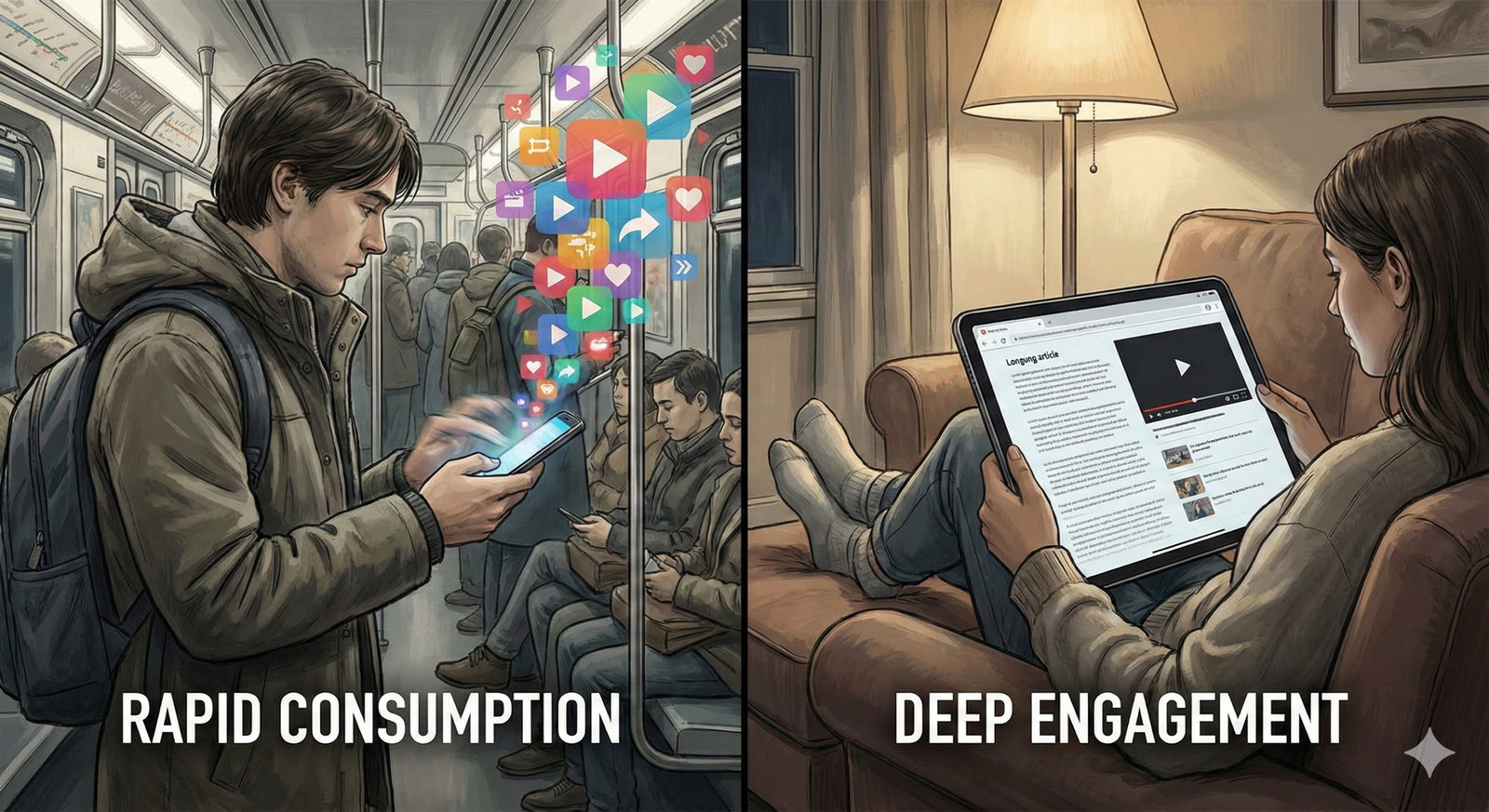

To understand the rise of financial influencers, one must first understand the platform dynamics that birthed them. While financial blogs and YouTube channels have existed for over a decade, the explosion of TikTok (and subsequently Instagram Reels and YouTube Shorts) changed the velocity and format of information consumption.

The Algorithm of Wealth

Unlike social networks based on a “social graph” (seeing content from people you follow), TikTok operates on an “interest graph.” The algorithm serves content based on what holds a user’s attention. Financial content, which is inherently high-stakes and often promises lifestyle improvements, performs exceptionally well under these metrics.

When a user engages with a single video about “how to save $1,000,” the algorithm quickly pivots to serve more niche content: index funds, high-yield savings accounts (HYSAs), or side hustles. This creates a feedback loop where financial content can go viral purely based on engagement, regardless of the creator’s credentials.

Who Are the Financial Influencers?

Financial influencers are content creators who share advice, tips, and commentary on money management. They generally fall into three broad categories:

- The Professionals: Certified Financial Planners (CFPs), accountants (CPAs), and lawyers who use social media to market their services or debunk myths. They often use disclaimers and focus on foundational literacy.

- The Enthusiasts/Educators: Self-taught investors who share their personal journeys. They often focus on “financial independence, retire early” (FIRE) strategies, budgeting hacks, and frugal living.

- The Hype Creators: Influencers who focus on speculative assets, “get rich quick” schemes, drop-shipping courses, and volatile cryptocurrencies. This group draws the most criticism and regulatory heat.

The Perfect Storm for Growth

The rise of FinTok was not accidental. It was catalyzed by a convergence of global events:

- The COVID-19 Pandemic: Lockdowns left millions of people at home with extra time, stimulus checks, and anxiety about their economic future.

- The Meme Stock Saga: The GameStop (GME) short squeeze of 2021 proved that online communities could move markets, validating the power of social sentiment in finance.

- Generational Disillusionment: Gen Z and Millennials, facing high housing costs and student debt, are actively seeking alternatives to the “work 9-to-5 and save” narrative which feels increasingly unattainable.

The Psychology of Social Finance

Why do millions of people take financial advice from strangers on the internet? The answer lies in the psychological architecture of social media and the failure of traditional finance to connect emotionally.

Relatability vs. Authority

Traditional financial advisors often speak a language of exclusivity, filled with jargon like “asset allocation,” “fiduciary duty,” and “tax-loss harvesting.” While accurate, this language creates a barrier.

Finfluencers speak the language of the internet. They use memes, skits, and plain English. When a creator says, “Here is how I paid off $20,000 of debt while working a barista job,” it carries a weight of relatability that a brochure from a bank cannot replicate. The advice feels actionable because the person giving it looks and sounds like the viewer.

Parasocial Trust

Repeated exposure to a creator’s face and voice builds a “parasocial relationship”—a one-sided bond where the viewer feels they know the influencer personally. If a creator shares their wins, their losses, and their daily life, the audience trusts their recommendation for a budgeting app or a brokerage account as they would a friend’s recommendation. This trust is the currency of the creator economy, but in finance, it can be dangerous if the “friend” is misinformed or incentivized by hidden sponsorships.

FOMO and Social Proof

Financial content often leverages “Fear Of Missing Out” (FOMO). Videos showcasing massive returns on crypto or luxury lifestyles funded by “passive income” trigger a psychological urgency. Social proof—seeing thousands of comments and likes—validates the advice in the viewer’s mind, bypassing critical thinking filters that might otherwise question the feasibility of the claims.

Content Ecosystems: What Does FinTok Look Like?

FinTok is not a monolith. It is a collection of sub-communities, each with its own vocabulary, visual style, and level of risk.

1. The Frugal and Budgeting Community

This is perhaps the most wholesome corner of FinTok. Content here focuses on controlling expenses and organizing cash flow.

- Cash Stuffing: A revival of the envelope method where creators physically count cash into envelopes labeled for different expenses (Groceries, Rent, Fun). It is tactile, ASMR-friendly, and visually satisfying.

- No-Spend Challenges: Creators document their attempts to go a week or month spending money only on essentials.

- Couponing and Deals: Sharing hacks to save money at major retailers.

2. The Investing and Wealth Building Community

This sector focuses on long-term growth and creates the bridge to traditional investing.

- Index Fund Preaching: Creators who advocate for “boring” investing—buying the S&P 500 and holding.

- Dividend Investing: Focusing on building a portfolio that pays out regular income.

- Real Estate: From “house hacking” (renting out rooms in your primary residence) to BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategies.

3. The Side Hustle and Entrepreneurship Sector

This area blends finance with career advice and business coaching.

- Gig Economy: Tips for maximizing earnings on Uber, DoorDash, or freelance platforms.

- Passive Income: Discussions on print-on-demand, digital products, and vending machine businesses.

- Career Negotiation: Scripts and strategies for asking for a raise or job hopping to increase salary.

4. The Speculative and High-Risk Zone

This is the controversial edge of FinTok, often overlapping with “CryptoTok.”

- Day Trading: Livestreams or recaps of daily stock trades, often highlighting massive (and volatile) gains.

- Crypto and NFTs: Promotion of new coins or projects. This area is rife with volatility and potential scams.

- Forex and Multi-Level Marketing: Creators recruiting followers into trading groups or courses that promise unrealistic returns.

The Economics of a Finfluencer

How do these creators monetize their content? Understanding the business model of influencers is crucial for consumers to evaluate the bias in the advice they receive.

Brand Partnerships and Sponsorships

This is the primary revenue stream for many. Fintech companies, trading platforms, credit card issuers, and budgeting apps pay influencers to feature their products.

- Fixed Fee: A set price for a dedicated video or mention.

- Affiliate Marketing: The influencer provides a unique link or code (e.g., “Link in bio to get a free stock”). They earn a commission for every user who signs up or deposits money.

The Conflict of Interest: Affiliate models can incentivize influencers to push platforms that pay the highest commission (CPA – Cost Per Acquisition), rather than the platform that is best for the user. For example, a high-frequency trading platform might pay more than a conservative robo-advisor, encouraging influencers to push active trading to an audience that might be better suited for passive investing.

Digital Products and Courses

Many financial influencers pivot to education by selling:

- Courses: “Mastering the Stock Market” or “Budgeting 101.”

- Templates: Spreadsheets for tracking net worth or expenses.

- Communities: Paid access to Discord servers or Patreon groups where they share exclusive trade alerts or deeper analysis.

Creator Funds and Ad Revenue

Platforms like YouTube pay creators a share of ad revenue (AdSense). In the finance niche, the CPM (Cost Per Mille, or cost per 1,000 views) is significantly higher than in niches like comedy or gaming because advertisers (banks, brokerages) pay a premium to reach this audience.

The Dark Side: Risks, Scams, and Misinformation

While FinTok democratizes access, it also democratizes bad advice. The short-form nature of the content removes nuance, which is fatal in finance where “it depends” is often the only correct answer.

The Nuance Deficit

A 60-second video cannot adequately explain the tax implications of a Roth conversion or the risks of leverage trading. Creators often strip away the warnings to make the content punchy and viral. Universal advice like “everyone should buy real estate” ignores local market conditions, interest rates, and the individual’s credit score.

Pump and Dump Schemes

In the unregulated corners of crypto and penny stocks, malicious actors use influencers to artificially inflate the price of an asset. They buy the asset cheap, pay influencers to hype it up to their millions of followers, and then sell (dump) their holdings when the price peaks, leaving followers with worthless assets.

The “Guru” Trap

The “lifestyle finfluencer” often rents luxury cars and Airbnbs to project an image of immense wealth, claiming it came from their specific trading strategy. They sell courses teaching this strategy. In reality, their wealth often comes from selling the course, not the trading itself. This is a digital evolution of the classic seminar scam.

Survivorship Bias

The algorithm favors winners. You are more likely to see a video of someone who turned $1,000 into $100,000 than the 99 people who lost their $1,000 trying the same method. This creates a distorted view of risk and reward for young viewers.

The Regulatory Crackdown: Taming the Wild West

As of 2024 and heading into 2025, regulators globally have realized that finfluencers are effectively acting as unlicensed financial advisors. The era of unchecked promotion is ending.

United States: SEC and FTC

The Securities and Exchange Commission (SEC) and the Federal Trade Commission (FTC) are aggressive in this space.

- The Kardashian Precedent: In 2022, Kim Kardashian was charged by the SEC for touting a crypto security without disclosing the payment she received. She agreed to pay $1.26 million in penalties. This sent a shockwave through the industry: disclosure is mandatory.

- FTC Guidelines: Influencers must clearly disclose material connections to brands. ” #ad” or “#sponsored” must be visible, not hidden in a sea of hashtags.

- Anti-Touting Rules: It is illegal to promote securities without disclosing the nature and amount of compensation.

United Kingdom: The FCA

The Financial Conduct Authority (FCA) in the UK has taken a hard line.

- Restriction of Promotions: Promoting financial products is heavily restricted. Unauthorized persons (influencers) cannot approve financial promotions; they must be approved by an FCA-authorized firm.

- Criminal Penalties: The FCA has warned that non-compliance can lead to unlimited fines and up to two years in prison. They have explicitly stated that “memes” can be considered financial promotions.

European Union: ESMA

The European Securities and Markets Authority (ESMA) actively monitors social media for market manipulation and unauthorized advice, issuing warnings that influencers act as de facto investment advisors and fall under the MiFID II regulatory framework.

Platform Responsibility

TikTok, Instagram, and YouTube are under pressure to self-police. TikTok has updated its branded content policies to restrict the promotion of certain financial services and cryptocurrencies, though enforcement remains a game of whack-a-mole.

How Brands Can Safely Navigate FinTok

For legitimate financial institutions, FinTok is too big to ignore. However, the reputational risk is high. Here is how brands are adapting:

1. The Shift to “Brand Ambassadors” over “One-Offs”

Brands are moving away from paying random influencers for a single post. They are building long-term relationships with vetted creators who align with their values. This allows for compliance training and ensures the creator understands the product.

2. Strict Compliance Vetting

Legal teams now scrutinize influencer scripts. Brands require:

- Clear disclosures (#ad, #sponsored) in the first few seconds of video or text overlay.

- Avoidance of promissory language (e.g., changing “This will make you money” to “This could help you save”).

- Checking the influencer’s history for past controversies or scam promotions.

3. Creating Owned Content

Rather than relying solely on influencers, brands like Chime, SoFi, and even legacy banks like Chase are creating their own “influencer-style” content. They hire creators to work in-house or train their own charismatic employees to be the face of the brand on social media.

Evaluating Advice: A Checklist for Consumers

With the line between education and sales blurred, consumers need a framework to evaluate the financial content they consume.

The “Red Flag” Checklist

If a creator exhibits these behaviors, proceed with extreme caution:

- Promises Guaranteed Returns: There is no such thing in finance.

- Creates Urgency: Phrases like “Buy now before it’s too late” or “Last chance.”

- Shows Lifestyle over Process: Focuses on Lamborghinis and watches rather than charts and spreadsheets.

- Promotes Obscure Tokens/Stocks: Specifically assets with low liquidity.

- No Disclosures: Promotes a specific platform without marking it as an ad.

- Asks to Move to Encrypted Messaging: “DM me on WhatsApp/Telegram for the real tips” is almost always a scam.

The “Green Flag” Checklist

Trustworthy finfluencers generally:

- Discuss Risks: They talk about how you can lose money, not just make it.

- Cite Sources: They reference official news, tax codes, or historical data.

- Show Transparency: They disclose sponsorships clearly and explain how they make money.

- Focus on Education: They teach you how to fish (how to read a balance sheet), rather than giving you the fish (telling you exactly what to buy).

- Stay in Their Lane: They admit when they don’t know something or advise consulting a professional for complex tax/legal issues.

The Future of Digital Finance Communities

As the novelty of FinTok settles, the landscape is maturing. We are witnessing a shift from “hype” to “substance.”

1. The Rise of “Verified” Finance

We will likely see platforms introduce verification badges specifically for licensed professionals (CFPs, CFAs). This would allow users to filter content by credentialed experts versus general enthusiasts.

2. Vertical Integration

Influencers are becoming founders. Instead of just promoting a budgeting app, top influencers are building their own fintech tools or co-founding investment firms. This increases the stakes: their reputation is now tied to the performance of a product they own, not just one they market.

3. AI and Personalized Advice

The next wave of FinTok might not be a person at all. AI avatars and chatbots, integrated into social platforms, could provide personalized financial education at scale. While this reduces human error, it introduces algorithmic bias risks.

4. Community-Based Accountability

“FinTwit” (Financial Twitter) and Reddit have long been self-policing communities. FinTok is developing similar antibodies. Accounts dedicated to exposing “furu” (fake guru) scams are growing, holding influencers accountable for failed predictions and undisclosed ads.

Conclusion

FinTok is a double-edged sword. It has arguably done more for youth financial literacy in five years than the school system has done in fifty. It has empowered a generation to discuss salaries, tackle debt, and enter the stock market. However, it operates in a high-speed, high-risk environment where bad advice travels just as fast as good advice.

For the user, the key is media literacy: understanding that a 60-second video is a starting point, not a financial plan. For brands, the key is integrity: partnering with creators who prioritize education over extraction. And for the creators themselves, the future lies in professionalism. As regulations tighten and audiences grow savvier, the influencers who survive will be those who value trust over the quick algorithmic win.

The rise of financial influencers is not a trend that will vanish; it is the new reality of how the world interacts with money. The challenge now is ensuring that this new reality is built on a foundation of transparency and truth.

FAQs

What qualifies someone as a financial influencer?

Technically, anyone posting financial content on social media can be considered a financial influencer. However, there is no formal qualification required to use the label on social media. Some are licensed professionals (CFPs, CPAs), while others are self-taught enthusiasts. This lack of standardized qualification is a primary source of risk in the ecosystem.

Can I trust investment advice on TikTok?

You should never take investment advice on TikTok as a direct instruction to buy or sell. Treat FinTok content as “idea generation” or entertainment. If a creator mentions a concept or stock, use that as a prompt to do your own research (DYOR) or consult a licensed professional. Always verify claims against reputable financial news sources.

Do financial influencers have to disclose if they are paid?

Yes. In the US, UK, and EU, influencers are legally required to disclose if they have a financial relationship with the brand or product they are discussing. This usually takes the form of visual overlays like “#ad,” “Paid Partnership,” or verbal statements. Failure to do so violates consumer protection laws.

What is the “envelope method” often seen on FinTok?

The envelope method, often branded as “cash stuffing” on TikTok, is a budgeting technique where you withdraw your discretionary income in cash and allocate it into physical envelopes labeled for specific categories (e.g., Dining Out, Groceries, Gas). Once an envelope is empty, you cannot spend more in that category for the month. It is a visual and tactile way to prevent overspending.

Why are authorities cracking down on finfluencers?

Authorities are cracking down because unqualified advice can cause significant financial harm to consumers. Issues range from influencers promoting Ponzi schemes and volatile crypto tokens to giving incorrect tax advice. Regulators aim to protect consumers by ensuring that those promoting financial products adhere to the same transparency and fairness standards as traditional financial institutions.

How do I report a scam financial influencer?

Most social platforms (TikTok, Instagram, YouTube) have a “Report” function where you can flag content for “Scams and Fraud” or “Misinformation.” Additionally, in the US, you can file a complaint with the FTC or the SEC. In the UK, you can report misleading financial adverts to the FCA.

References

- Securities and Exchange Commission (SEC). (2022). SEC Charges Kim Kardashian for Unlawfully Touting Crypto Security. U.S. Securities and Exchange Commission. https://www.sec.gov

- Financial Conduct Authority (FCA). (2024). Financial promotions on social media. FCA.org.uk. https://www.fca.org.uk

- Federal Trade Commission (FTC). (2019). Disclosures 101 for Social Media Influencers. FTC.gov. https://www.ftc.gov

- CFA Institute. (2023). The Finfluencer Appeal: Investing in the Age of Social Media. CFA Institute Research & Policy Center. https://www.cfainstitute.org

- European Securities and Markets Authority (ESMA). (2024). Warning on the risks of social media investment advice. ESMA.europa.eu. https://www.esma.europa.eu

- Klapper, L., Lusardi, A., & van Oudheusden, P. (2015). Financial Literacy Around the World. Standard & Poor’s Ratings Services Global Financial Literacy Survey. https://gflec.org

- Swiss Finance Institute. (2023). Finfluencers. Swiss Finance Institute Research Paper Series. https://www.sfi.ch