If you’re comparing NFT marketplaces across blockchains, you want clarity on where to mint, buy, and sell with the fewest surprises. In plain terms, an NFT marketplace is a platform that lets you list, discover, and trade unique tokens backed by smart contracts on a specific chain (or multiple chains). The right choice hinges on cost, creator tooling, royalty handling, wallets, and the culture of each chain. Below is a skimmable overview followed by twelve deep dives—one per ecosystem—so you can match your goals to the best venue. This guide is informational, not financial advice; always do your own research and consider consulting qualified professionals for tax and legal matters.

Quick answer: choose a chain that aligns with your audience and budget, then pick a marketplace native to that chain with liquidity in your niche (art, gaming assets, collectibles). For how-to steps, a typical flow is: 1) choose a chain and wallet, 2) fund with the native token, 3) pick a marketplace with the features you need, 4) verify the collection and royalty settings, 5) list or bid with clear price discipline, 6) track fees and taxes.

At-a-glance, one small table for orientation

| Chain | Core NFT Standard(s) | Popular Marketplaces (examples) | Common Wallets (examples) | Notes |

|---|---|---|---|---|

| Ethereum | ERC-721, ERC-1155, EIP-2981 | OpenSea, Blur, Rarible, SuperRare | MetaMask, Ledger | Deep liquidity; gas varies; broad creator tooling. |

| Solana | Metaplex Token Metadata | Magic Eden, Tensor, SolSea | Phantom, Solflare | Low fees; fast confirms; rich creator programs. |

| Polygon | ERC-721/1155 (EVM) | OpenSea (Polygon), Magic Eden | MetaMask, Phantom (EVM) | EVM chain with lower fees than mainnet. |

| Bitcoin | Ordinals (inscriptions) | Magic Eden, Gamma | Xverse, Hiro | No smart contracts; inscription-based trading. |

| Tezos | FA2 (TZIP-12) | objkt, fxhash | Temple, Kukai | Energy efficient; strong art culture. |

| Flow | NonFungibleToken (Cadence) | Gaia, Dapper-powered apps | Dapper, Lilico | App-driven experiences; creator-friendly SDKs. |

| Immutable | L2 for Ethereum (zk) | Immutable Marketplace, partners | MetaMask, Immutable Passport | Gas-free trading model on L2 rails. |

| Avalanche | ERC-721/1155 (EVM) | Joepegs | Core, MetaMask | Fast finality; growing culture for collectibles. |

| BNB Chain | BEP-721/1155 | Binance NFT, Element | Binance Web3 Wallet, MetaMask | CEX on-ramps; broad audience. |

| Cardano | Native assets + metadata (CIP-25 family) | JPG Store | Nami, Eternl | UTXO model; vibrant art/collectibles. |

| NEAR | NEP-171 (+ royalty/events NEPs) | Mintbase-powered markets, Paras (ecosystem) | NEAR Wallet, Sender | Low fees; flexible marketplace building. |

| Algorand | ASA + ARC-3/ARC-19 metadata | Rand Gallery | Pera, Defly | Efficient finality; metadata standards evolving. |

1. Ethereum: deep liquidity, standards maturity, and creator tooling

Ethereum marketplaces are the industry bellwether for discovery, liquidity, and secondary sales. If your audience already trades on Ethereum or you want maximum interoperability with wallets, analytics, and tooling, it’s often the default. NFTs here typically follow ERC-721 or ERC-1155, with EIP-2981 signaling royalty info that marketplaces can use to calculate payouts. In practice, creator royalty enforcement is policy-driven per marketplace, but having standard royalty metadata improves cross-platform handling. Gas costs fluctuate, which affects minting and listing behavior—batching, lazy minting, and L2s can mitigate some of that. You’ll also find a full ecosystem of aggregators, launchpads, curation galleries, and pro-trading tools built first for Ethereum.

Why choose Ethereum

- Largest pool of collectors across art, PFPs, 1/1s, and high-value grails.

- Mature standards and libraries, broad hardware wallet support.

- Extensive analytics, provenance tools, and marketplace diversity.

- Rich creator infra (custom contracts, allowlists, mint sites).

- Deep liquidity around marquee collections.

How trading works (common path)

- Set up MetaMask or a hardware wallet; fund with ETH.

- Choose a marketplace (e.g., OpenSea, Blur, Rarible) based on features.

- Verify collection metadata and royalty fields (EIP-2981).

- List or bid; watch gas and adjust timing/price discipline.

Numbers & guardrails

- Standards: ERC-721, ERC-1155, and EIP-2981 for royalty signaling.

- Fees: Platform fees differ; OpenSea lists 1% seller fee and clarifies gas is paid to validators, not OpenSea.

- Mini case: Listing a 0.5 ETH piece with a 5% creator royalty and a 1% platform fee means ~0.07 ETH in non-seller proceeds before gas (0.025 ETH royalties + 0.005 ETH platform), with gas varying by network conditions.

Synthesis: Choose Ethereum if you need the broadest market reach and tooling. Plan around gas and be explicit about royalties to keep cross-market behavior predictable.

2. Solana: low fees, fast confirmations, and creator-centric features

Solana marketplaces shine for speed and cost: transactions are tiny and confirmations are quick, keeping experimentation affordable. Most collections integrate Metaplex Token Metadata, which defines how NFT data, token standard flags, and programmable primitives are stored and interpreted. The dominant marketplaces—Magic Eden and Tensor—iterate quickly on creator royalties, trait bidding, and pro-trading UX. Wallets like Phantom and Solflare offer smooth onboarding, fiat ramps, and mobile flows, making Solana friendly for newer collectors as well as pros. For large mints, compressed NFTs and advanced mint tools can materially reduce costs while preserving verifiable ownership and royalties in metadata.

Tools & examples

- Magic Eden (broad collections, multi-chain support) and Tensor (trader focus).

- Phantom or Solflare for wallets; Ledger for hardware custody.

- Metaplex programs for metadata, collection verification, programmable NFTs. developers.metaplex.com

Numbers & guardrails

- Platform fees: Magic Eden documents 2% transaction fees and 0% listing fees; royalties can be optional per buyer across chains. help.magiceden.io

- Mini case: A 20 SOL sale with a 2% platform fee and 6% royalties nets the seller ~18.8 SOL pre-gas (20 − 0.4 − 1.2).

Synthesis: Pick Solana when you want fast, inexpensive iteration and modern trading UX. Ensure royalty settings are embedded correctly so marketplaces can read them consistently.

3. Polygon: EVM familiarity with lower costs and brand collabs

Polygon gives you EVM contracts, Ethereum wallet compatibility, and significantly lower fees—useful for drops with many transactions or mainstream partnerships. You can reuse ERC-721/1155 contracts or deploy new ones tailored to Polygon, all while keeping onboarding simple for users who already have MetaMask. Many Ethereum-first marketplaces also support Polygon, so discoverability carries over. For creators, Polygon is friendly for gamified assets, loyalty collectibles, and brand-driven campaigns where throughput and cost matter more than mainnet cachet.

How to work it

- Point MetaMask to Polygon (RPC), bridge assets if needed.

- Use marketplaces that list Polygon natively; confirm royalty fields.

- Batch minting or lazy minting can help in large-supply drops.

Numbers & guardrails

- Standards: ERC-721/1155; marketplaces often read EIP-2981 on Polygon, too.

- Costs: Gas is typically a fraction of mainnet; platform fees vary by marketplace (use the same venue’s fee schedule you’d check on Ethereum).

- Mini case: For a 100-piece drop at 0.05 ETH-equivalent per token, Polygon’s lower gas can keep per-mint overhead to pennies, leaving price psychology intact for entry-level collectors.

Synthesis: Choose Polygon for EVM comfort plus cost efficiency—ideal for brands, games, and large-scale drops without mainnet gas anxiety.

4. Bitcoin Ordinals & Runes: inscription-based collecting without smart contracts

Bitcoin doesn’t run Ethereum-style smart contracts for NFTs. Instead, Ordinals inscribe content onto individual satoshis, creating unique, traceable artifacts. Marketplaces like Magic Eden and Gamma index and trade these inscriptions, offering listing, bidding, and collection views. Because the model differs from ERC-style tokens, wallet flows (e.g., UTXO management) and tooling (indexers, inscription services) feel distinct. Expect careful handling of addresses, change outputs, and fee estimation in sats, plus a culture that values on-chain permanence and minimalism.

How it works

- Use Ordinals-aware wallets (e.g., Xverse, Hiro) and be precise with addresses.

- Inscription tooling handles creation; marketplaces provide discovery and offers.

- Fees are in sats; mempool congestion affects settlement timing.

Numbers & guardrails

- Concepts: “Inscription numbers” reflect reveal order; quirks exist from historical bugs.

- Mini case: Selling an inscription for 0.02 BTC with a 2% platform fee yields ~0.0196 BTC pre-miner fees; miners’ fees swing based on blockspace demand.

Synthesis: Choose Bitcoin if you value permanence and provenance on the oldest chain; double-check UTXO-specific flows and fee math before you click “send.”

5. Tezos: artist-led culture, FA2 standard, and efficient costs

Tezos emphasizes energy efficiency and accessible fees, which nurtured a strong community of independent artists and generative art. NFTs typically conform to FA2 (TZIP-12), a flexible token interface that supports fungible and non-fungible tokens. The marketplace objkt anchors secondary trading across art, music, and collectibles, while fxhash specializes in generative art with on-chain randomness and creator-friendly tooling. Wallets like Temple and Kukai make onboarding approachable; contract deployment and storage costs are modest compared to many EVM chains.

Tools/Examples

- objkt for broad Tezos trading and auctions; fxhash for generative art mints/collections.

- Temple/Kukai wallets support common flows and ledger integrations.

Numbers & guardrails

- objkt fee structure: documentation illustrates a 5% marketplace fee scenario with multi-recipient royalties in XTZ.

- Mini case: On a 100 XTZ sale with two creators at 10% each and a 5% platform fee, the seller receives ~75 XTZ after royalties and fees (per objkt’s example math).

Synthesis: Pick Tezos for art-forward audiences and fair costs. If you’re doing generative drops, fxhash’s ecosystem and FA2 flexibility are tailor-made for that niche.

6. Flow: app-driven experiences and Cadence-based standards

Flow’s marketplace landscape grew from application-specific ecosystems (sports collectibles, gaming) built on the NonFungibleToken Cadence interface. Rather than a single monolithic marketplace, you’ll often interact with app-native storefronts (e.g., league or game sites) or general hubs like Gaia. The developer experience is strong, with structured standards, typed resources, and a clear event model—helpful if you’re building a bespoke storefront. Wallet flows (Dapper, Lilico) aim to simplify onboarding for mainstream users, which is why many “first NFT” experiences launched here.

Why it matters

- Strong SDKs and tutorials with opinionated security patterns.

- App-specific marketplaces align utility and trading UX.

- Clear standard contracts and event semantics.

Numbers & guardrails

- Standards: NonFungibleToken contract interfaces; ongoing improvements track Cadence updates.

- Mini case: A sports collectible listed at 50 FLOW with a 2.5% platform fee and 5% royalty would net ~46.25 FLOW to the seller pre-gas.

Synthesis: Choose Flow if your project is an app with embedded trading, or your users value guided onboarding over chain-agnostic wallets.

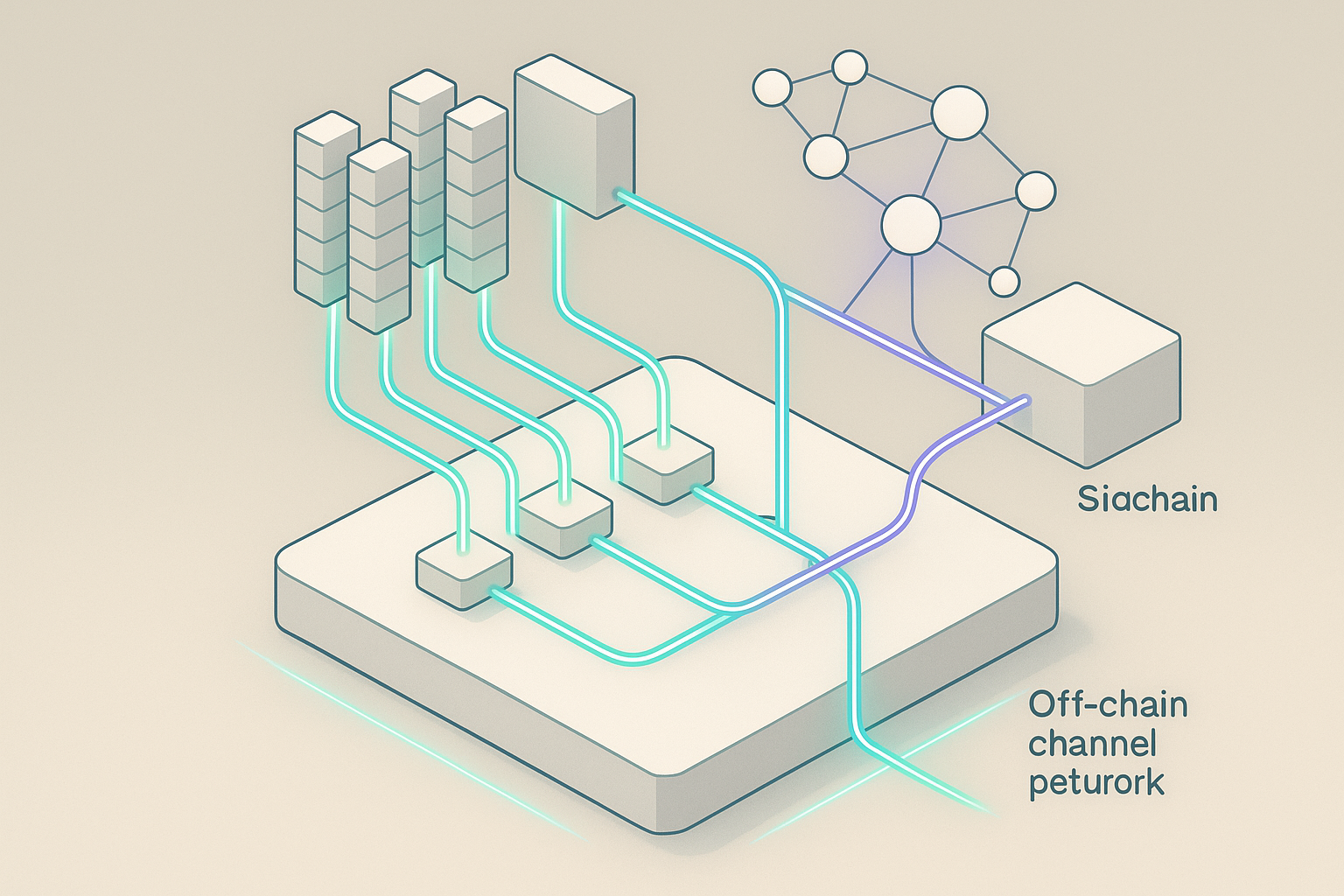

7. Immutable: gas-free trading model on Ethereum L2 rails

Immutable runs on Ethereum security with zero-gas trading for end users on its L2 stack. That design makes it compelling for gaming assets, where frequent transfers and micro-transactions would otherwise be cost-prohibitive. Creators can list on Immutable’s marketplace or partner venues; the platform publishes maker–taker fee guidance and marketplace criteria for production-grade UX. If you’re building a game, the SDKs, orderbooks, and fiat ramps collapse much of the commerce plumbing you’d otherwise assemble.

How to operate

- Connect an EVM wallet (e.g., MetaMask) or Immutable Passport.

- Use partner or native marketplaces; rely on shared orderbooks.

- Enjoy gas-free trading; factor in marketplace fees per venue docs.

Numbers & guardrails

- Gas-free trading on the L2; fee policies published in docs and blog.

- Mini case: A 20 USDC sword sale with a 1.5% marketplace fee and 5% royalties yields 18.7 USDC to the seller, with no user-paid gas on the trade.

Synthesis: Choose Immutable for high-volume, low-value item economies where frictionless transfers beat raw chain expressiveness.

8. Avalanche: fast finality and culture around collectibles

Avalanche’s C-Chain is EVM-compatible, so you’ll use ERC-721/1155 contracts and MetaMask-style wallets. Joepegs is the flagship marketplace, with straightforward listing and discovery and a growing roster of art and collectibles. Avalanche’s finality and throughput are strong, and subnets offer optional customizability for games that later want their own execution lane. The collector culture is tight-knit, and liquidity continues to consolidate around Joepegs, with occasional cross-chain listings via aggregators. joepegs.com

What to expect

- EVM tooling familiarity; deploy or bridge contracts.

- Core Wallet and MetaMask support common flows.

- Collections often integrate launchpad-style minting and allowlists.

Numbers & guardrails

- Fees: Marketplace fee schedules vary; community sources cite low single-digit rates, but check the current Joepegs UI before assuming a number.

- Mini case: Listing at 50 AVAX with a 2% fee and 5% royalties would net ~46.5 AVAX to the seller, excluding gas.

Synthesis: Choose Avalanche if you want EVM comfort plus fast finality, and your buyers already congregate on Joepegs.

9. BNB Chain: CEX-grade onboarding and broad reach

BNB Chain’s native marketplaces include Binance NFT, which leverages exchange accounts, fiat ramps, and KYC. That helps creators reach audiences who might not use self-custody wallets yet. Under the hood, NFTs commonly use BEP-721/1155 interfaces similar to ERC standards. Binance documents platform fees and minting costs by chain; beyond the centralized marketplace, third-party venues exist for self-custody purists. If you’re optimizing for reach and easy on-ramps, BNB Chain is a pragmatic choice—just align with your audience’s custody preferences. Binance

Practical flow

- Decide whether you want centralized exchange onboarding or self-custody.

- For Binance NFT, follow KYC and account funding steps; for decentralized venues, use MetaMask or Binance Web3 Wallet.

- Confirm royalty settings and fee schedules per venue.

Numbers & guardrails

- Fees: Binance materials discuss 1% trading fees on secondary sales; minting fees are listed per supported chain. Always verify current schedules in the help center. CryptoPotato

- Mini case: A 200 USDT sale with a 1% platform fee and 7% royalty nets ~184 USDT to the seller, not including network costs.

Synthesis: Choose BNB Chain if you want the broadest fiat-onboarded audience and can work within exchange policies for listings and payouts.

10. Cardano: native assets, UTXO model, and a strong art hub

Cardano treats NFTs as native assets with metadata rather than separate smart-contract balances, which, together with the UTXO model, affects how marketplaces build custody and listing logic. JPG Store leads secondary trading, offering creator tooling, launchpads, and simple wallet flows. Wallets like Nami and Eternl support signing and listing; royalties are handled in marketplace logic with metadata signals. For 1/1 art, photo, and curated projects, Cardano’s community is active and supportive, with pricing in ADA and stable low network fees that make listing and bid tweaking affordable.

How to use it

- Set up a Cardano wallet (Nami/Eternl), fund with ADA.

- Verify collection policy IDs; beware of look-alikes.

- Use JPG Store for discovery; read fee/royalty breakdowns.

Numbers & guardrails

- Fees: JPG Store documents a 2% service fee on secondary sales and outlines mint-related costs. help.jpg.store

- Mini case: On a 1,000 ADA sale with 2% platform fee and 7.5% royalty, the seller would net about 905 ADA before network costs.

Synthesis: Choose Cardano if you like native-asset simplicity and a supportive art market; verify policy IDs to ensure provenance.

11. NEAR: low fees and build-your-own market flexibility

NEAR’s NEP-171 standard defines core NFT interfaces, with complementary NEPs for royalties and events. Rather than a single dominant centralized marketplace, NEAR leans into Mintbase-powered storefronts and community venues, making it attractive if you want to build a marketplace, embed commerce in your app, or earn a small market fee by curating. Fees are low, account names are human-readable, and storage economics are predictable. If you need a lean, customizable setup, NEAR’s tooling and docs are straightforward for both Rust and JavaScript SDKs.

How it works

- Create a NEAR account; fund with NEAR for storage and gas.

- Deploy or reuse an NFT contract following NEP-171; wire royalty/payout logic per NEP guidance.

- Stand up a custom storefront or list on existing Mintbase-powered markets. docs.near.org

Numbers & guardrails

- Standards: NEP-171 (core), with event and royalty extensions documented in the spec.

- Mini case: A 200 NEAR sale with a 1.25% market fee (example: curated storefront) and 7% royalties nets the seller ~183.5 NEAR, with low gas/storage overheads.

Synthesis: Choose NEAR if you value low costs and want to own your marketplace experience rather than rent shelf space in a monolith.

12. Algorand: efficient finality, ASA-based NFTs, and evolving ARC metadata

On Algorand, NFTs are implemented as Algorand Standard Assets (ASA) with metadata standards like ARC-3 and ARC-19. That gives predictable performance and finality, which creators often pair with marketplaces like Rand Gallery. Wallets such as Pera and Defly support common flows; transaction fees remain low, and metadata improvements continue via community ARCs. If your collectors care about fast settlement and minimal overhead, Algorand provides a polished, developer-friendly path with clear docs and evolving best practices for traits and media storage.

How to operate

- Create an ASA using ARC-3/ARC-19 metadata; verify media links and integrity fields.

- List on Rand Gallery; verify collection pages and trait filters. Rand Gallery

- Use Pera for mobile signing; hardware wallets for high-value items.

Numbers & guardrails

- Standards: ASA with ARC-3 metadata and ARC-16 trait conventions; watch deprecations and recommended combos (e.g., ARC-3 + ARC-19).

- Mini case: A 1,000 ALGO sale with a 2% fee and 7% royalty nets ~910 ALGO to the seller before network fees.

Synthesis: Choose Algorand for efficient settlement and clear metadata standards; double-check trait conventions so filters work consistently across tools.

Conclusion

Cross-chain NFT trading isn’t about finding a single “best” marketplace; it’s about matching your objectives to the trade-offs each chain and venue makes. If you want deep liquidity and tooling, Ethereum leads—gas costs are the main tax to plan around. If you want speed and inexpensive iteration, Solana and Polygon deliver. For gaming economies, Immutable’s gas-free L2 can reduce friction dramatically. If you prefer artist-centric or generative scenes, Tezos and Cardano have thriving cultures; if you need low-overhead custom storefronts, NEAR and Algorand offer clean developer ergonomics. Bitcoin Ordinals provides a different aesthetic and technical model focused on permanence. The smartest path is to shortlist two or three ecosystems, test small, and learn where your actual audience engages. Then double down with consistent royalty settings, clear provenance, and disciplined pricing. Ready to choose? Pick one chain, open a wallet, and list a single piece this week to validate fit—then scale what works.

FAQs

1) Which NFT marketplace is “best” for artists starting from scratch?

There isn’t a universal best. If you want low fees and an art-centric audience, Tezos (objkt, fxhash) and Cardano (JPG Store) are strong. If you want maximum reach and tools, Ethereum (OpenSea, Rarible, curated galleries) wins, but factor in gas. Solana is excellent for quick iteration and mobile-friendly onboarding. Match audience, cost, and community before deciding.

2) How do royalties actually work across chains and marketplaces?

Royalties are signaled on-chain (e.g., EIP-2981 on EVM) or in metadata (Metaplex, FA2), but enforcement depends on marketplace policy. Some venues enforce, others make them optional, and many allow multiple recipients. Always check a venue’s policy and embed royalty info properly so at least the numbers are discoverable by any marketplace that chooses to honor them.

3) What fees should I expect besides platform fees?

You’ll pay network fees (gas) to validators/miners and, on many marketplaces, a platform fee and creator royalties on sales. OpenSea, for example, documents a 1% seller fee and explains that gas goes to validators, not the marketplace. Expect small signing fees on some chains and occasional one-time approvals.

4) Are Bitcoin Ordinals “real” NFTs?

They’re different. Ordinals are inscriptions on satoshis, not ERC-style tokens. There’s no smart-contract standard; instead, indexers and marketplaces coordinate around inscription numbers and content. If you value durability and minimalism, they’re compelling, but the tooling and trade flows differ from EVM chains.

5) How do I avoid buying fakes?

Verify the contract address (EVM), the policy ID (Cardano), or the collection verification status (Solana/Tezos marketplaces). Use links from official project channels; compare metadata fields and check for mismatched traits or supply anomalies. Many marketplaces label “verified” collections—use that as a starting filter.

6) What wallet should I use?

Use a chain-native wallet with a good track record: MetaMask or hardware wallets for EVM chains, Phantom/Solflare for Solana, Temple/Kukai for Tezos, Nami/Eternl for Cardano, Dapper/Lilico for Flow, Pera for Algorand. Consider a hardware wallet for high-value holdings.

7) Can I mint on one chain and list on another?

Not directly. NFTs are native to their chain. You can bridge or wrap assets in some ecosystems, but that introduces extra risk/complexity and often fragments liquidity. Most creators mint and trade where their buyers are, then expand to additional chains if demand exists.

8) How should I price my first NFT?

Start with comps on your chosen chain in your category. Consider total buyer cost (price + royalties + platform fee + gas). For entry pricing, many creators test a lower-priced open edition or a small fixed-price series, then adjust based on sell-through and secondary activity.

9) What’s the safest way to list?

Use official marketplace links, double-check signer prompts, and confirm the exact contract and token ID before listing. Avoid “gasless approvals” you don’t understand. For larger assets, test with a minimal-value token first to verify your listing flow.

10) Do I need a custom smart contract?

Not always. Many marketplaces offer shared contracts with good metadata and royalty features. Custom contracts help with brand provenance, on-chain logic, and marketplace independence, but they require development and audits. Start simple; go custom once you’ve validated demand.

References

- ERC-721 Non-Fungible Token Standard, Ethereum.org, September 17, 2025. ethereum.org

- ERC-1155: Multi Token Standard, Ethereum Improvement Proposals, June 17, 2018. Ethereum Improvement Proposals

- ERC-2981: NFT Royalty Standard, Ethereum Improvement Proposals, September 15, 2020. Ethereum Improvement Proposals

- Token Metadata — Overview, Metaplex Developer Hub (Solana). developers.metaplex.com

- Inscriptions, Ordinals Docs. docs.ordinals.com

- What fees do I pay on OpenSea?, OpenSea Help Center. support.opensea.io

- What are gas fees?, OpenSea Help Center. support.opensea.io

- Fees | Immutable Documentation, Immutable. docs.immutable.com

- FA2 Tokens, Tezos Documentation. docs.tezos.com

- Fee Structure, objkt.com Documentation (Tezos), February 22, 2024. docs.objkt.com

- Non-Fungible Token Contract, Flow Developers. developers.flow.com

- NEP-171 Core Functionality, NEAR Protocol Specification (Nomicon). nomicon.io

- Algorand Standard Assets (ASAs), Algorand Developer Docs. developer.algorand.org

- ARC Token Standards Explained for NFT Creators, Algorand. algorand.co

- JPG Store | Largest Cardano NFT Marketplace, JPG Store. jpg.store

1 Comment