The digital landscape is undergoing a profound structural shift. For over a decade, the “creator economy” has largely been defined by centralized platforms—social media giants and streaming services—that act as intermediaries between creators and their audiences. While these platforms provided visibility, they also monopolized control, retaining ownership of the audience relationship, the distribution algorithms, and the majority of the revenue. Today, a new paradigm is emerging: decentralized content ownership.

This shift, often categorized under the umbrella of Web3, utilizes blockchain technology, Non-Fungible Tokens (NFTs), and token-gated communities to restore power to the individual. It is not merely a change in technology, but a change in the fundamental economics of creativity. It moves the creator from a “renter” of digital space to an “owner” of their digital destiny.

In this guide, decentralized content ownership refers to the use of blockchain-based assets to prove authorship, manage access rights, and facilitate direct monetization without reliance on a singular central authority. We will explore how NFTs serve as more than just digital collectibles—acting as access keys and equity—and how token-gated communities are redefining fan engagement.

Key Takeaways

- Ownership vs. Renting: Centralized platforms allow you to rent an audience; decentralized protocols allow you to own the relationship.

- The Utility of NFTs: Beyond art, NFTs function as programmable access keys (tokens) that unlock content, experiences, and community channels.

- Direct Monetization: Smart contracts allow for immediate royalty payments and peer-to-peer transactions, removing the 30–50% cuts often taken by Web2 intermediaries.

- Portability: In a decentralized model, your audience and content history travel with you across different applications, rather than being locked into one app’s silo.

- Community Governance: Token-gated communities often allow fans to have a say in the direction of the project, turning consumers into stakeholders.

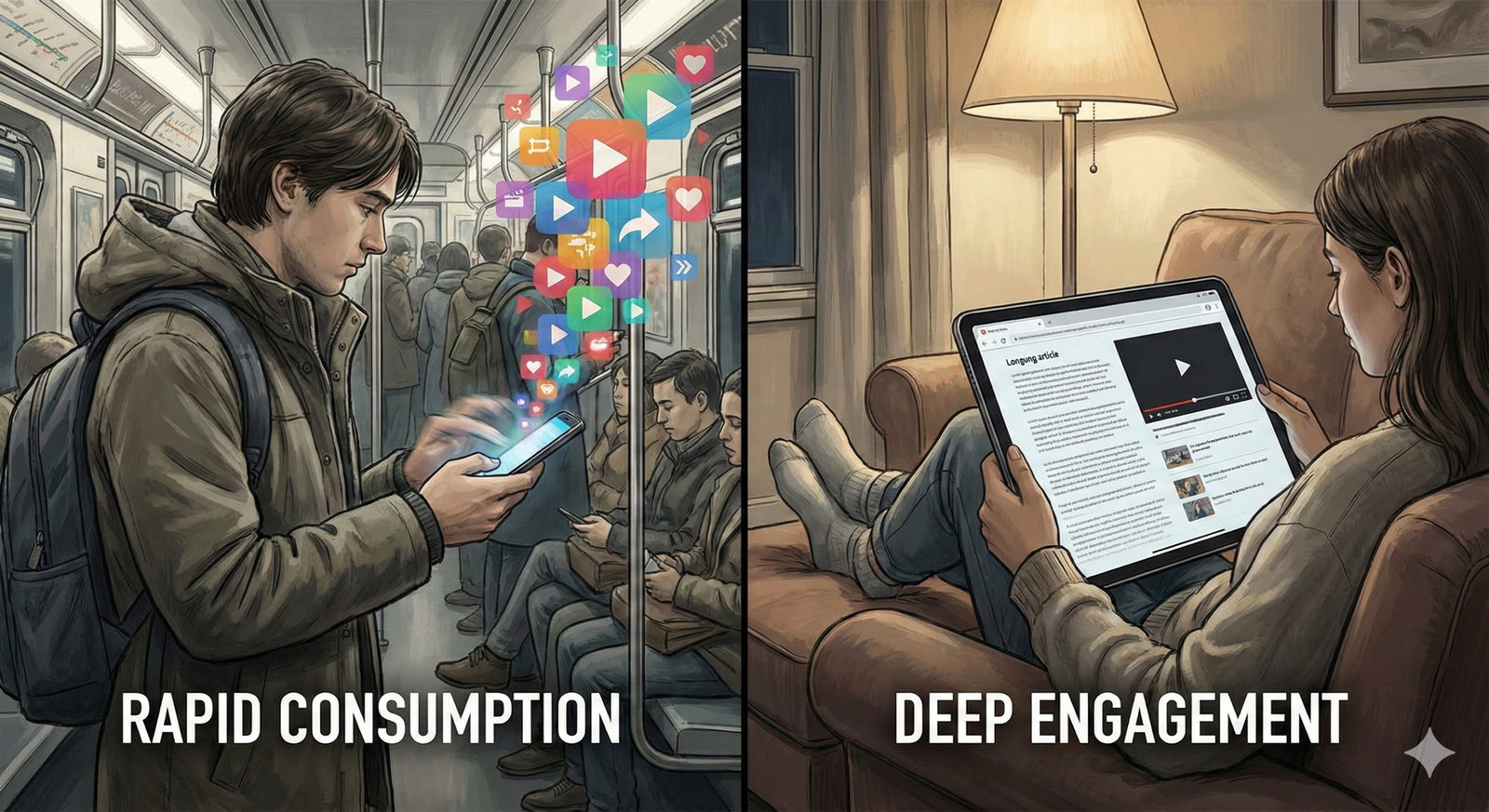

- Sustainability: This model favors “1,000 true fans” who are deeply invested, rather than millions of passive viewers required by ad-based models.

Who this is for (and who it isn’t)

This guide is for:

- Creators and Artists: Musicians, writers, visual artists, and educators looking to escape algorithm dependence and build sustainable income.

- Community Builders: Managers and founders seeking deeper engagement tools beyond standard Discord or Slack setups.

- Brand Strategists: Forward-thinking marketers exploring how Web3 loyalty programs can replace traditional points systems.

- Tech-Curious Professionals: Individuals wanting to understand the practical utility of blockchain beyond cryptocurrency speculation.

This guide is NOT for:

- Get-Rich-Quick Seekers: If you are looking for advice on flipping JPEGs for profit or finding the next “moon” coin, this article will not help you.

- Passive Content Aggregators: This model requires active community management and value creation; it is not a “set it and forget it” passive income stream.

The Crisis of Centralized Content

To understand the urgency of decentralized content ownership, we must first look at the precarious nature of the status quo. In the traditional Web2 model, creators sign a Faustian bargain: they get free hosting and potential virality in exchange for their data and their direct line to followers.

The “Platform Risk” Reality

Creators face what is known as “platform risk.” At any moment, an algorithm change can tank engagement by 80%, a shadowban can silence a voice without recourse, or a monetization policy change can wipe out an income stream overnight. In this environment, you do not own your followers; the platform owns a database entry that points to your profile. If the platform shuts down or bans you, that asset involves zero portability.

The Monetization Gap

The economics of streaming and social media are volume-based. A musician needs millions of streams to earn a living wage on Spotify. A YouTuber needs massive view counts to generate significant ad revenue. This forces creators to prioritize breadth (mass appeal) over depth (niche connection), often compromising their artistic vision to feed the algorithm.

Decentralized content ownership flips this funnel. By allowing creators to sell “ownership” or “access” directly to their biggest fans, they can monetize high-intent users immediately, reducing the need for massive scale.

Defining Decentralized Content Ownership

Decentralized content ownership is the capability to create, distribute, and monetize digital work using infrastructure that no single entity controls. It relies on the public blockchain as a ledger of truth.

The Core Technology Stack

- Blockchains (The Ledger): Networks like Ethereum, Solana, or Polygon act as the database. They record who created what and who currently owns it.

- Smart Contracts (The Logic): Self-executing code that defines the rules. For example, “If User A sends 0.05 ETH to Creator B, send User A the NFT key and unlock the newsletter.”

- Wallets (The Identity): Digital wallets (like MetaMask or Phantom) serve as the user’s login credential. Instead of “Log in with Facebook,” you “Connect Wallet.” This wallet holds the tokens that prove you have the right to access content.

- IPFS/Arweave (The Storage): Decentralized file storage systems ensure the actual content (the video, the PDF, the image) is hosted across a network of computers, ensuring it cannot be censored or deleted by a single server failure.

The Shift from Copying to Owning

The internet was originally built as a giant copy machine. If I send you a file, we both have it. This is great for information spread but terrible for value capture. Blockchains introduce digital scarcity. When a creator mints an NFT, they create a unique digital object that cannot be copied (even if the image it points to can be). This distinction allows digital items to accrue value and function as keys.

How Token-Gated Communities Work

A token-gated community is an online space—a Discord server, a website, a newsletter, or a video stream—that automatically restricts access based on the contents of a user’s crypto wallet.

The Mechanism of Access

This process is seamless for the user but technically sophisticated:

- The Lock: The creator sets up a digital “gate” on their platform (e.g., a private Discord channel). The rule is: “You must hold 1 ‘Gold Tier’ NFT to enter.”

- The Key: The fan purchases the NFT from the creator. This NFT resides in their digital wallet.

- The Handshake: When the fan tries to join the Discord channel, a bot (like Collab.Land or Guild.xyz) asks them to sign a transaction verifying they own the wallet.

- The Verification: The bot scans the blockchain to confirm the wallet holds the required NFT.

- Access Granted: If confirmed, the user is instantly granted access. If they sell the NFT later, the bot detects the change and removes access.

Types of Tokens Used

- NFTs (ERC-721): Unique tokens. Ideally used for memberships that have specific tiers or unique attributes (e.g., “Founder’s Pass #42”).

- Social Tokens (ERC-20): Fungible tokens (like currency). Used for governance or volume-based access (e.g., “Hold 100 $CREATOR coins to vote on the next video topic”).

- Semi-Fungible Tokens (ERC-1155): A hybrid often used for ticketing or game items, where you might have 1,000 identical “General Admission” passes.

Practical Applications: What This Looks Like in Practice

Decentralized content ownership is not theoretical; it is actively reshaping verticals within the creator economy. Here is how different creators are leveraging these tools.

1. Writers and Journalists

Platforms like Mirror.xyz or Paragraph.xyz allow writers to publish content on the blockchain.

- Crowdfunding: A journalist can sell NFTs to fund a deep-dive investigative piece. The NFT holders might get their names in the credits or early access to the findings.

- Collectable Entries: Writers can mint their essays as NFTs. Superfans “collect” the essay to show patronage, similar to buying a first-edition book.

- Newsletter Gating: A writer can make their newsletter free to the public but offer a “Pro” analysis strictly to readers who hold a subscription NFT. Because the subscription is an NFT, the reader actually owns the subscription and could theoretically sell the remaining months to someone else if they no longer need it.

2. Musicians and Audio Artists

The music industry has been notoriously slow to pay artists fairly. Decentralized ownership disrupts this via “Music NFTs.”

- Royalty Sharing: Some artists sell NFTs that grant the holder a percentage of the streaming royalties for a song. This turns fans into investors and marketers—they want the song to succeed because they profit too.

- Unlockable Tracks: An artist releases an album where 10 tracks are public, but 3 “bonus” tracks are only playable on a website that checks for a specific token in the user’s wallet.

- Concert Perks: Kings of Leon famously released an NFT album that included “Golden Tickets” guaranteeing front-row seats to their concerts for life.

3. Visual Artists and Designers

This is the most mature sector of the NFT space, but it evolves beyond just selling JPEGs.

- Commercial Rights (CC0 vs. Copyright): Some creators (like those behind the Bored Ape Yacht Club) grant NFT holders full commercial rights to the image they own. The holder can put their specific Ape on a T-shirt or a coffee brand and keep the profit. This decentralizes the marketing of the brand itself.

- Process Access: Artists can token-gate a live stream of their studio practice, allowing only collectors to watch them paint or design in real-time.

4. Educators and Coaches

- Lifetime Access Passes: Instead of paying a monthly fee for a course platform, a student buys an NFT Access Pass. This pass grants lifetime access to the course material and the alumni community.

- Resalable Education: If the student finishes the course and no longer needs the access, they can resell the NFT on a secondary market. The original educator can program a royalty (e.g., 10%) into the smart contract, earning revenue every time the course “seat” changes hands.

The Benefits of the Decentralized Model

Why go through the technical friction of setting this up? The benefits for both sides of the equation are substantial.

For the Creator

- High-Fidelity Signal: People who buy a token are financially and emotionally committed. This filters out trolls and passive scrollers, creating a high-quality community.

- Immediate Cash Flow: Revenue settlement on the blockchain is near-instant. There is no “Net 60” payment term or waiting for a payout threshold.

- Data Sovereignty: You are not renting the user list from Patreon or Substack. You can view the blockchain address of every holder. You can airdrop (send) them content directly without any algorithm blocking you.

- Interoperability: If you start your community on Discord but decide to move to Telegram or a custom app, the “login system” (the token) moves with you. You don’t lose your subscribers just because you switched platforms.

For the Community Member (Fan)

- Asset Ownership: The money spent on a subscription is usually gone forever. Money spent on an NFT membership buys an asset that might retain value or be resalable.

- Aligned Incentives: If the community grows and becomes more desirable, the “access pass” (NFT) may increase in value. Early supporters are rewarded for their early belief, unlike early subscribers to Netflix who pay the same (or more) as new users.

- Portability of Status: A fan can carry their reputation across the web. Owning a specific high-value token acts as a digital flex or a badge of honor that is visible on any platform that integrates with the blockchain.

Challenges, Risks, and Common Pitfalls

While the promise is grand, the reality of decentralized content ownership involves significant friction and risk. It is crucial to approach this with eyes wide open.

1. User Experience (UX) Friction

For the average internet user, setting up a wallet (like MetaMask), writing down a 12-word seed phrase, and purchasing cryptocurrency to pay for “gas” (transaction fees) is a massive barrier to entry.

- Mitigation: Newer platforms are integrating “custodial wallets” (where an email login creates a wallet in the background) and credit card checkout flows to smooth this transition.

2. Market Volatility

If your community access is tied to a token that has a monetary price, your community vibe acts like a stock market. If the token price crashes (due to broader crypto market trends), community sentiment often turns toxic. “Wen moon?” (When will the price go up?) becomes the dominant conversation, drowning out the actual content.

- Mitigation: Decouple the community value from financial speculation. Focus on utility and connection rather than price appreciation.

3. Scams and Security

The decentralized nature means there is no “Forgot Password” button. If a creator’s wallet is hacked, they might lose control of their project’s smart contract. If a fan connects their wallet to a malicious link, they can lose their assets.

- Mitigation: Heavy investment in security education and the use of hardware wallets (cold storage) is mandatory for serious participants.

4. Regulatory Uncertainty

Governments are still deciding how to classify tokens. Are they securities? Commodities? Utility items? The regulatory landscape, especially regarding “social tokens” that act like currency, is shifting rapidly.

- Mitigation: Focus on utility NFTs (access passes) rather than investment schemes. Consult legal counsel regarding securities laws in your jurisdiction.

Strategy: Building a Decentralized Content Strategy

If you are a creator looking to pivot to this model, do not start by minting 10,000 tokens. Start with the value proposition. Here is a strategic framework.

Phase 1: The “100 True Fans” Pilot

Do not aim for mass adoption immediately. Identify your top 100 super-fans.

- The Offer: Create a simple “Genesis Pass” NFT. Keep the supply low.

- The Utility: Offer something high-touch, like a monthly Zoom call, voting rights on your next video, or access to a private chat.

- The Tech: Use simple, no-code tools like Manifold (for minting) and Guild.xyz (for gating) to test the waters without hiring developers.

Phase 2: Content-First, Token-Second

Ensure the content justifies the friction.

- Produce high-quality content that is publicly available (Web2 funnel).

- Use the public content to funnel users toward the token-gated experience.

- Crucial Rule: Never gate 100% of your content. You need public content for discovery. The token should offer depth, not just access.

Phase 3: Community Treasury

As revenue comes in from token sales, consider putting a percentage into a “Community Treasury”—a wallet managed by the community.

- Allow token holders to vote on how these funds are used. Should the community hire an editor? Host a real-world meetup? Commission new art?

- This cements the feeling of shared ownership and participatory storytelling.

Tools of the Trade: A Tech Stack for Decentralized Creators

You do not need to be a coder to build decentralized content. A robust ecosystem of no-code tools has emerged.

| Category | Tool Examples | Purpose |

| Publishing | Mirror, Paragraph | Writing and publishing on-chain; newsletter gating. |

| Gating | Guild.xyz, Collab.Land | Connecting wallets to Discord/Telegram/Websites to verify assets. |

| Minting | Manifold, Zora | Creating the actual NFT contracts without writing code. |

| Community | Discord, Telegram | The social layer where the conversation happens. |

| Treasury | Gnosis Safe | Multi-signature wallets for managing shared community funds safely. |

| Events | POAP (Proof of Attendance) | Digital badges given to people who attend specific events or streams. |

Case Study: The “Podcast Plus” Model

Imagine a podcaster.

- Public Layer: The podcast is free on Spotify/Apple (Web2).

- NFT Layer: They sell a “Producer’s Pass” NFT.

- Utility: Holders get access to a private RSS feed with ad-free episodes, extended cuts, and a monthly AMA where they help select guests.

- Outcome: The podcaster monetizes directly without ads, and the fans feel like they are part of the production team.

The Future: Interoperability and the Metaverse

As we look forward, decentralized content ownership paves the way for a true Metaverse—not necessarily a VR world, but an interoperable digital reality.

Currently, if you buy a skin in Fortnite, you cannot wear it in Call of Duty. In a decentralized future, digital assets (3D models, avatars, music tracks) are owned by the user, not the game developer. A “sword” NFT earned in one game could theoretically unlock a “statue” in a virtual home or a “badge” in a community forum.

This creates a “composable” internet where content and items flow freely between applications, bound together by the user’s ownership. For creators, this means their work has a longer shelf life and broader utility than ever before.

Conclusion

Decentralized content ownership via NFTs and token-gated communities represents a maturation of the internet. It corrects the power imbalance of the Web2 era, moving from an economy of attention extraction to an economy of ownership and alignment.

While the technology is still smoothing out its rough edges, the trajectory is clear. The future belongs to creators who build their own castles rather than renting land from tech giants. By leveraging these tools, you can build a community that is smaller but stronger, more profitable, and deeply invested in your shared success.

Next Steps

If you are ready to explore this, start small. Set up a digital wallet (like MetaMask), buy a small amount of currency for transaction fees, and try purchasing a creator’s access token to experience the “unlock” process yourself. Understanding the user journey is the first step to building your own.

Frequently Asked Questions (FAQs)

1. Do I need to understand coding to start a token-gated community? No. There are many “no-code” platforms available today. Tools like Manifold allow you to create (mint) NFTs via a visual interface, and tools like Guild.xyz or Collab.Land allow you to set up the “gates” for your Discord or website just by clicking through settings.

2. What is the difference between an NFT and a subscription like Patreon? A Patreon subscription is a payment for temporary access; once you stop paying, you lose access and walk away with nothing. An NFT is a digital asset you own. It grants access as long as you hold it, but you can also sell it, gift it, or transfer it. It is an asset, not just a receipt.

3. Are NFTs bad for the environment? This was a major concern with early “Proof of Work” blockchains. However, Ethereum (the largest blockchain for NFTs) switched to “Proof of Stake” in 2022, reducing its energy consumption by over 99.9%. Other chains like Solana and Polygon are also highly energy-efficient, comparable to standard cloud computing.

4. Can I enforce copyright with NFTs? An NFT proves ownership of a specific digital token, but it does automatically transfer legal copyright unless specified. You must clearly state the rights in your project’s terms. Some creators retain copyright, while others grant “CC0” (public domain) or commercial rights to the token holder.

5. What happens if the platform I use shuts down? This is the beauty of decentralization. Your tokens live on the blockchain, not on a specific company’s servers. If the platform you use to display your content (e.g., a specific marketplace) goes bankrupt, you can simply plug your community into a different platform that reads the same blockchain data.

6. How much does it cost to launch a token-gated community? It can be very cheap. Minting tokens on “Layer 2” networks like Polygon or Base costs pennies. The main costs are your time, potential art production design, and any premium tiers of software tools you might use for community management.

7. Why would a fan want to resell their membership? Fans’ lives change. A fan might love your content for two years and then move on to different interests. In Web2, they just cancel. In Web3, they can resell their membership to a new fan who wants in. The exiting fan gets some money back, and you (the creator) can earn a royalty on that resale.

8. What prevents someone from screenshotting my NFT content? “Right-click save” copies the image, but it does not copy the private key required to verify ownership. A screenshot cannot log you into a token-gated website or Discord channel. The value lies in the access and utility the token provides, not just the image itself.

9. Is this only for “crypto people”? Ideally, no. The goal of current technology is to make the crypto part invisible. “Onboarding” is getting easier with email-based wallets and credit card payments. You can market the benefits (exclusive access, community) without focusing heavily on the underlying tech (blockchain, tokens).

10. How do I price my NFTs? Pricing is an art. It depends on the utility you offer and the size of your audience. It is generally better to start with a lower price (or even a free mint) to build a loyal community first, rather than trying to extract maximum revenue immediately, which often leads to project failure.

References

- Ethereum Foundation. (n.d.). What are NFTs? Ethereum.org. https://ethereum.org/en/nft/

- Chayka, K. (2021). What the First “Creator Economy” Boom Can Teach Us About the NFT Craze. The New Yorker. https://www.newyorker.com

- Li, J. (2020). The Ownership Economy: Crypto & The Next Frontier of Consumer Software. Variant Fund. https://variant.fund

- Andreessen Horowitz (a16z). (2021). NFTs and a Thousand True Fans. Future.com. https://future.com

- Guild.xyz. (2023). Documentation: How Token-Gating Works. Guild.xyz Official Docs.

- Mirror.xyz. (2022). Building a Web3 Publishing Platform. Mirror Development Blog.

- Buterin, V. (2022). Soulbound: On or off Chain? Vitalik.ca. https://vitalik.ca

- Manifold. (2023). Creator Contracts and Sovereignty. Manifold Docs. https://docs.manifold.xyz

- Creative Commons. (n.d.). CC0 “No Rights Reserved”. CreativeCommons.org. https://creativecommons.org/share-your-work/public-domain/cc0/

- Polygon Technology. (2022). The Environmental Impact of the Merge. Polygon Blog. https://polygon.technology/blog