Non-fungible tokens (NFTs) are unique digital tokens recorded on a blockchain that represent specific items—artworks, game assets, memberships, even rights to use something. Unlike fungible coins where each unit is interchangeable, every NFT carries an identity that distinguishes it from all others. That uniqueness is what “non-fungible” means, and it’s the reason NFTs can track ownership, transfer, and provenance for one-of-one or limited-edition assets across open networks.

Quick disclaimer: This guide is educational, not financial or legal advice. When money, taxes, or rights are involved, consult qualified professionals.

In one sentence: An NFT is a unique token on a blockchain that points to data (often via a metadata link) and proves who owns that specific token at any moment.

Fast-start steps (skim-friendly):

- Pick your network and wallet; back up your recovery phrase securely.

- Decide your token standard (often ERC-721 or ERC-1155) and define your collection’s supply.

- Prepare metadata (JSON) and assets; use content-addressed storage like IPFS or Arweave.

- Choose minting model (allowlist, open edition, lazy minting) and test on a testnet.

- Decide royalty signaling (e.g., EIP-2981) and publish clear license/usage rights.

- Launch, monitor security, and track on-chain metrics (unique holders, distribution, listings).

You’ll walk away knowing the essential architecture, trade-offs, and guardrails that keep NFTs useful, durable, and safer to operate.

1. Non-Fungibility Explained: Why Uniqueness Matters

Non-fungibility means your token isn’t interchangeable one-for-one with another of its kind; it has distinct identity and properties. That matters because ownership of a specific item—#1 in a series, seat A12, a character with particular traits—depends on being able to tell tokens apart. NFTs encode that uniqueness at the smart-contract level, assigning each token a unique identifier and maintaining a verifiable record of transfers. This differs from fungible tokens, where you don’t care which unit you hold so long as the quantity is the same. Practically, non-fungibility unlocks provenance (who owned what, when), scarcity (fixed supply or edition sizes), and item-specific rules (e.g., rentals, time-limited access). For creators, that means you can map digital or phygital items to a ledger; for collectors, you can verify authenticity and trade on open marketplaces without platform lock-in.

Why it matters

- Provenance: The chain stores a tamper-evident ownership trail for each token.

- Scarcity design: You can set a total supply or rarity structure across a collection.

- Item-level logic: Rules can apply per token (e.g., rentals, access keys).

- Composability: Other apps can read token IDs to grant perks or utilities.

- Interoperability: Standards let wallets and marketplaces render NFTs consistently.

Numbers & guardrails

- Edition math: If you plan 10,000 tokens, define rarity buckets up front (e.g., 5 traits with 5–8 options each yields millions of theoretical combos—far more than your supply).

- Supply signaling: Publish a fixed maximum supply on-chain or via immutable metadata to avoid trust issues later.

Synthesis: Non-fungibility is the foundation that makes individual digital items ownable, trackable, and programmable across open ecosystems.

2. How NFTs Work Under the Hood (IDs, Contracts, and Metadata)

At the core, an NFT is defined by a smart contract that tracks owners of unique token IDs. Each ID corresponds to a piece of metadata—typically a JSON file—that describes the item (name, description, traits) and links to its media (image, animation). Wallets and marketplaces call the contract’s functions to fetch the metadata URI and render the NFT. Transfers update the on-chain owner field, creating a verifiable history; burns remove tokens from circulation. Most collections implement widely used interfaces so wallets know how to query them. The metadata often lives off-chain (for cost and flexibility) but is referenced by a content-addressed link for integrity.

How to do it

- Choose a standard: Pick a contract interface your ecosystem supports (e.g., single-asset ERC-721 or multi-asset ERC-1155).

- Design metadata: Use a predictable JSON schema with fields like name, description, image, animation_url, attributes.

- Link storage: Prefer ipfs:// CIDs or ar:// transaction IDs to avoid brittle https:// links.

- Implement safety: Limit who can change URIs; consider an irreversible “freeze metadata” function once final.

- Test end-to-end: Verify rendering in multiple wallets/marketplaces before mainnet launch.

Mini case

- You mint 10,000 ERC-721 tokens. Token IDs run 0–9,999. Each token’s metadata URI points to ipfs://<CID>/<id>.json. If token #345 transfers to a new wallet, the chain’s owner mapping updates; the marketplace UI reflects the change immediately without any centralized registry.

Synthesis: Contracts assign identities, metadata gives meaning, and content-addressed links keep what you see tied to what the token claims.

3. Picking a Token Standard (ERC-721, ERC-1155, Royalties, Rentals)

Your choice of standard shapes cost, flexibility, and UX. ERC-721 is the classic one-token-per-ID model; ERC-1155 can house multiple token types—fungible and non-fungible—inside one contract, which can lower costs for large collections and enable semi-fungible items (e.g., limited runs). You can also add opt-in interfaces such as EIP-2981 for royalty signaling or ERC-4907 for time-bound user roles (rentals). Choose based on supply shape, media type, and anticipated utility rather than trends alone.

Quick comparison (one-glance)

| Standard | Good for | Notable trait |

|---|---|---|

| ERC-721 | 1/1s and fixed-edition collectibles | Simple model; each ID is unique |

| ERC-1155 | Mixed items, large drops, game assets | Multiple token types in one contract |

| EIP-2981 | Creator earnings signaling | Conveys royalty info to marketplaces |

| ERC-4907 | Rentals/time-limited use | Adds user role with expiry |

Numbers & guardrails

- Batching: If you ship 50 item types with 100 editions each, ERC-1155 can batch mints and transfers, often lowering overall on-chain operations versus deploying many ERC-721 contracts.

- Royalties: A common royalty range is 2%–10%; keep rates sustainable for secondary markets.

- Rentals: Set usage windows (e.g., 7 days) directly in the contract with automatic expiry to avoid manual revocations.

Synthesis: Pick standards to match how your assets behave—one-offs, editions, rentals, or mixed inventories—so you control costs and UX from day one.

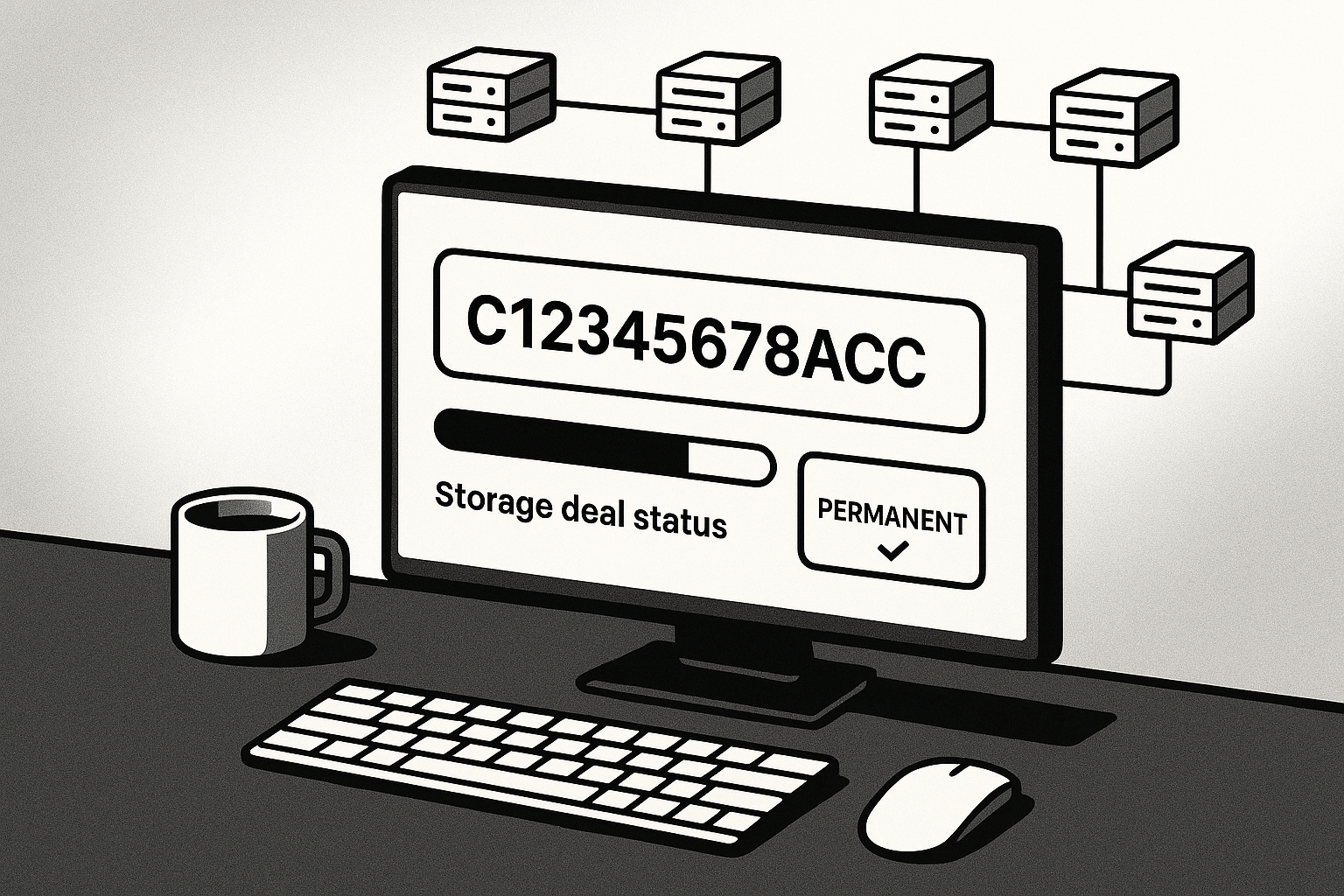

4. Metadata, Media, and Storage (IPFS, Arweave, and Rendering)

Metadata tells wallets what your NFT is and where to load its media. The robust approach is content-addressed storage: IPFS uses CIDs derived from the file’s hash; Arweave uses transaction IDs anchored on its network. Both help ensure that if the file changes, the reference changes, preventing silent swaps. In practice, you’ll publish JSON metadata with fields like image (for previews) and optionally animation_url (for video/3D). Avoid relying on a single centralized https:// server for critical media; if it goes offline, your NFT may still exist but won’t render correctly.

Tools/Examples

- Fields that matter: name, description, image, animation_url, attributes (trait array), external_url (project site).

- Practical tips: Use square images; marketplaces commonly recommend large source resolution (for example, ≈3,000 × 3,000 px for crisp previews).

- Content integrity: Pin IPFS content through multiple providers or use Arweave for durable storage; document whether metadata is mutable.

Mini case

- Your collection stores image at ipfs://bafy…/1234.png and a 3D preview at animation_url: ipfs://bafy…/1234.glb. If you later compress the GLB and re-upload, the CID changes. Because wallets cache by CID, holders can confirm whether the asset they see still matches the original reference.

Synthesis: Solid metadata and content-addressed storage keep your NFTs viewable, verifiable, and resilient to link rot.

5. Wallets, Keys, and Custody (Staying Safe Without Becoming a Sysadmin)

Your wallet controls your NFTs through private keys. Lose the key (or its recovery phrase), and you lose the tokens. Expose it, and an attacker can drain assets instantly. The safest default is to treat keys like crown jewels: use a reputable wallet, separate day-to-day spending from vault storage, and enable hardware signing for high-value items. For teams, implement roles—one address to mint, another to administer metadata, another to receive proceeds. Multisig (multiple approvals required) can protect treasury moves, while permission-scoped operator roles limit damage if a key is compromised.

Common mistakes

- Storing the recovery phrase in cloud notes, email, or screenshots.

- Signing approvals you don’t understand on unfamiliar sites.

- Using one hot wallet for everything, including admin actions.

- Skipping revocations after testing on third-party sites.

Mini-checklist

- Backups: Keep 2–3 physically separate, offline copies of your recovery phrase.

- Segregation: Use a dedicated admin wallet and a separate minting/deployer wallet.

- Revocations: Regularly review and revoke token approvals you no longer need.

- Hardware: For core assets, require hardware confirmation.

Synthesis: Good key hygiene and role separation prevent most irreversible losses long before an auditor ever touches your code.

6. Minting Models and Drop Mechanics (Cost, UX, and Fairness)

Minting turns your concept into tokens. You’ll choose a model that balances demand, fairness, and cost. Allowlists pre-approve wallets; public mints open to everyone; open editions mint as many as buyers demand within a window; lazy minting defers on-chain creation until purchase; burn-to-mint trades one token for another. Testnet rehearsals catch rendering and supply bugs. Communicate the exact supply, pricing, and timeline, and publish the contract address where buyers can verify they’re minting the real thing.

How to do it

- Dry run: Test metadata reveal and mint functions on a test network.

- Gas UX: Batch mints for multiple tokens per transaction when possible; time windows reduce gas spikes.

- Fairness: Randomize token assignment (e.g., shuffle post-reveal) to prevent sniping rares.

- Support: Provide a clear, signed message template and walkthrough to prevent phishing.

Mini case

- You price a mint at 0.035 ETH with a cap of 3 per wallet and total supply 5,000. With batching, a buyer mints all three in one transaction, reducing overhead fees. After the reveal block, your script shuffles token URIs to randomize rarity distribution.

Synthesis: Thoughtful drop mechanics turn mint day from chaos into a controlled, verifiable process that respects buyers and your budget.

7. Royalties, Earnings, and Marketplace Realities

Creator earnings on secondary sales are signaled, not guaranteed. The common interface for signaling is EIP-2981, which returns a royalty recipient and rate so marketplaces know what you’re asking. Some venues choose to honor this; others may not. Treat royalties as part of your business model, not an entitlement—supplement with primary sales, memberships, or in-contract utilities. If you do set royalties, keep them reasonable and publish the policy; consider different rates for commercial vs. community marketplaces if your tooling supports it.

Numbers & guardrails

- Rate planning: A typical band is 2%–10%. Higher rates can push trading to venues with lower or no royalties.

- Forecast example: If a collection’s lifetime resale volume reaches 2,000 ETH and the royalty rate is 4%, signaled earnings are 80 ETH—subject to marketplace enforcement.

- Clarity: Post royalty details in docs and embed the standard interface so marketplaces can read it automatically.

Tools/Examples

- Embed EIP-2981 to broadcast your policy.

- Use dashboards that track realized vs. signaled royalties by venue.

- Pair with membership utilities (token-gated perks) that don’t rely on secondary revenue.

Synthesis: Signal royalties with the standard, but build a model that stands even when secondary earnings fluctuate.

8. Real Utility: From Art and Tickets to Game Items and Identity

NFTs are not just pictures; they can gate communities, grant software licenses, represent seats at events, or serve as in-game items. In games, NFTs can be skins, weapons, or characters with stats; in memberships, they can confer voting weight or benefits; for tickets, they encode seat numbers and entrance windows. Advanced patterns like token-bound accounts let NFTs hold other tokens or interact autonomously with apps. The most successful projects anchor the NFT to a clear utility with a repeatable reason to hold beyond pure speculation.

How to do it

- Define value: Answer “What can holders do that non-holders cannot?”

- Map flows: Sketch how wallets read token IDs to unlock features (APIs, signatures, or contract calls).

- Plan upgrades: If utilities evolve, choose a metadata strategy (mutable with signatures or plugin-style contracts) that preserves trust.

- Accessibility: Ensure utility works on mobile and common wallets.

Mini case

- A creator launches a membership pass with 1,500 tokens. Each token gates a private forum and quarterly live workshops. On renewal cycles, holders sign a message; the backend checks the token’s ownership and unlocks booking credits without exposing private keys. A subset of passes also unlocks a token-bound account that can hold loyalty points for on-chain rewards.

Synthesis: Tie tokens to tangible, repeatable actions and you’ll build gravity that persists beyond hype cycles.

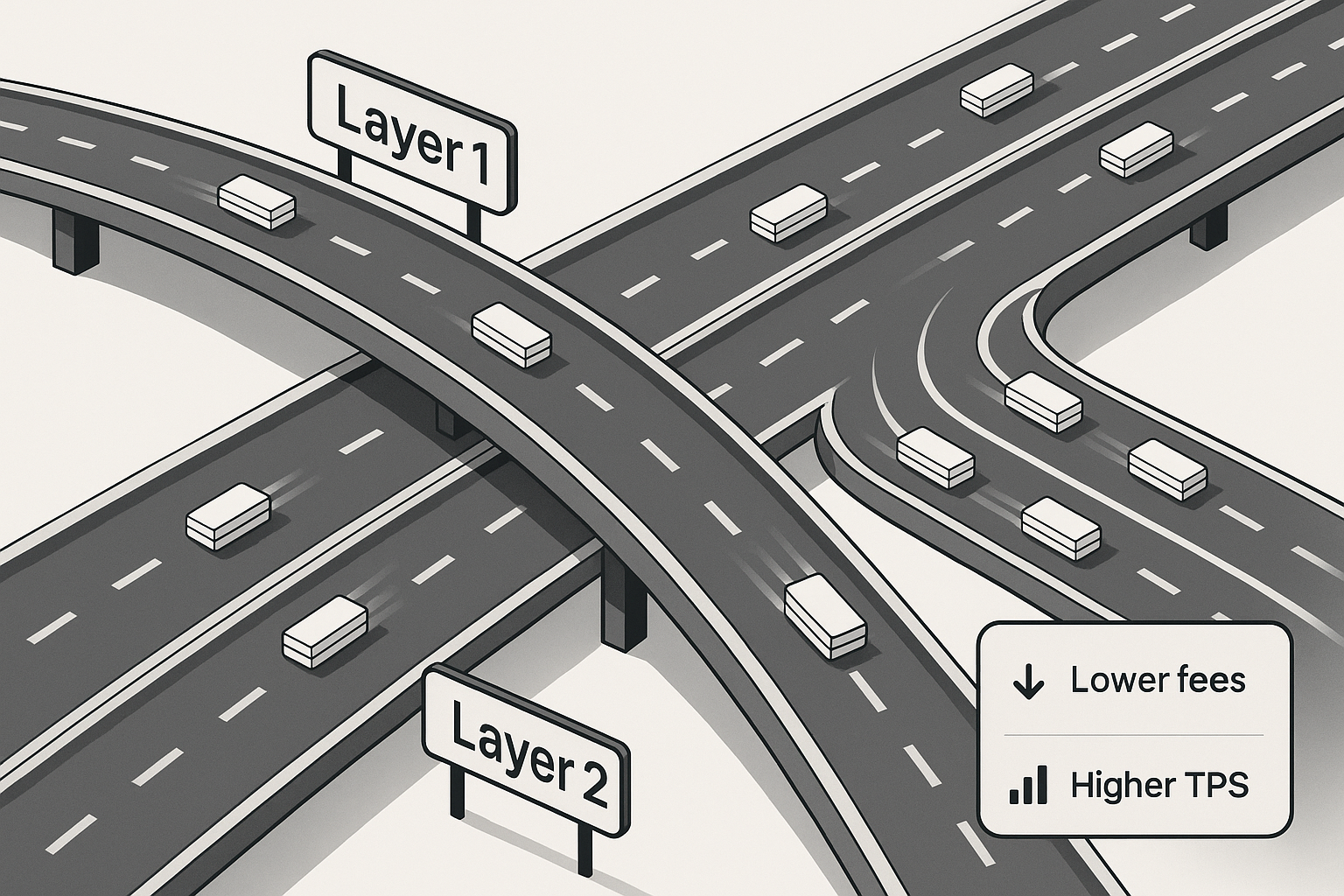

9. Interoperability and Cross-Chain Choices (Ethereum, Solana, Flow)

Different ecosystems offer different trade-offs. Ethereum has deep liquidity and mature standards; Solana emphasizes throughput and low fees with Metaplex standards; Flow focuses on consumer-grade experiences with resource-oriented smart contracts. If you plan cross-chain presence, decide whether you’ll bridge (lock on one chain, mint a representation on another) or multi-mint separate canonical collections. Each path introduces complexity for metadata sync, royalties, and holder communications.

Numbers & guardrails

- Bridging: Expect two ledgers to reconcile: the origin token and the representation. Document which one is canonical and how to redeem back to origin.

- Multi-mint: If you ship 1,000 on Chain A and 1,000 on Chain B, publish supply per chain and avoid confusing total counts.

Mini-checklist

- Standardize trait names and media across chains.

- Publish official contract addresses for each chain in one page.

- Clarify utility parity: is a Solana token equal to an Ethereum token in perks?

Synthesis: Choose your home chain for depth, and treat cross-chain as an extension only when it improves holder UX.

10. Rights, Licenses, and What Ownership Really Means

Owning an NFT usually means you control the token—not automatically the copyright to the art or asset. Unless a license explicitly grants commercial rights, you typically receive display/use rights only. Some projects use permissive licenses (e.g., Creative Commons or bespoke terms); others restrict commercial exploitation. Clarity prevents disputes: publish plain-language summaries and link the full license from your collection page. If you’re representing physical goods or services, spell out delivery, redemption, and what happens if an item is lost or damaged.

Common mistakes

- Assuming token ownership equals copyright ownership.

- No written license; promises are made only in social posts.

- Embedding license text only in off-chain docs that can disappear.

Mini-checklist

- Put a concise rights summary in metadata (external_url) and documentation.

- For brand collaborations, specify logo placement and duration of rights.

- For tickets or subscriptions, include transfer rules and refund policies.

- If using CC licenses, state whether derivatives are allowed.

Synthesis: Legal clarity protects you and your community; a token alone doesn’t transfer IP—your license does.

11. Security, Audits, and Operational Resilience

Smart contracts are powerful but unforgiving. A bug can lock or lose assets permanently. Follow conservative patterns, reuse audited libraries, and adopt secure defaults (e.g., pull over push payments, role-based access control, pause switches). Pre-deployment reviews should include unit tests, differential fuzzing, and third-party audits. Post-launch, monitor anomaly signals (sudden approval spikes, unexpected operator events) and maintain an incident plan: pause, communicate, patch, unpause. Educate your community to avoid phishing, malicious signature prompts, and fake mint sites.

Numbers & guardrails

- Testing discipline: Aim for >90% unit test coverage of contract logic and fuzz tests for edge cases.

- Separation: Keep deployer keys offline; require 2–3 signers for treasury moves via multisig.

- Bounties: Offer a structured bug bounty with clear scope and rewards for reproducible vulnerabilities.

Tools/Examples

- Use established libraries for token standards and access control.

- Follow a smart-contract security checklist (invariants, reentrancy, overflow, authorization).

- Run an approval-scanner link for holders so they can revoke risky allowances.

Synthesis: Treat security as a lifecycle, not a launch task—strong design plus ongoing monitoring keeps collections safe and trusted.

12. Measuring Success and Managing the Lifecycle

Beyond “floor price,” healthier signals tell you whether your project is working. Track unique holders, holder concentration (top-10 ownership share), listing rate, secondary volume vs. primary revenue, and engagement (utility usage, event attendance, token-gated activity). Plan lifecycle events—metadata finalization, trait reveals, upgrades, or burns—so they’re predictable, announced, and reversible where appropriate. Publish change logs and avoid surprise contract migrations unless absolutely necessary.

Numbers & guardrails

- Distribution target: Aim for >60% of supply held by unique wallets to avoid concentration risk (context matters by project).

- Liquidity signal: A listing rate under 10% often indicates holders are content; sudden spikes warrant communication.

- Engagement: Tie utilities to simple, repeatable actions that you can count monthly (e.g., redemptions, check-ins).

How to do it

- Build a small analytics dashboard that reads on-chain events.

- Document every change: contract versions, metadata freezes, royalty updates.

- Maintain a roadmap that explains why upcoming changes help holders.

Synthesis: Define success with measurable, behavior-based metrics and steward the collection through predictable, well-communicated changes.

Conclusion

NFTs turn unique digital (and phygital) items into programmable, transferable assets on public ledgers. The fundamentals you’ve learned—non-fungibility, standards, metadata and storage, key security, mint models, royalties, interoperability, rights, and lifecycle management—form a durable toolkit you can apply to art, games, memberships, tickets, and beyond. Start by picking a standard that fits your supply, commit to content-addressed storage, and communicate rights and royalties clearly. Then build safety into every step: role separation, audits, incident plans, and holder education. Measure what matters—distribution and engagement—not just price chatter.

If you’re ready to move from theory to practice, pick your standard, draft your metadata, and run a testnet mint today.

FAQs

1) What’s the difference between an NFT and a JPEG I can right-click?

An NFT is a token on a blockchain that points to media and metadata; it records ownership and transfer history. A JPEG is just a file. You can copy a file, but you can’t copy the token’s on-chain provenance or the rights that the license grants to the token’s owner. The token’s verifiable identity is what apps use to confer access or benefits.

2) Do NFTs store the actual image on-chain?

Usually not. Storing large media directly on a blockchain is expensive, so most NFTs store a link to content-addressed storage such as IPFS or Arweave. The file’s hash (or transaction ID) acts like a fingerprint; if the file changes, the link changes. That keeps rendering honest and prevents silent swaps.

3) Are royalties guaranteed on resales?

No. A common standard (EIP-2981) lets creators signal preferred royalty info, but marketplaces decide whether to honor it. Treat royalties as a helpful revenue stream, not the entire business model, and publish clearly how you expect royalties to work for your collection.

4) How do ERC-721 and ERC-1155 differ for creators?

ERC-721 creates one unique token per ID—great for 1/1s and fixed editions. ERC-1155 can handle many token types (fungible or non-fungible) in one contract, making batch mints and transfers cheaper and enabling semi-fungible items. Choose based on your supply shape and utility.

5) What is a token-bound account and why should I care?

A token-bound account (commonly discussed under ERC-6551) lets an NFT function like a smart-contract wallet that can hold other assets or interact with apps. That expands utility—think characters that carry inventory or membership passes that accrue points—without handing control to a separate user wallet.

6) How should I secure my NFTs?

Use a reputable wallet, keep recovery phrases offline with multiple physical backups, prefer hardware confirmation for valuable items, and separate admin roles from everyday use. Regularly revoke approvals you no longer need and avoid signing transactions from untrusted sites.

7) What’s the safest way to store metadata?

Use content-addressed storage. IPFS CIDs or Arweave transaction IDs ensure the reference changes if the content changes. Pin content through multiple providers, document whether metadata is mutable, and consider a “freeze” once art and traits are final.

8) Can I use my NFT commercially?

Only if the license says so. Some projects give broad commercial rights; others limit you to personal use. Read the license and, if needed, consult legal counsel. The token itself doesn’t automatically grant copyright.

9) Are open editions bad for long-term value?

Not inherently. Open editions trade scarcity for accessibility. If the goal is community participation or funding a utility, they work well. If you aim for collectible rarity, define caps or windows and explain how the edition fits into your broader collection economics.

10) What metrics should I watch after launch?

Prioritize unique holder count, holder concentration, listing rate, and utility engagement. These reveal the health of your community and whether your utility resonates, whereas price alone can swing for external reasons you don’t control.

References

- “Non-fungible tokens (NFT).” Ethereum.org. https://ethereum.org/nft/

- “ERC-721: Non-Fungible Token Standard.” Ethereum Improvement Proposals (EIPs). https://eips.ethereum.org/EIPS/eip-721

- “ERC-1155: Multi Token Standard.” Ethereum Improvement Proposals (EIPs). https://eips.ethereum.org/EIPS/eip-1155

- “ERC-2981: NFT Royalty Standard.” Ethereum Improvement Proposals (EIPs). https://eips.ethereum.org/EIPS/eip-2981

- “Content Identifiers (CIDs) — Content Addressing.” IPFS Docs. https://docs.ipfs.tech/concepts/content-addressing/

- “Best Practices for Storing NFT Data Using IPFS.” IPFS Docs. https://docs.ipfs.tech/how-to/best-practices-for-nft-data/

- “Metadata Standards.” OpenSea Docs. https://docs.opensea.io/docs/metadata-standards

- “Overview — Metaplex Core.” Metaplex Docs (Solana). https://developers.metaplex.com/core

- “Non-Fungible Token Contract.” Flow Developer Portal. https://developers.flow.com/build/cadence/core-contracts/non-fungible-token

- “OWASP Smart Contract Security Verification.” OWASP. https://owasp.org/www-project-smart-contract-security-verification-standard/

- “NIST IR 8472: Non-Fungible Token Security.” National Institute of Standards and Technology (NIST). https://nvlpubs.nist.gov/nistpubs/ir/2024/NIST.IR.8472.pdf